425

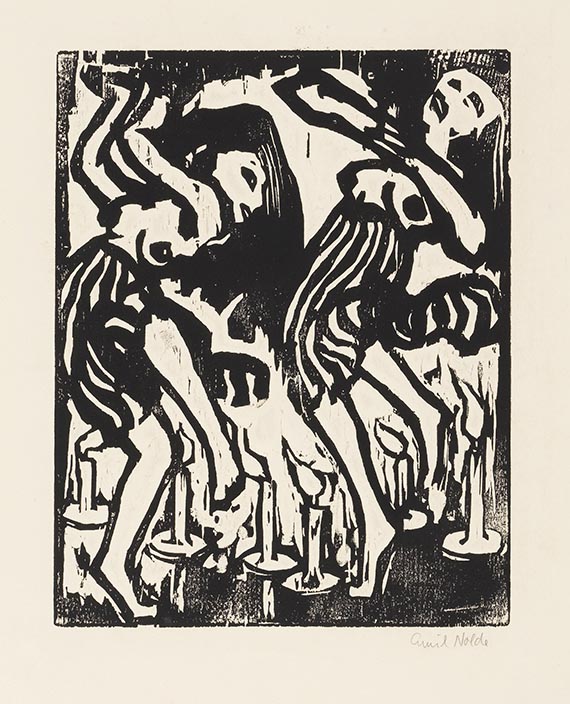

Emil Nolde

Kerzentänzerinnen, 1917.

Woodcut

Estimate:

€ 18,000 / $ 20,340 Sold:

€ 20,574 / $ 23,248 (incl. surcharge)

Kerzentänzerinnen. 1917.

Woodcut.

Schiefler/Mosel/Urban H 127 V (of V). Signed. According to Nolde's documentation, 13 copies of this printing state were made. Another 8 copies of the other states were printed. On firm off-white paper. 30.5 x 23.8 cm (12 x 9.3 in). Sheet: 41,3 x 33,8 cm (16,2 x 13,3 in).

[JS].

• Nolde's "Kerzentänzerinnen"- characterized by an expressive force and a mystical exotic appeal.

• The eccentric motif of this rare hand-made print is based on one Nolde's most significant expressionist painting: the "Kerzentänzerinnen" from 1912 (Nolde Foundation Seebüll).

• The fascination for expressive free dance is one of the key motifs of German Expressionism.

• In those days Nolde, Kirchner, Pechstein, Jawlensky, Kandinsky and many others were fascinated by the expressive value of modern dance.

• The traditions of ritual dances in many exotic cultures offered inspiration for the dance and art avant-garde at the beginning of the 20th century.

• Rare. To date only a maximum of six other hand-printed copies of this woodcut have been offered on the international auction market (source: www.artprice.com).

PROVENANCE: Kornfeld und Klipstein, Bern, auction 153, 1974.

Private collection Hesse (acquired from the above, ever since family-owned).

Woodcut.

Schiefler/Mosel/Urban H 127 V (of V). Signed. According to Nolde's documentation, 13 copies of this printing state were made. Another 8 copies of the other states were printed. On firm off-white paper. 30.5 x 23.8 cm (12 x 9.3 in). Sheet: 41,3 x 33,8 cm (16,2 x 13,3 in).

[JS].

• Nolde's "Kerzentänzerinnen"- characterized by an expressive force and a mystical exotic appeal.

• The eccentric motif of this rare hand-made print is based on one Nolde's most significant expressionist painting: the "Kerzentänzerinnen" from 1912 (Nolde Foundation Seebüll).

• The fascination for expressive free dance is one of the key motifs of German Expressionism.

• In those days Nolde, Kirchner, Pechstein, Jawlensky, Kandinsky and many others were fascinated by the expressive value of modern dance.

• The traditions of ritual dances in many exotic cultures offered inspiration for the dance and art avant-garde at the beginning of the 20th century.

• Rare. To date only a maximum of six other hand-printed copies of this woodcut have been offered on the international auction market (source: www.artprice.com).

PROVENANCE: Kornfeld und Klipstein, Bern, auction 153, 1974.

Private collection Hesse (acquired from the above, ever since family-owned).

425

Emil Nolde

Kerzentänzerinnen, 1917.

Woodcut

Estimate:

€ 18,000 / $ 20,340 Sold:

€ 20,574 / $ 23,248 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 425

Lot 425