Frame image

48

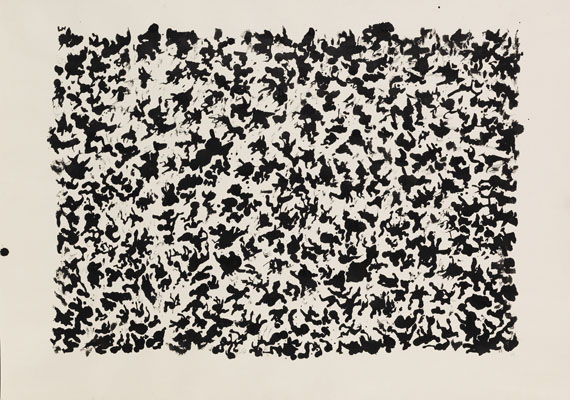

Henri Michaux

I 61, 1965.

Brush and India ink drawing

Estimate:

€ 14,000 / $ 16,520 Sold:

€ 17,500 / $ 20,650 (incl. surcharge)

I 61. 1965.

Brush and India ink drawing.

Monogrammed in lower right and upper left. Verso dated and titled as well as inscribed with direction instructions and a direction arrow. On wove paper by BFK Rives (with blindstamp). 75 x 105 cm (29.5 x 41.3 in), size of sheet. [CH].

• In private Swiss ownership for 45 years.

• From Michaux's important series of "Encre de Chine" pictures.

• Large format testimony to his fascination for Asian calligraphy, especially for Chinese ideograms.

• Further works from this series are at, among others, the Städel Museum in Frankfurt am Main, the London Tate, the Guggenheim Museum in New York and the Center Georges Pompidou in Paris.

PROVENANCE: Galerie Le Point Cardinal, Paris.

Erker-Galerie, St. Gallen.

Private collection Switzerland (acquired from aforementioned in 1975).

EXHIBITION: Henri Michaux, Erker-Galerie, St. Gallen, July 7 - September 7, 1974.

Brush and India ink drawing.

Monogrammed in lower right and upper left. Verso dated and titled as well as inscribed with direction instructions and a direction arrow. On wove paper by BFK Rives (with blindstamp). 75 x 105 cm (29.5 x 41.3 in), size of sheet. [CH].

• In private Swiss ownership for 45 years.

• From Michaux's important series of "Encre de Chine" pictures.

• Large format testimony to his fascination for Asian calligraphy, especially for Chinese ideograms.

• Further works from this series are at, among others, the Städel Museum in Frankfurt am Main, the London Tate, the Guggenheim Museum in New York and the Center Georges Pompidou in Paris.

PROVENANCE: Galerie Le Point Cardinal, Paris.

Erker-Galerie, St. Gallen.

Private collection Switzerland (acquired from aforementioned in 1975).

EXHIBITION: Henri Michaux, Erker-Galerie, St. Gallen, July 7 - September 7, 1974.

48

Henri Michaux

I 61, 1965.

Brush and India ink drawing

Estimate:

€ 14,000 / $ 16,520 Sold:

€ 17,500 / $ 20,650 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 48

Lot 48