118

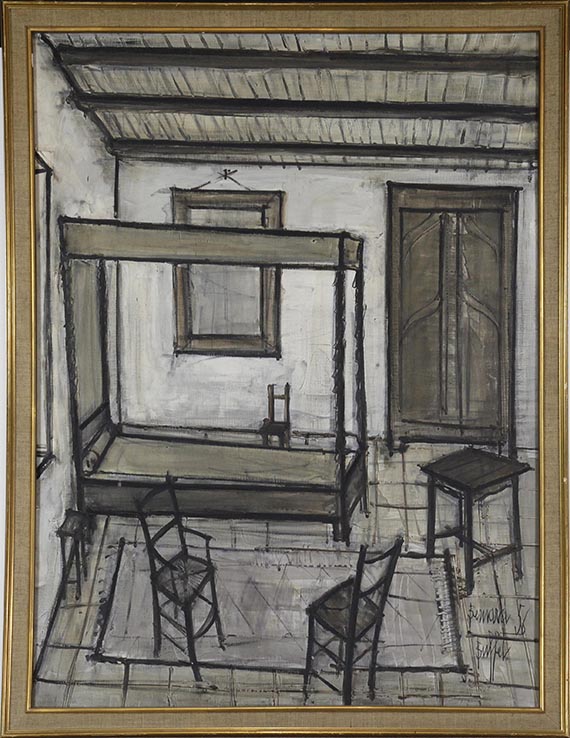

Bernard Buffet

Interieur, 1956.

Oil on canvas

Estimate:

€ 40,000 / $ 47,200 Sold:

€ 41,910 / $ 49,453 (incl. surcharge)

Interieur. 1956.

Oil on canvas.

Lower right signed and dated. Inscribed "R14" on teh reverse, presumably by a hand other than that of the artist. 130 x 97 cm (51.1 x 38.1 in). [EH].

• Prime example of an interior from Bernard Buffet's early work.

• In 1955, the magazine "Connaissance des Arts" named Bernard Buffet, only 27 years old, the greatest French painter of the younger generation.

• His paintings vividly convey the world of thought of the Parisian existentialists.

• The Musée Bernard Buffet opened in Shizouoka, Japan, in 1973.

• Works by Bernard Buffet are at, among others, the Sammlung Im Obersteg at the Kunstmuseum Basel, the Musée National d'Art Moderne, Paris, and the Tate Gallery in London.

The work will be included into the forthcoming volume II of the catalogue raisonné of Bernard Buffet's paintings.

PROVENANCE: Private collection Northern Germany.

Oil on canvas.

Lower right signed and dated. Inscribed "R14" on teh reverse, presumably by a hand other than that of the artist. 130 x 97 cm (51.1 x 38.1 in). [EH].

• Prime example of an interior from Bernard Buffet's early work.

• In 1955, the magazine "Connaissance des Arts" named Bernard Buffet, only 27 years old, the greatest French painter of the younger generation.

• His paintings vividly convey the world of thought of the Parisian existentialists.

• The Musée Bernard Buffet opened in Shizouoka, Japan, in 1973.

• Works by Bernard Buffet are at, among others, the Sammlung Im Obersteg at the Kunstmuseum Basel, the Musée National d'Art Moderne, Paris, and the Tate Gallery in London.

The work will be included into the forthcoming volume II of the catalogue raisonné of Bernard Buffet's paintings.

PROVENANCE: Private collection Northern Germany.

118

Bernard Buffet

Interieur, 1956.

Oil on canvas

Estimate:

€ 40,000 / $ 47,200 Sold:

€ 41,910 / $ 49,453 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 118

Lot 118