228

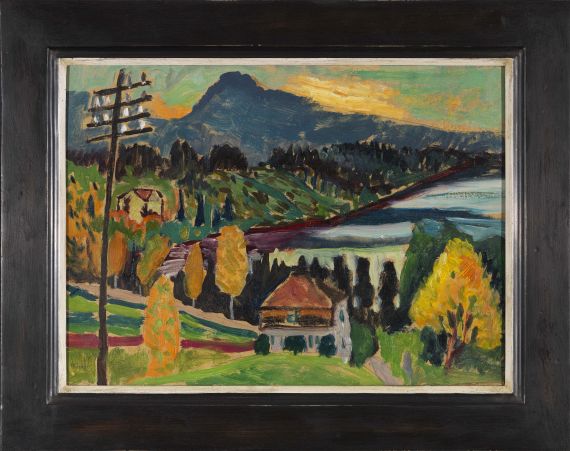

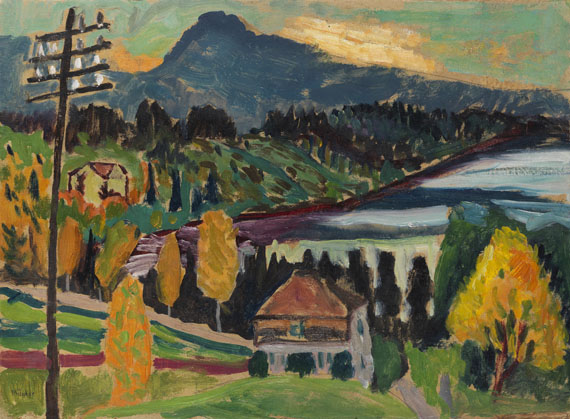

Gabriele Münter

Murnauer Landschaft, 1923.

Oil on cardboard over pencil

Estimate:

€ 150,000 / $ 160,500 Sold:

€ 275,000 / $ 294,250 (incl. surcharge)

Murnauer Landschaft. 1923.

Oil on cardboard over pencil.

Lower left signed. Verso once more signed, dated "25. X.23", "25.X 23. II" and "Herbst 1923/5" and twice titled.

Rear with the estate stamp and an adhesive label with the partly stamped and partly hand-written number "L 78" and a label with the stamped number "1218". 33 x 45 cm (12.9 x 17.7 in).

• In 1923 motifs of her beloved Murnau helped Gabriele Münter to overcome a creative crisis after Kandinsky had left her.

• Atmospheric autumnal view of the Staffelsee in bright colors.

• The pastose colors call reminiscence of Gabriele Münter's expressive duct in the days of the "Blauer Reiter".

PROVENANCE: Artist's estate.

Private collection Southern Germany (acquired from aforementioned).

Private collection Southern Germany (gifted from aforementioned).

EXHIBITION: Gabriele Münter malt Murnau, Schloßmuseum Murnau, July 26 - November 3, 1996 and August Macke Haus , Bonn, November 10, 1996 - February 16, 1997, p. 105.

Gabriele Münter, Städtische Galerie Bietigheim-Bissingen, July 3 - September 19, 1999, no. 45, color illu. on p. 127.

Oil on cardboard over pencil.

Lower left signed. Verso once more signed, dated "25. X.23", "25.X 23. II" and "Herbst 1923/5" and twice titled.

Rear with the estate stamp and an adhesive label with the partly stamped and partly hand-written number "L 78" and a label with the stamped number "1218". 33 x 45 cm (12.9 x 17.7 in).

• In 1923 motifs of her beloved Murnau helped Gabriele Münter to overcome a creative crisis after Kandinsky had left her.

• Atmospheric autumnal view of the Staffelsee in bright colors.

• The pastose colors call reminiscence of Gabriele Münter's expressive duct in the days of the "Blauer Reiter".

PROVENANCE: Artist's estate.

Private collection Southern Germany (acquired from aforementioned).

Private collection Southern Germany (gifted from aforementioned).

EXHIBITION: Gabriele Münter malt Murnau, Schloßmuseum Murnau, July 26 - November 3, 1996 and August Macke Haus , Bonn, November 10, 1996 - February 16, 1997, p. 105.

Gabriele Münter, Städtische Galerie Bietigheim-Bissingen, July 3 - September 19, 1999, no. 45, color illu. on p. 127.

228

Gabriele Münter

Murnauer Landschaft, 1923.

Oil on cardboard over pencil

Estimate:

€ 150,000 / $ 160,500 Sold:

€ 275,000 / $ 294,250 (incl. surcharge)

Lot 228

Lot 228