Video

Back side

134

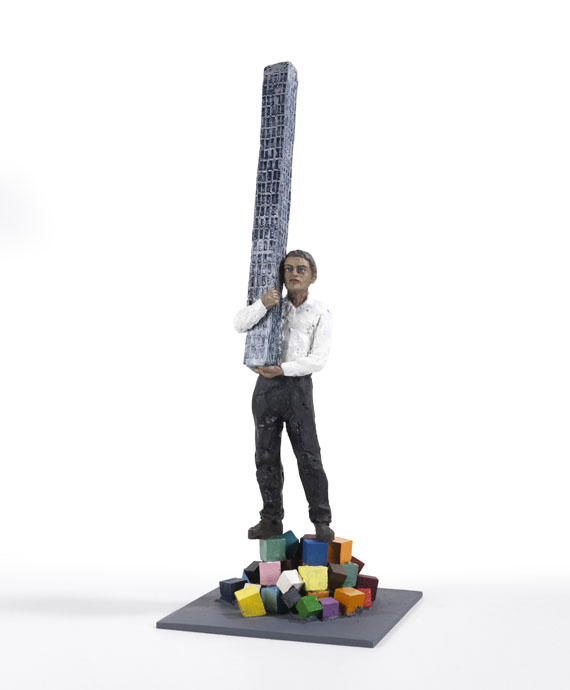

Stephan Balkenhol

Mann mit Turm (Toronto), 2015.

Bronze, with colors

Estimate:

€ 15,000 / $ 16,050 Sold:

€ 52,500 / $ 56,175 (incl. surcharge)

Mann mit Turm (Toronto). 2015.

Bronze, with colors.

Underside of the plinth with name, date and number. One of 30 copies. Incl. plinth: 76.8 x 29 x 27 cm (30.2 x 11.4 x 10.6 in).

[AM].

• This is the first time that a copy of "Mann mit Turm (Toronto)“ is offered on the international auction market (source: artprice.com).

• Stephan Balkenhol's sculptures have an unparalleled recognition value.

• Balkenhol was the leading mind behind the revival of figurative sculpting in the early 1980s.

PROVENANCE: Galerie Löhrl, Mönchengladbach.

Private collection Baden-Württemberg.

Bronze, with colors.

Underside of the plinth with name, date and number. One of 30 copies. Incl. plinth: 76.8 x 29 x 27 cm (30.2 x 11.4 x 10.6 in).

[AM].

• This is the first time that a copy of "Mann mit Turm (Toronto)“ is offered on the international auction market (source: artprice.com).

• Stephan Balkenhol's sculptures have an unparalleled recognition value.

• Balkenhol was the leading mind behind the revival of figurative sculpting in the early 1980s.

PROVENANCE: Galerie Löhrl, Mönchengladbach.

Private collection Baden-Württemberg.

134

Stephan Balkenhol

Mann mit Turm (Toronto), 2015.

Bronze, with colors

Estimate:

€ 15,000 / $ 16,050 Sold:

€ 52,500 / $ 56,175 (incl. surcharge)

Lot 134

Lot 134