13

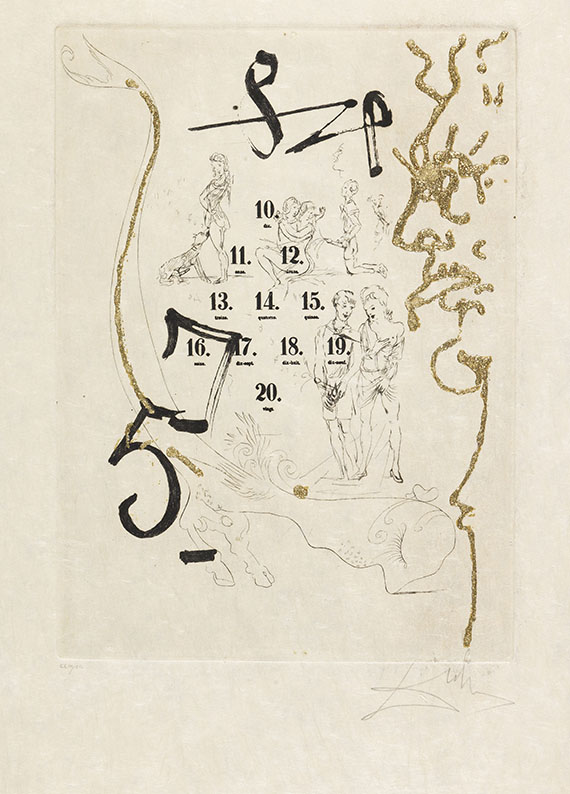

Salvador Dalí

Les Amours Jaunes, 1974.

Portfolio with 10 Drypoints with gold coating

Estimate:

€ 4,000 / $ 4,280 Sold:

€ 4,375 / $ 4,681 (incl. surcharge)

Les Amours Jaunes. 1974.

Portfolio with 10 Drypoints with gold coating.

Field 74-15. Each signed and numbered. Additionally numbered in imprint. From an edition of 200 copies on Japon. Imprint on Arches (with the watermark). Each: 29.5 x 21.2 cm (11.6 x 8.3 in). Sheet: each 38,7 x 28 cm (15,2 x 11 in).

The ten etchings by Dalí illustrate poems from Tristan Corbière's (1845-1875) poetry book "Les amours jaunes" from 1873. In original cloth case with the artist's gilt-tooled name.

Printed by Ateliers Bellini, gilt coating applied by Daniel Jacomet, Paris. Published by Èditions Pierre Belfond, Paris 1974 (with signed certificate of authenticity). This is the second German edition, published simultaneously with the first edition by Timm Gierig. [CH].

Complete portfolio.

The gilt coating makes each work a unique object.

Dalí's interpretation of the poetry book "Les amours jaunes“.

After a literary model.

Bruce Hochman OS has kindly confirmed the authenticity of this lot.

Portfolio with 10 Drypoints with gold coating.

Field 74-15. Each signed and numbered. Additionally numbered in imprint. From an edition of 200 copies on Japon. Imprint on Arches (with the watermark). Each: 29.5 x 21.2 cm (11.6 x 8.3 in). Sheet: each 38,7 x 28 cm (15,2 x 11 in).

The ten etchings by Dalí illustrate poems from Tristan Corbière's (1845-1875) poetry book "Les amours jaunes" from 1873. In original cloth case with the artist's gilt-tooled name.

Printed by Ateliers Bellini, gilt coating applied by Daniel Jacomet, Paris. Published by Èditions Pierre Belfond, Paris 1974 (with signed certificate of authenticity). This is the second German edition, published simultaneously with the first edition by Timm Gierig. [CH].

Complete portfolio.

The gilt coating makes each work a unique object.

Dalí's interpretation of the poetry book "Les amours jaunes“.

After a literary model.

Bruce Hochman OS has kindly confirmed the authenticity of this lot.

13

Salvador Dalí

Les Amours Jaunes, 1974.

Portfolio with 10 Drypoints with gold coating

Estimate:

€ 4,000 / $ 4,280 Sold:

€ 4,375 / $ 4,681 (incl. surcharge)

Lot 13

Lot 13