Frame image

335

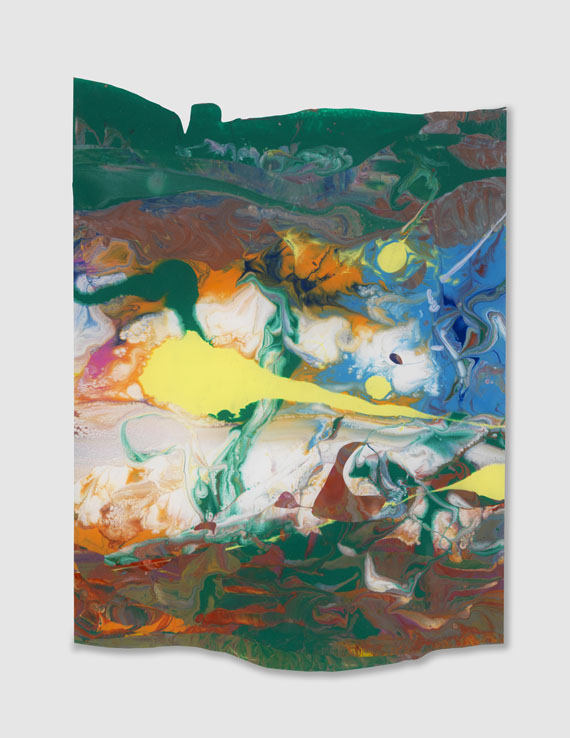

Gerhard Richter

Abdallah, 2010.

Acrylic lacquer behind glass

Estimate:

€ 70,000 / $ 82,600 Sold:

€ 81,250 / $ 95,875 (incl. surcharge)

Abdallah. 2010.

Acrylic lacquer behind glass.

Online catalog raisonné of paintings 917-59. Verso signed and dated and inscribed with the work number "917-59". 33 x 33 cm (12.9 x 12.9 in), incl. frame.

• To date only 3 other paintings from the "Abdallah" series have been offered on the international auction market.

• Richter's reverse glass paintings are marvelous documents of his technical mastery and innovative power.

• With a fascinating balance between calculation and coincidence Richter creates impressive color structures on the smooth surface of the image carrier.

• Richter opens up a vast associative space with his reverse glass compositions based on a strict selection process and with titles from the Middle Eastern folk tales of One Thousand and One Nights.

PROVENANCE: Galerie Fred Jahn, Munich.

Private collection Hesse (acquired from aforementioned).

LITERATURE: Gerhard Richter, Marian Goodman Gallery, London 2014, p. 7.

Gerhard Richter: Streifen & Glas, Staatliche Kunstsammlungen Dresden / Kunstmuseum Winterthur, Cologne 2013, p. 31.

"I am fascinated by coincidence, because everything happens coincidental. The way we are, why I wasn't born in Africa but here. It's all coincidence."

Gerhard Richter, November 2016.

Acrylic lacquer behind glass.

Online catalog raisonné of paintings 917-59. Verso signed and dated and inscribed with the work number "917-59". 33 x 33 cm (12.9 x 12.9 in), incl. frame.

• To date only 3 other paintings from the "Abdallah" series have been offered on the international auction market.

• Richter's reverse glass paintings are marvelous documents of his technical mastery and innovative power.

• With a fascinating balance between calculation and coincidence Richter creates impressive color structures on the smooth surface of the image carrier.

• Richter opens up a vast associative space with his reverse glass compositions based on a strict selection process and with titles from the Middle Eastern folk tales of One Thousand and One Nights.

PROVENANCE: Galerie Fred Jahn, Munich.

Private collection Hesse (acquired from aforementioned).

LITERATURE: Gerhard Richter, Marian Goodman Gallery, London 2014, p. 7.

Gerhard Richter: Streifen & Glas, Staatliche Kunstsammlungen Dresden / Kunstmuseum Winterthur, Cologne 2013, p. 31.

"I am fascinated by coincidence, because everything happens coincidental. The way we are, why I wasn't born in Africa but here. It's all coincidence."

Gerhard Richter, November 2016.

After a few experimental attempts, Richter discovered the technique of reverse glass painting as a means of artistic creation in 2008 and began to employ it for his painting of controlled chance. This led to the series of paintings "Sindbad" (2008), "Aladin", "Bagdad", "Ifrit", "Perizade" and "Abdallah" (each from 2010), of which all carry titles with origins in the rich culture of the Orient. Richter borrowed these titles from the characters of Islamic mythology and the famous collection of fairy tales "1001 Nights", which was translated from Middle Persian into Arabic in Baghdad around the year 800 and from then on was widely spread aroud he world, first in oriental cultures and later also in western cultures. It is certainly no coincidence that Richter puts this theme of a flourishing West alongside his abstract creations at a time when the oriental country of Iraq id torn by war and devastation. Gerhard Richter is not only a master of artistic experiments in a field between calculation and chance, but also a master in playing with free associations. Richter's oriental titles give the viewer room to associate the luminous, abstract color gradients with the luminous colors of the Orient or their finely structured movement fixed behind the glass with the repertoire of forms of Arabic calligraphy. And ultimately, an association with the uncontrolled chaos of the destruction of war cannot be excluded, either. Richter makes the luminous, abstract color structures, which are the result of a masterly staged calculated coincidence, the protagonists of his composition. The fact that they are executed on the back of the image carrier adds a mesmerizing aura. In order to realize this impressive result, Richter first lets the paint flow onto an acrylic glass panel and only partially intervenes in this random process of image creation through the use of brushes, sticks and spatulas. Finally, Richter transfers the desired section of the resulting composition onto the glass plate in a perfect copying process and permanently preserves these wonderful marbled color structures. [JS]

335

Gerhard Richter

Abdallah, 2010.

Acrylic lacquer behind glass

Estimate:

€ 70,000 / $ 82,600 Sold:

€ 81,250 / $ 95,875 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 335

Lot 335