276

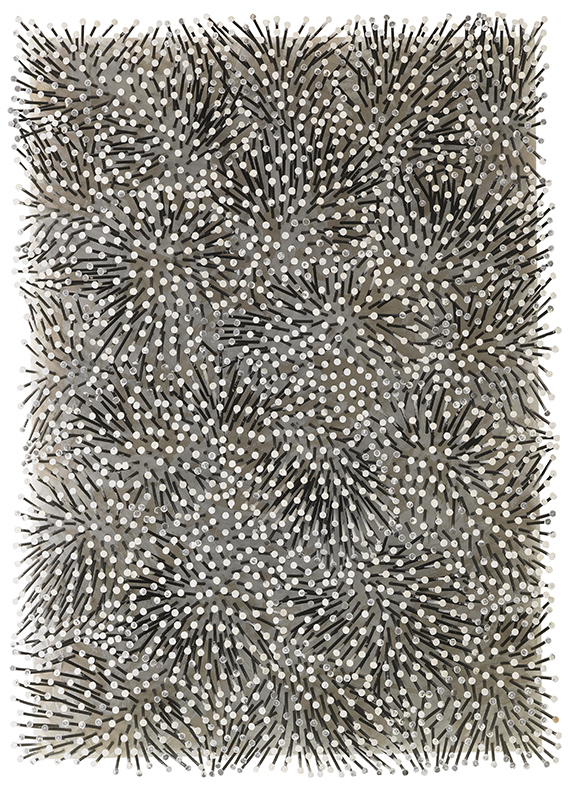

Günther Uecker

Feld, 1997.

Nails and white paint, on canvas and on wood

Estimate:

€ 300,000 / $ 339,000 Sold:

€ 550,000 / $ 621,499 (incl. surcharge)

Feld. 1997.

Nails and white paint, on canvas and on wood.

Verso signed, dated, titled, with a direction arrow and a dedication. 105 x 75 x 15 cm (41.3 x 29.5 x 5.9 in).

With a drawing of a mounting instruction by Günther Uecker, pencil on paper, signed, 43 x 23 cm, size of sheet. [SM].

• From Uecker's acclaimed key work groups of the "Nail Fields"

• Large power field with an expressive effect

• Particularly dense and highly dynamic nail arrangement.

The work is registered at the Uecker Archive with the number GU.97.067 and will be included into the catalog raisonné.

PROVENANCE: Private collection Hesse (directly from the artist).

"If you have the opportunity to see him [Uecker] work, just like I had, you get the impression that he places the nails on the field almost blind and in a swift and continuous action, that he sees the result as a whole only after completion or when exhaustion forces him to. [..] In terms of spontaneity, most of his large nail fields can be considered a continuation of Action Painting - just with different means, even though in Uecker's art the action does not explain the picture but the picture explains the action."

Dieter Honisch, in: Günther Uecker. Zwanzig Kapitel, 2005, p. 60.

Nails and white paint, on canvas and on wood.

Verso signed, dated, titled, with a direction arrow and a dedication. 105 x 75 x 15 cm (41.3 x 29.5 x 5.9 in).

With a drawing of a mounting instruction by Günther Uecker, pencil on paper, signed, 43 x 23 cm, size of sheet. [SM].

• From Uecker's acclaimed key work groups of the "Nail Fields"

• Large power field with an expressive effect

• Particularly dense and highly dynamic nail arrangement.

The work is registered at the Uecker Archive with the number GU.97.067 and will be included into the catalog raisonné.

PROVENANCE: Private collection Hesse (directly from the artist).

"If you have the opportunity to see him [Uecker] work, just like I had, you get the impression that he places the nails on the field almost blind and in a swift and continuous action, that he sees the result as a whole only after completion or when exhaustion forces him to. [..] In terms of spontaneity, most of his large nail fields can be considered a continuation of Action Painting - just with different means, even though in Uecker's art the action does not explain the picture but the picture explains the action."

Dieter Honisch, in: Günther Uecker. Zwanzig Kapitel, 2005, p. 60.

276

Günther Uecker

Feld, 1997.

Nails and white paint, on canvas and on wood

Estimate:

€ 300,000 / $ 339,000 Sold:

€ 550,000 / $ 621,499 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 276

Lot 276