444

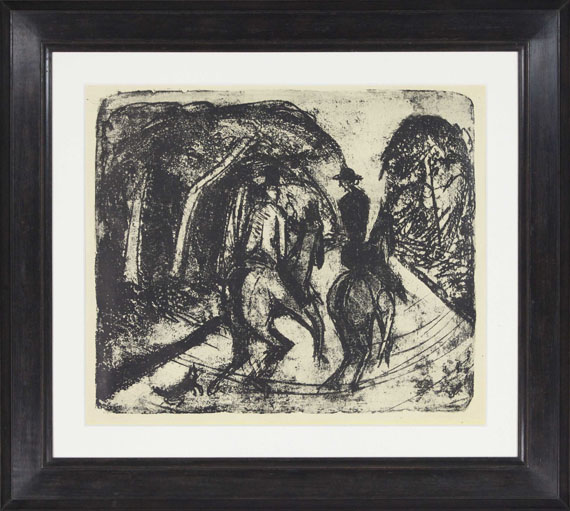

Ernst Ludwig Kirchner

Reiter im Grunewald, 1914.

Lithograph

Estimate:

€ 20,000 / $ 21,400 Sold:

€ 27,500 / $ 29,425 (incl. surcharge)

Reiter im Grunewald. 1914.

Lithograph.

Dube L 251 IV (von IV). Gercken 633 III. Schiefler L 245. Signed and incribed "Handdruck". Verso with the estate stamp of the Kunstmuseum Basel (Lugt 1570 b) and the hand-written regsitration number "L 245 III". One of to date 9 known copies. On firm yellow wove paper. 50.3 x 59.3 cm (19.8 x 23.3 in). Sheet: 57,8 x 65,8 cm (22,8 x 25,9 in).

The copy is mentioned in the catlog raisonné Gercken. The fact that Gercken mentions a different date than Dube is owed to stylistic reasons and must be seen in context with similar sketches in sketchbook 27 with sketches made durng a stay on the island of Fehmarn in 1913 (cf. sketch Skb 27/57, Gerd Presler, 1996, p. 221). [CE].

From Kirchner's most sought-after period of creation.

Hand-made print with strong contrasts.

Only one other copy has ever been offered on the international auction market (artprice.com).

PROVENANCE: From the artist's estate.

Private collection Southern Germany.

LITERATURE: Ketterer Kunst, Munich, 380th auction, Modern Art, June 4, 2011, lot 31 (with illu.).

Lithograph.

Dube L 251 IV (von IV). Gercken 633 III. Schiefler L 245. Signed and incribed "Handdruck". Verso with the estate stamp of the Kunstmuseum Basel (Lugt 1570 b) and the hand-written regsitration number "L 245 III". One of to date 9 known copies. On firm yellow wove paper. 50.3 x 59.3 cm (19.8 x 23.3 in). Sheet: 57,8 x 65,8 cm (22,8 x 25,9 in).

The copy is mentioned in the catlog raisonné Gercken. The fact that Gercken mentions a different date than Dube is owed to stylistic reasons and must be seen in context with similar sketches in sketchbook 27 with sketches made durng a stay on the island of Fehmarn in 1913 (cf. sketch Skb 27/57, Gerd Presler, 1996, p. 221). [CE].

From Kirchner's most sought-after period of creation.

Hand-made print with strong contrasts.

Only one other copy has ever been offered on the international auction market (artprice.com).

PROVENANCE: From the artist's estate.

Private collection Southern Germany.

LITERATURE: Ketterer Kunst, Munich, 380th auction, Modern Art, June 4, 2011, lot 31 (with illu.).

444

Ernst Ludwig Kirchner

Reiter im Grunewald, 1914.

Lithograph

Estimate:

€ 20,000 / $ 21,400 Sold:

€ 27,500 / $ 29,425 (incl. surcharge)

Lot 444

Lot 444