277

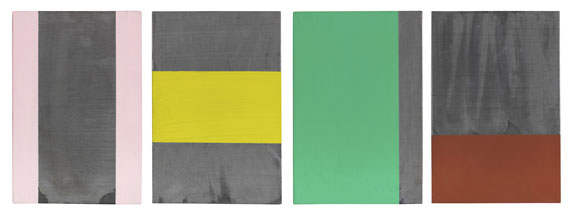

Günther Förg

Ohne Titel, 2001.

Acrylic on lead and on panel. 4 parts

Estimate:

€ 40,000 / $ 42,800 Sold:

€ 52,500 / $ 56,175 (incl. surcharge)

Ohne Titel. 2001.

Acrylic on lead and on panel. 4 parts.

Verso signed, dated and numbered as well as consecutively numbered. From an edition of 36 copies. Each of a unique object due to manually applied colors. Each 30 x 20 cm (11.8 x 7.8 in).

[SM].

• The manual color application makes every object a unique object

• Characteristic painting on lead

• The importance of the series in Förg's creation is emphasized by the work's multi-part form.

• Segmentation makes Förg's serial production and thinking seizable.

• Masterly variation, its special strength is in the maximal reduction of color and form

• A radical citation of Barnett Newman's strenge Farbfeldmalerei.

We are grateful to Mr. Michael Neff of the Estate Günther Förg for his confirmation of this work's authenticity. The work is registered at the archive with the number WVF.01.B.0661.

PROVENANCE: Galerie Fahnemann, Berlin.

Private collection Hesse (since 2001, acquired directly from aforementioned).

Acrylic on lead and on panel. 4 parts.

Verso signed, dated and numbered as well as consecutively numbered. From an edition of 36 copies. Each of a unique object due to manually applied colors. Each 30 x 20 cm (11.8 x 7.8 in).

[SM].

• The manual color application makes every object a unique object

• Characteristic painting on lead

• The importance of the series in Förg's creation is emphasized by the work's multi-part form.

• Segmentation makes Förg's serial production and thinking seizable.

• Masterly variation, its special strength is in the maximal reduction of color and form

• A radical citation of Barnett Newman's strenge Farbfeldmalerei.

We are grateful to Mr. Michael Neff of the Estate Günther Förg for his confirmation of this work's authenticity. The work is registered at the archive with the number WVF.01.B.0661.

PROVENANCE: Galerie Fahnemann, Berlin.

Private collection Hesse (since 2001, acquired directly from aforementioned).

277

Günther Förg

Ohne Titel, 2001.

Acrylic on lead and on panel. 4 parts

Estimate:

€ 40,000 / $ 42,800 Sold:

€ 52,500 / $ 56,175 (incl. surcharge)

Lot 277

Lot 277