173

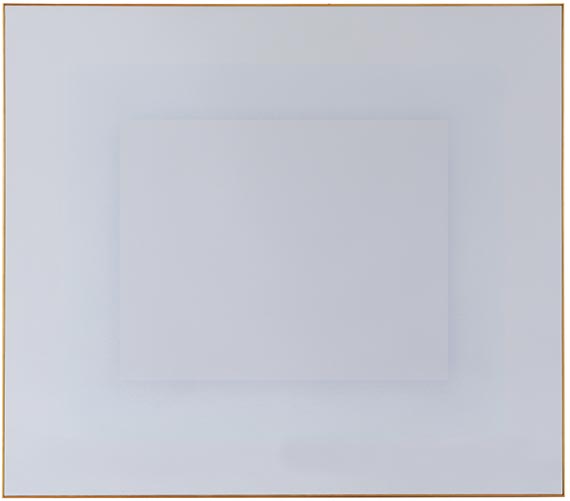

Ulrich Erben

Festlegung des Unbegrenzten (VI), 2014.

Acrylic and pigment on canvas

Estimate:

€ 15,000 / $ 17,700 Sold:

€ 19,050 / $ 22,479 (incl. surcharge)

Festlegung des Unbegrenzten (VI). 2014.

Acrylic and pigment on canvas.

Signed and dated on the reverse of the folded canvas. Signed, dated, and inscribed with the technique and a direction arrow by the artist on the backing board. 145 x 165 cm (57 x 64.9 in).

In the studio frame. [AW].

• Masterfully reduced composition characterized by an outstanding minimalist focus.

• In 1977, he participated in documenta 6 in Kassel.

• Today, the artist's works can be found in numerous public collections, such as the Hamburger Bahnhof - Museum für Gegenwart in Berlin and the Museum Folkwang in Essen.

PROVENANCE: Galerie Hans Strelow, Dusseldorf.

Private collection, South Germany (acquired from aforementioned).

Acrylic and pigment on canvas.

Signed and dated on the reverse of the folded canvas. Signed, dated, and inscribed with the technique and a direction arrow by the artist on the backing board. 145 x 165 cm (57 x 64.9 in).

In the studio frame. [AW].

• Masterfully reduced composition characterized by an outstanding minimalist focus.

• In 1977, he participated in documenta 6 in Kassel.

• Today, the artist's works can be found in numerous public collections, such as the Hamburger Bahnhof - Museum für Gegenwart in Berlin and the Museum Folkwang in Essen.

PROVENANCE: Galerie Hans Strelow, Dusseldorf.

Private collection, South Germany (acquired from aforementioned).

173

Ulrich Erben

Festlegung des Unbegrenzten (VI), 2014.

Acrylic and pigment on canvas

Estimate:

€ 15,000 / $ 17,700 Sold:

€ 19,050 / $ 22,479 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 173

Lot 173