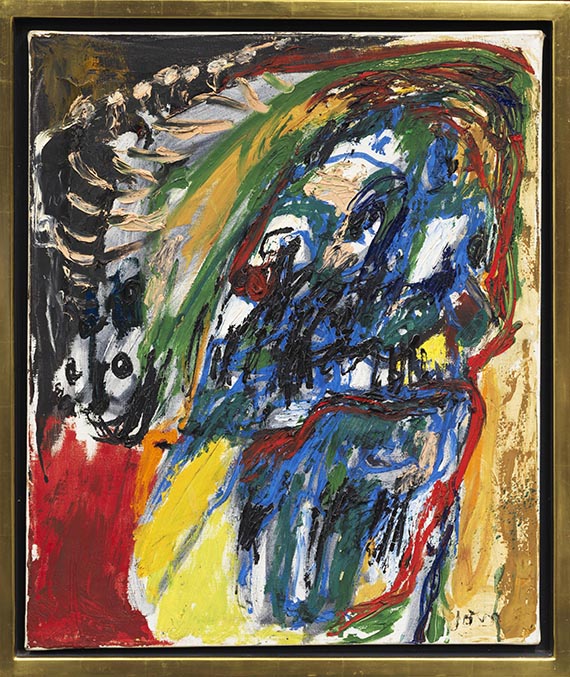

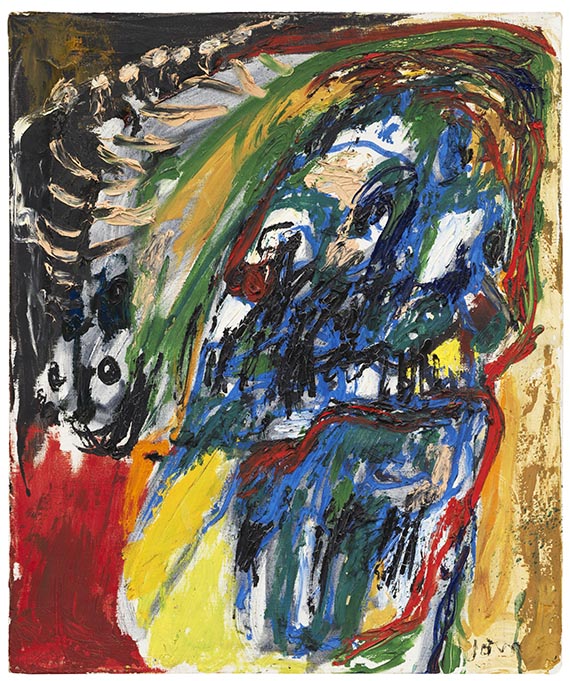

126

Asger Jorn

Le regard au dos (Looking back), 1962.

Oil on canvas

Estimate:

€ 60,000 - 80,000

$ 64,200 - 85,600

Le regard au dos (Looking back). 1962.

Oil on canvas.

Signed in the lower right. Signed, dated and titled on the reverse. 73 x 60 cm (28.7 x 23.6 in).

• The important Danish artist Asger Jorn created dynamic pictorial worlds with a powerful visual language oscillating between abstraction and figuration, showing a playful lightness and exploring emotional abysses.

• In 1948, Jorn founded the artist group “CoBrA” together with Appel, Constant, Corneille, Dotremont and Noiret.

• Jorn became a key figure of the Munich art scene, he repeatedly spent time in the city as of 1957, his figurative-expressive style was formative for local culture.

• From an important creative period: In 1959 and 1964 he participated in the Kassel documenta, and in 1961 he published manifestos of the “Situationist International” movement.

PROVENANCE: Galleri Moderne, Silkeborg.

Private collection Denmark (acquired directly from the above).

Private collection Norway (since 2014).

LITERATURE: Guy Atkins, Asger Jorn, The Crucial Years 1954-1964, London 1977, catalogue raisonné No. 1416.

- -

Arne Bruun Rasmussen, Copenhagen, auction in June 1968, lot 560.

Christie's, Amsterdam, auction on December 6, 1995, lot 281.

Christie's, London, auction on June 28, 2001, lot 629.

Arne Bruun Rasmussen, Copenhagen, auction on September 23, 2014, lot 624.

Ingrid Schjoldager (ed.), The Narud Collection, Oslo 2021 (illu. in color on p. 111).

Called up: June 7, 2024 - ca. 14.06 h +/- 20 min.

Oil on canvas.

Signed in the lower right. Signed, dated and titled on the reverse. 73 x 60 cm (28.7 x 23.6 in).

• The important Danish artist Asger Jorn created dynamic pictorial worlds with a powerful visual language oscillating between abstraction and figuration, showing a playful lightness and exploring emotional abysses.

• In 1948, Jorn founded the artist group “CoBrA” together with Appel, Constant, Corneille, Dotremont and Noiret.

• Jorn became a key figure of the Munich art scene, he repeatedly spent time in the city as of 1957, his figurative-expressive style was formative for local culture.

• From an important creative period: In 1959 and 1964 he participated in the Kassel documenta, and in 1961 he published manifestos of the “Situationist International” movement.

PROVENANCE: Galleri Moderne, Silkeborg.

Private collection Denmark (acquired directly from the above).

Private collection Norway (since 2014).

LITERATURE: Guy Atkins, Asger Jorn, The Crucial Years 1954-1964, London 1977, catalogue raisonné No. 1416.

- -

Arne Bruun Rasmussen, Copenhagen, auction in June 1968, lot 560.

Christie's, Amsterdam, auction on December 6, 1995, lot 281.

Christie's, London, auction on June 28, 2001, lot 629.

Arne Bruun Rasmussen, Copenhagen, auction on September 23, 2014, lot 624.

Ingrid Schjoldager (ed.), The Narud Collection, Oslo 2021 (illu. in color on p. 111).

Called up: June 7, 2024 - ca. 14.06 h +/- 20 min.

126

Asger Jorn

Le regard au dos (Looking back), 1962.

Oil on canvas

Estimate:

€ 60,000 - 80,000

$ 64,200 - 85,600

Buyer's premium, taxation and resale right compensation for Asger Jorn "Le regard au dos (Looking back)"

This lot can be subjected to differential taxation plus a 7% import tax levy (saving approx. 5 % compared to regular taxation) or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 126

Lot 126