377

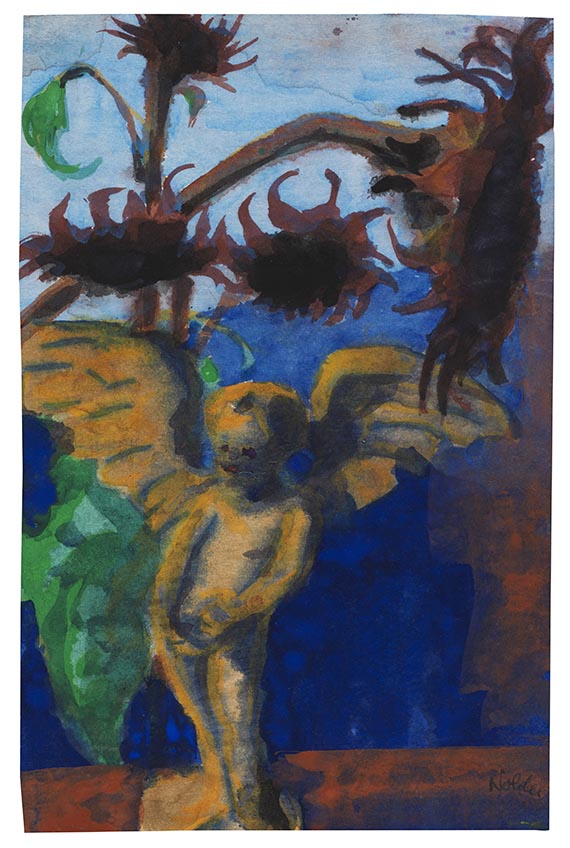

Emil Nolde

Engel vor Sonnenblumen, Um 1935.

Watercolor

Estimate:

€ 25,000 / $ 29,500 Sold:

€ 46,990 / $ 55,448 (incl. surcharge)

Engel vor Sonnenblumen. Um 1935.

Watercolor.

Lower right signed. On Japon. 24.5 x 16 cm (9.6 x 6.2 in), the full sheet.

[SM].

• In this watercolor, Nolde united two characteristic themes: the human figure and flowers.

• A particularly personal motif: a figure of an angel from his own collection and the sunflowers from his garden.

• In strong colors.

Accompanied by a duplicate of the photo expertise issued by Prof. Dr. Martin Urban, Foundation Seebüll Ada and Emil Nolde, from May 29, 2001 and a confirmation of this expertise issued by Prof. Dr. Manfred Reuther, Foundation Seebüll Ada and Emil Nolde, on August 7, 2006.

PROVENANCE: Private collection (1995)

C.G. Boerner, Düsseldorf.

Art dealer Hubertus Melsheimer, Cologne.

Private collection Northern Germany.

LITERATURE: Karl & Faber, Munich, 181st auction, May 28/29, 1991, lot 961.

Grisebach, Berlin, May 26, 1995, lot 24.

Bernhard Fulda, Emil Nolde. Eine deutsche Legende. Der Künstler im Nationalsozialismus. Essay- und Bildband zur Ausst. Neue Galerie im Hamburger Bahnhof - Museum für Gegenwart, Berlin (April 12 - September 15, 2019), Munich 2019, p. 192 (color illu.).

Watercolor.

Lower right signed. On Japon. 24.5 x 16 cm (9.6 x 6.2 in), the full sheet.

[SM].

• In this watercolor, Nolde united two characteristic themes: the human figure and flowers.

• A particularly personal motif: a figure of an angel from his own collection and the sunflowers from his garden.

• In strong colors.

Accompanied by a duplicate of the photo expertise issued by Prof. Dr. Martin Urban, Foundation Seebüll Ada and Emil Nolde, from May 29, 2001 and a confirmation of this expertise issued by Prof. Dr. Manfred Reuther, Foundation Seebüll Ada and Emil Nolde, on August 7, 2006.

PROVENANCE: Private collection (1995)

C.G. Boerner, Düsseldorf.

Art dealer Hubertus Melsheimer, Cologne.

Private collection Northern Germany.

LITERATURE: Karl & Faber, Munich, 181st auction, May 28/29, 1991, lot 961.

Grisebach, Berlin, May 26, 1995, lot 24.

Bernhard Fulda, Emil Nolde. Eine deutsche Legende. Der Künstler im Nationalsozialismus. Essay- und Bildband zur Ausst. Neue Galerie im Hamburger Bahnhof - Museum für Gegenwart, Berlin (April 12 - September 15, 2019), Munich 2019, p. 192 (color illu.).

377

Emil Nolde

Engel vor Sonnenblumen, Um 1935.

Watercolor

Estimate:

€ 25,000 / $ 29,500 Sold:

€ 46,990 / $ 55,448 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 377

Lot 377