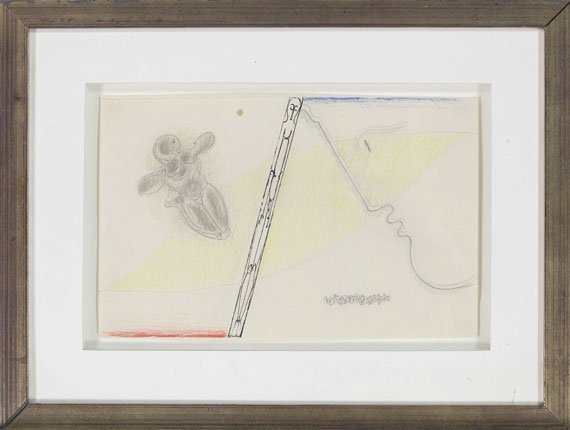

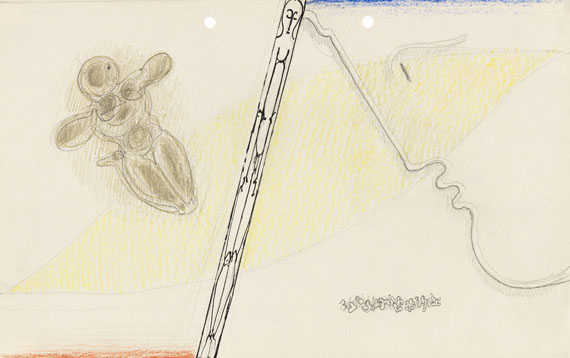

495

Oskar Schlemmer

Wandbild-Entwurf für Haus Dieter Keller (Toter zwischem Schwebenden und Profil), 1940.

Pencil drawing, India ink and color pen

Estimate:

€ 12,000 / $ 14,160 Sold:

€ 17,500 / $ 20,650 (incl. surcharge)

Wandbild-Entwurf für Haus Dieter Keller (Toter zwischem Schwebenden und Profil). 1940.

Pencil drawing, India ink and color pen.

On delicate brownish wove paper (punched in upper margin). 18.5 x 29.6 cm (7.2 x 11.6 in), size of sheet.

[CE].

PROVENANCE: Artist's estate.

Spencer A. Samuels & Company, New York (with the label on rear of the frame).

Private collection New York.

Galerie Brockstedt, Hamburg (with the label on rear of the frame).

Private collection Lower Saxony.

LITERATURE: Villa Grisebach, Berlin, auction 28, November 28, 1992, lot 230 (with illu.).

Karin von Maur, Oskar Schlemmer Monographie, Munich 1979, p. 262, no. 149.

Oskar Schlemmer, ex. cat. Württembergischer Kunstverein, Stuttgart 1977, p. 88, no. 234.

Wulf Herzogenrath, Oskar Schlemmer, Munich 1973, p. 252, no. 24/25.

Pencil drawing, India ink and color pen.

On delicate brownish wove paper (punched in upper margin). 18.5 x 29.6 cm (7.2 x 11.6 in), size of sheet.

[CE].

PROVENANCE: Artist's estate.

Spencer A. Samuels & Company, New York (with the label on rear of the frame).

Private collection New York.

Galerie Brockstedt, Hamburg (with the label on rear of the frame).

Private collection Lower Saxony.

LITERATURE: Villa Grisebach, Berlin, auction 28, November 28, 1992, lot 230 (with illu.).

Karin von Maur, Oskar Schlemmer Monographie, Munich 1979, p. 262, no. 149.

Oskar Schlemmer, ex. cat. Württembergischer Kunstverein, Stuttgart 1977, p. 88, no. 234.

Wulf Herzogenrath, Oskar Schlemmer, Munich 1973, p. 252, no. 24/25.

495

Oskar Schlemmer

Wandbild-Entwurf für Haus Dieter Keller (Toter zwischem Schwebenden und Profil), 1940.

Pencil drawing, India ink and color pen

Estimate:

€ 12,000 / $ 14,160 Sold:

€ 17,500 / $ 20,650 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 495

Lot 495