26

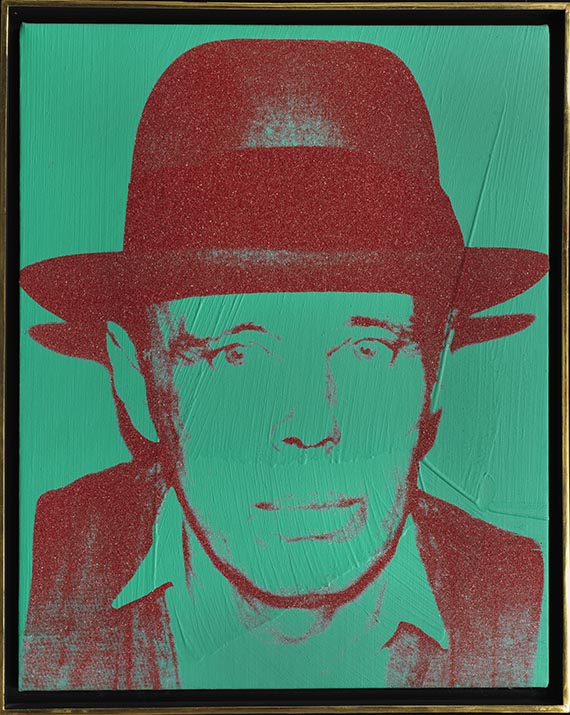

Andy Warhol

Joseph Beuys, 1982.

Acrylic with silkscreen and diamond dust on canvas

Estimate:

€ 250,000 / $ 295,000 Sold:

€ 317,500 / $ 374,650 (incl. surcharge)

Joseph Beuys. 1982.

Acrylic with silkscreen and diamond dust on canvas.

Signed and dated on the reverse. 50.5 x 40.5 cm (19.8 x 15.9 in).

• Warhol shot the Polaroid the work is based on at his legendary Factory.

• On the occassion of his exhibition at the Guggenheim Museum, Beuys was in New York and visited the Factory.

• Unique objects with diamond dust are extremely rare.

• Process of creation: clear traces of the green on the canvas; while the silkscreen's red, in return, is emphasized by the diamond dust.

• Consistent provenance.

Accompanied by a confirmation of authenticity issued by Vincent Fremont, Vice-President of Andy Warrhol Enterprises / Andy Warhol Studio New York, dated May 13, 1983.

PROVENANCE: Galerie Silvia Menzel, Berlin 1983

Private collection Cologne.

EXHIBITION: Andy Warhol. Bilder, Zeichnungen, Plakate, Galerie Silvia Menzel, Berlin, March 15 - April 14, 1983.

Acrylic with silkscreen and diamond dust on canvas.

Signed and dated on the reverse. 50.5 x 40.5 cm (19.8 x 15.9 in).

• Warhol shot the Polaroid the work is based on at his legendary Factory.

• On the occassion of his exhibition at the Guggenheim Museum, Beuys was in New York and visited the Factory.

• Unique objects with diamond dust are extremely rare.

• Process of creation: clear traces of the green on the canvas; while the silkscreen's red, in return, is emphasized by the diamond dust.

• Consistent provenance.

Accompanied by a confirmation of authenticity issued by Vincent Fremont, Vice-President of Andy Warrhol Enterprises / Andy Warhol Studio New York, dated May 13, 1983.

PROVENANCE: Galerie Silvia Menzel, Berlin 1983

Private collection Cologne.

EXHIBITION: Andy Warhol. Bilder, Zeichnungen, Plakate, Galerie Silvia Menzel, Berlin, March 15 - April 14, 1983.

Silvia Menzel opened her gallery on Leibnitzstrasse in Berlin in 1982. Over the many years of her collecting activities, she had become acquainted with many artists and even was friends with some of them. Her first exhibition featured works by Joseph Beuys, Fetting and Andy Warhol. In addition to early drawings from 1954 to 1958, Andy Warhol also made some smaller pictures available to her. (In Berlin bin ich ein Aussenseiter. Marius Babias talks with Silvia Menzel and Michael Geisler, in: Kunstforum international, vol. 95, 1988, pp. 320ff.) The present picture, which was acquired from the gallery in 1983, is a typical work by the great pop artist. In his depiction of Joseph Beuys he captured the important German conceptual artist with his essential identifying feature: the hat. His photo shows the myth of Beuys par excellence; it has become an icon in itself. The template is a Polaroid, the creation of which the Berlin collector Dr. Erich Marx describes as follows: "While we set up the Beuys exhibition at the Guggenheim Museum in late October 1979, Joseph Beuys, Andy Warhol and I met before the opening of another Beuys exhibition at Galerie Feldmann. Warhol and I watched Beuys making a self-portrait by painting over a photo canvas with a thin asphalt substance. While Beuys was working, I talked to Andy about a portrait of Beuys. Andy Warhol invited us to the Factory the next day. The photos were also shot that day, .." (Heiner Bastian, Beuys Rauschenberg Twombly Warhol. Marx Collection, Munich 1982 p. 136). [EH]

26

Andy Warhol

Joseph Beuys, 1982.

Acrylic with silkscreen and diamond dust on canvas

Estimate:

€ 250,000 / $ 295,000 Sold:

€ 317,500 / $ 374,650 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 26

Lot 26