465

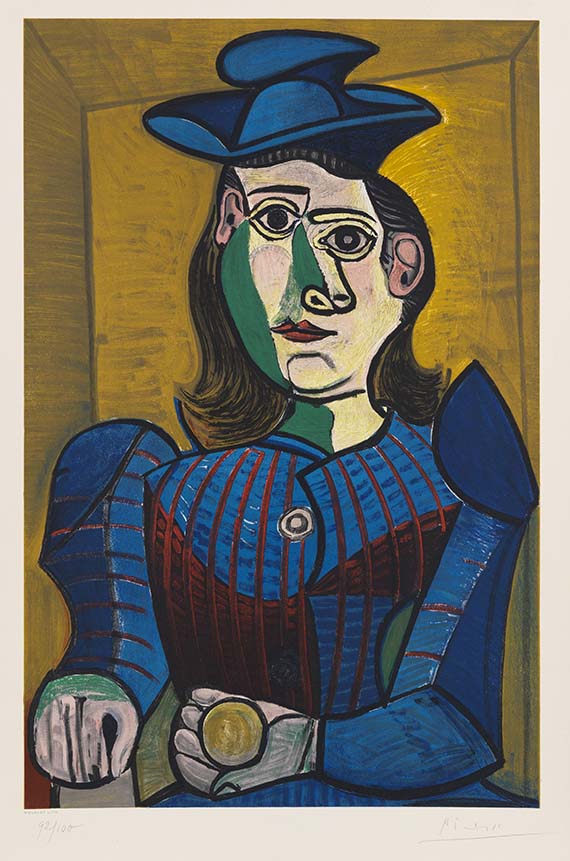

Pablo Picasso

Femme assise (Dora Maar), 1955.

Lithograph in colors after the painting "Dora

Estimate:

€ 18,000 / $ 20,340 Sold:

€ 62,500 / $ 70,625 (incl. surcharge)

Femme assise (Dora Maar). 1955.

Lithograph in colors after the painting "Dora Maar" from 1944.

Czwiklitzer 104. Rodrigo 038. Signed, numbered and with the typographic inscription "Mourlot Lith.". From an edition of 100 copies. On BFK Rives wove paper (with watermark). 92 x 60.2 cm (36.2 x 23.7 in). Sheet: 104,5 x 69,9 cm (41,1 x 27,5 in).

Printed by Fernand Mourlot, Paris. Poster before letters for the Picasso exhibition at Musée des Arts Décoratifs, Paris, June-October 1955. [AR].

• During his lifetime Picasso made many posters for his exhibitions himself, today they are on display at many international museums.

• His wifes and lovers repeatedly served him as model, in this case the very successful photographer Dora Maar.

• Picasso's female portraits are among the 20th century's most famous artworks.

PROVENANCE: Private collection Southern Germany.

"I paint the things the way I think them, not how I see them."

Pablo Picasso, quoted from: http://www.kunstzitate.de/bildendekunst/kuenstlerueberkunst/picasso_pablo.html

Lithograph in colors after the painting "Dora Maar" from 1944.

Czwiklitzer 104. Rodrigo 038. Signed, numbered and with the typographic inscription "Mourlot Lith.". From an edition of 100 copies. On BFK Rives wove paper (with watermark). 92 x 60.2 cm (36.2 x 23.7 in). Sheet: 104,5 x 69,9 cm (41,1 x 27,5 in).

Printed by Fernand Mourlot, Paris. Poster before letters for the Picasso exhibition at Musée des Arts Décoratifs, Paris, June-October 1955. [AR].

• During his lifetime Picasso made many posters for his exhibitions himself, today they are on display at many international museums.

• His wifes and lovers repeatedly served him as model, in this case the very successful photographer Dora Maar.

• Picasso's female portraits are among the 20th century's most famous artworks.

PROVENANCE: Private collection Southern Germany.

"I paint the things the way I think them, not how I see them."

Pablo Picasso, quoted from: http://www.kunstzitate.de/bildendekunst/kuenstlerueberkunst/picasso_pablo.html

465

Pablo Picasso

Femme assise (Dora Maar), 1955.

Lithograph in colors after the painting "Dora

Estimate:

€ 18,000 / $ 20,340 Sold:

€ 62,500 / $ 70,625 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 465

Lot 465