176

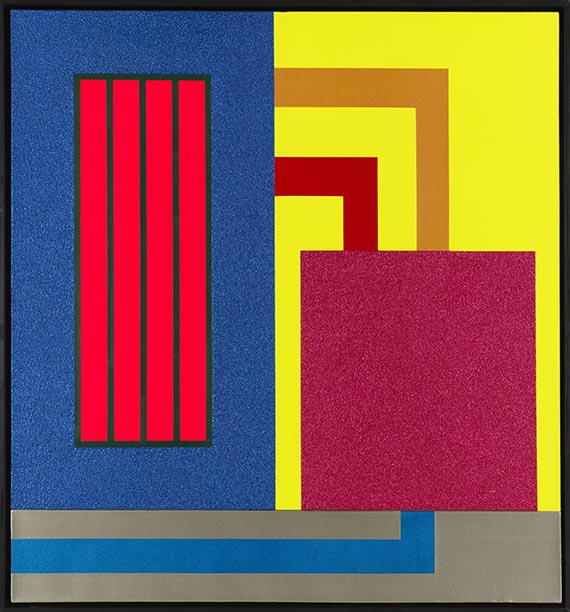

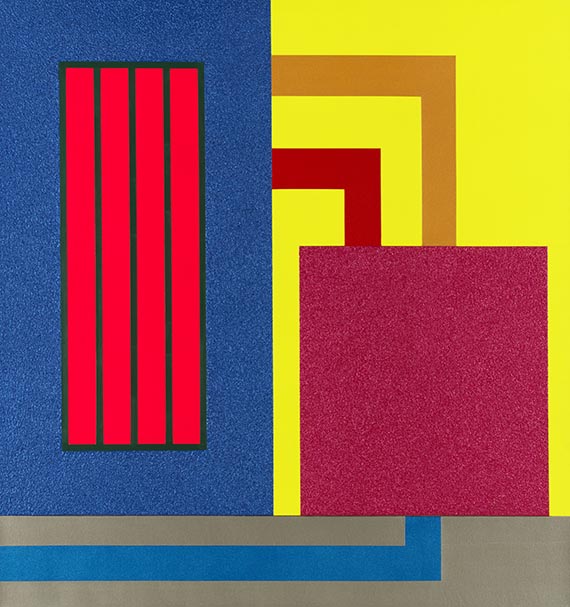

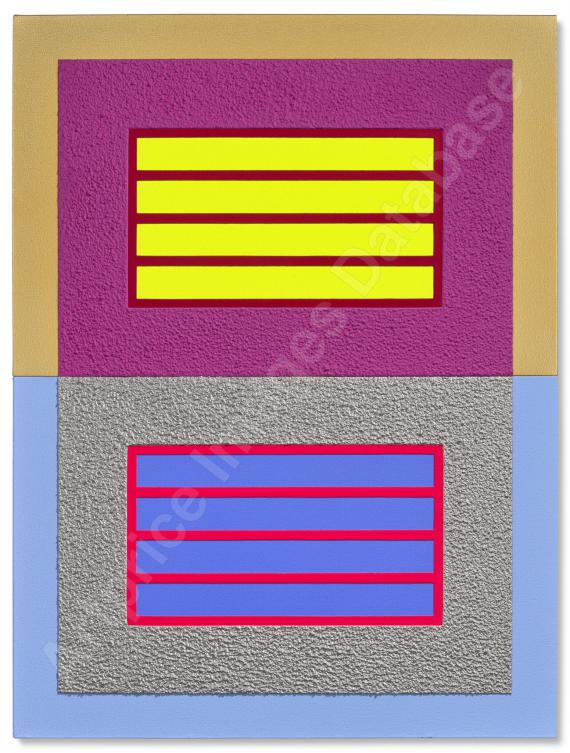

Peter Halley

Dada Ji, 2005.

Acrylic and Roll-a-Tex on canvas

Estimate:

€ 70,000 - 90,000

$ 74,900 - 96,300

Dada Ji. 2005.

Acrylic and Roll-a-Tex on canvas.

Twice signed and dated on the reverse. 173 x 162 cm (68.1 x 63.7 in). [AW].

• Halley's unmistakably expressive work in complementary contrasts.

• The haptic quality, as well as the harmonious colors make for a particularly beautiful composition.

• “Wires” as a means of communication between the pictorial elements and the viewer are an important component of Halley's art.

• Works by the artist can be found in renowned international collections like the Museum of Modern Art, New York, the Tate Gallery, London, the Städel Museu, Frankfurt am Main, and the Whitney Museum of American Art, New York.

PROVENANCE: Beyaz Art, Istanbul.

Olbricht Collection, Essen/Berlin (acquired from the above).

"Believe it or not, my work is a kind of diary. As you know, I employ a very small vocabulary of symbols in my work - diagrammatic cells and prisons that are connected by conduits, all set on a flat colored field. Each painting evolves from those that came before, but as I draw, I never know what will happen next as I compose and rearrange these elements."

Peter Halley in an interview with Peter Doroshenko, Dallas Contemporary, May 2020

Called up: June 7, 2024 - ca. 15.14 h +/- 20 min.

Acrylic and Roll-a-Tex on canvas.

Twice signed and dated on the reverse. 173 x 162 cm (68.1 x 63.7 in). [AW].

• Halley's unmistakably expressive work in complementary contrasts.

• The haptic quality, as well as the harmonious colors make for a particularly beautiful composition.

• “Wires” as a means of communication between the pictorial elements and the viewer are an important component of Halley's art.

• Works by the artist can be found in renowned international collections like the Museum of Modern Art, New York, the Tate Gallery, London, the Städel Museu, Frankfurt am Main, and the Whitney Museum of American Art, New York.

PROVENANCE: Beyaz Art, Istanbul.

Olbricht Collection, Essen/Berlin (acquired from the above).

"Believe it or not, my work is a kind of diary. As you know, I employ a very small vocabulary of symbols in my work - diagrammatic cells and prisons that are connected by conduits, all set on a flat colored field. Each painting evolves from those that came before, but as I draw, I never know what will happen next as I compose and rearrange these elements."

Peter Halley in an interview with Peter Doroshenko, Dallas Contemporary, May 2020

Called up: June 7, 2024 - ca. 15.14 h +/- 20 min.

176

Peter Halley

Dada Ji, 2005.

Acrylic and Roll-a-Tex on canvas

Estimate:

€ 70,000 - 90,000

$ 74,900 - 96,300

Buyer's premium, taxation and resale right compensation for Peter Halley "Dada Ji"

This lot can be purchased subject to differential or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 176

Lot 176