480

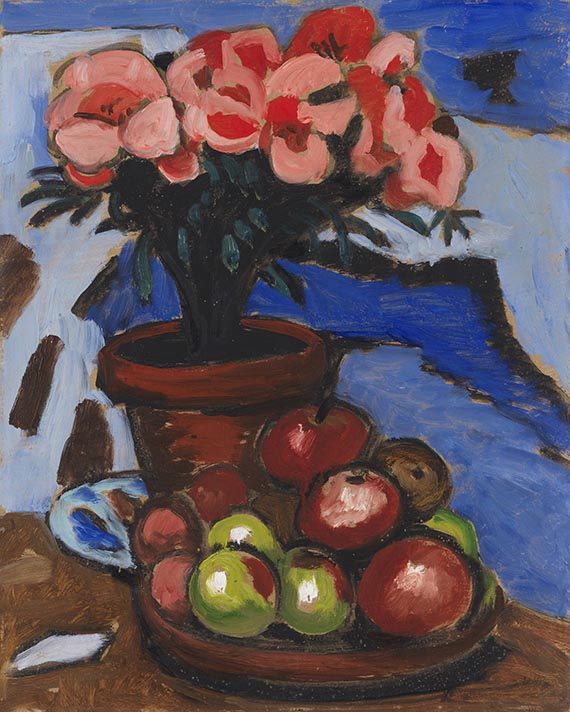

Gabriele Münter

Blumen und Früchtestilleben, Ca. 1940/50.

Oil on cardboard

Estimate:

€ 50,000 - 70,000

$ 53,500 - 74,900

Blumen und Früchtestilleben. Ca. 1940/50s.

Oil on cardboard.

With the estate stamp on the reverse, there also with a label inscribed with the estate number "S 79", partly by hand and partly in typography, as well as with a label with the stamped number "965". 41 x 32.5 cm (16.1 x 12.7 in). [EH].

• Wonderful work from the group of flower still lifes in Münter's late oeuvre.

• With bold colors, strong contrasts and a background dissolved in free forms, Gabriele Münter created an extremely appealing still life.

• In 1955, the artist's works were presented at the first documenta in Kassel.

• This year, Gabriele Münter is internationally celebrated with numerous museum exhibitions (Vienna, Madrid, London and Bern).

PROVENANCE: Estate of the artist.

Private collection North Rhine-Westphalia.

“Despite all repetitions, Münter's flower paintings, even those made at an advanced age, are characterized by an indestructible vitality."

Annegret Hoberg and Helmut Friedel, in: Gabriele Münter: 1877-1962. Retrospective (on the occasion of the exhibition in the Städtische Galerie im Lenbachhaus, Munich 1992, in the Schirn Kunsthalle, Frankfurt 1993, and in the Liljevalchs Konsthall, Stockholm 1993), Munich 1992, p. 238.

Called up: June 8, 2024 - ca. 18.46 h +/- 20 min.

Oil on cardboard.

With the estate stamp on the reverse, there also with a label inscribed with the estate number "S 79", partly by hand and partly in typography, as well as with a label with the stamped number "965". 41 x 32.5 cm (16.1 x 12.7 in). [EH].

• Wonderful work from the group of flower still lifes in Münter's late oeuvre.

• With bold colors, strong contrasts and a background dissolved in free forms, Gabriele Münter created an extremely appealing still life.

• In 1955, the artist's works were presented at the first documenta in Kassel.

• This year, Gabriele Münter is internationally celebrated with numerous museum exhibitions (Vienna, Madrid, London and Bern).

PROVENANCE: Estate of the artist.

Private collection North Rhine-Westphalia.

“Despite all repetitions, Münter's flower paintings, even those made at an advanced age, are characterized by an indestructible vitality."

Annegret Hoberg and Helmut Friedel, in: Gabriele Münter: 1877-1962. Retrospective (on the occasion of the exhibition in the Städtische Galerie im Lenbachhaus, Munich 1992, in the Schirn Kunsthalle, Frankfurt 1993, and in the Liljevalchs Konsthall, Stockholm 1993), Munich 1992, p. 238.

Called up: June 8, 2024 - ca. 18.46 h +/- 20 min.

480

Gabriele Münter

Blumen und Früchtestilleben, Ca. 1940/50.

Oil on cardboard

Estimate:

€ 50,000 - 70,000

$ 53,500 - 74,900

Buyer's premium, taxation and resale right compensation for Gabriele Münter "Blumen und Früchtestilleben"

This lot can be purchased subject to differential or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 480

Lot 480