360

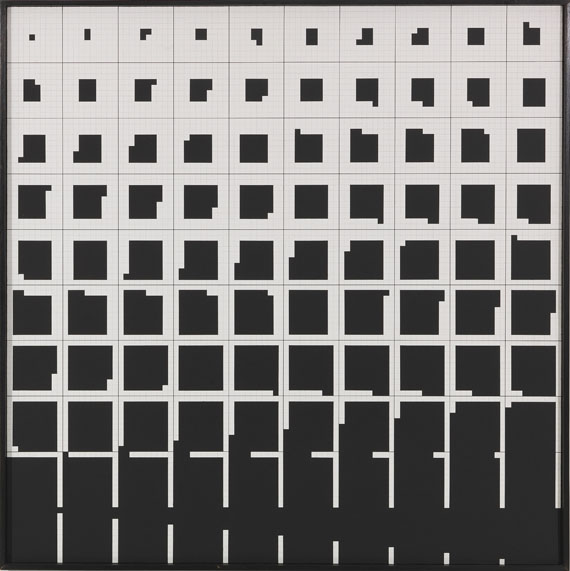

Ryszard Winiarski

Game 10 x 10 - Logical Course - A Centrifugal Spiral, 1977.

Acrylic on canvas

Estimate:

€ 20,000 / $ 21,400 Sold:

€ 40,000 / $ 42,800 (incl. surcharge)

Game 10 x 10 - Logical Course - A Centrifugal Spiral. 1977.

Acrylic on canvas.

Verso signed, dated and titled. 103 x 103 x 5 cm (40.5 x 40.5 x 1.9 in).

With printed explanations about the image's structure on an adhesive label on verso. In artist's frame. [CH].

PROVENANCE: Private collection Rhineland.

"After my exhibition 'Spiele' in Holland in 1976 I came to conclude that the graphic arrangements in a series of fields on which the game is controlled by coincidence and logic, can lead to interesting results.“

Ryszard Winiarski, quote from: Manfred Mohr (editor), System + Zufall. François Morellet, Herman de Vries, Ryszard Winiarski, ex. cat. Landespavillon Stuttgart November 2 - November 22, 1978, p. 34.

Acrylic on canvas.

Verso signed, dated and titled. 103 x 103 x 5 cm (40.5 x 40.5 x 1.9 in).

With printed explanations about the image's structure on an adhesive label on verso. In artist's frame. [CH].

PROVENANCE: Private collection Rhineland.

"After my exhibition 'Spiele' in Holland in 1976 I came to conclude that the graphic arrangements in a series of fields on which the game is controlled by coincidence and logic, can lead to interesting results.“

Ryszard Winiarski, quote from: Manfred Mohr (editor), System + Zufall. François Morellet, Herman de Vries, Ryszard Winiarski, ex. cat. Landespavillon Stuttgart November 2 - November 22, 1978, p. 34.

360

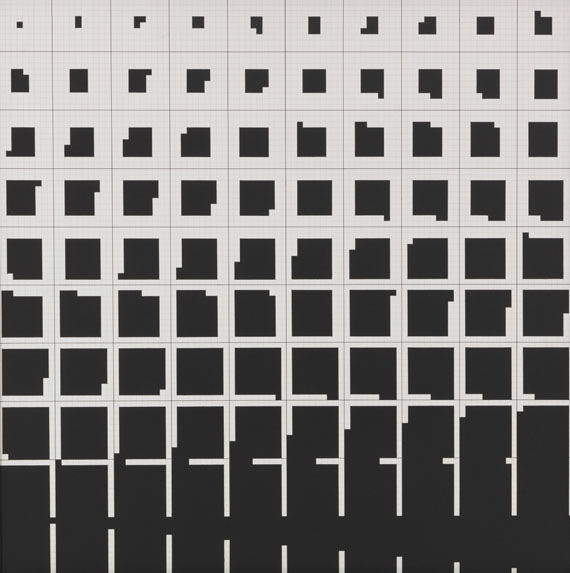

Ryszard Winiarski

Game 10 x 10 - Logical Course - A Centrifugal Spiral, 1977.

Acrylic on canvas

Estimate:

€ 20,000 / $ 21,400 Sold:

€ 40,000 / $ 42,800 (incl. surcharge)

Lot 360

Lot 360