Frame image

350

Karl Horst Hödicke

Die Telefonzelle, 1982.

Synthetic resin on canvas

Estimate:

€ 30,000 / $ 35,400 Sold:

€ 38,100 / $ 44,958 (incl. surcharge)

Die Telefonzelle. 1982.

Synthetic resin on canvas.

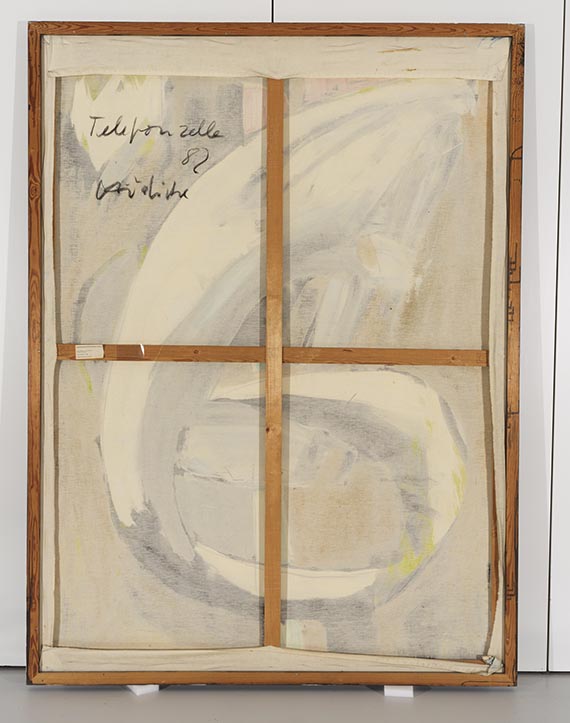

Signed, dated and titled on the reverse. 230 x 170 cm (90.5 x 66.9 in).

[AR].

• Anonymity in a night-time scene: a characteristic human study by the critical chronicler of Berlin city life.

• With his expressive-realistic painting, K. H. Hödicke is one of the most influential pioneers of post-war Berlin art.

• Exhibited in the extensive 1986 retrospective of the artist's work at the Kunstsammlung Nordrhein-Westfalen.

PROVENANCE: Gallery Gmyrek, Düsseldorf.

Private collection, North Rhine-Westphalia (acquired from the above).

EXHIBITION: K. H. Hödicke. Retrospektive, Kunstsammlung Nordrhein-Westfalen, Düsseldorf, August 15 - September 21, 1986, Städtische Kunsthalle, Mannheim, Feb. - March, 1987, Städtische Galerie Wolfsburg, Wolfsburger Kunstverein e.V., 1987, p. 19 and p. 113 ( illustrated in color, titled "Telefonzelle II", label on the reverse).

Synthetic resin on canvas.

Signed, dated and titled on the reverse. 230 x 170 cm (90.5 x 66.9 in).

[AR].

• Anonymity in a night-time scene: a characteristic human study by the critical chronicler of Berlin city life.

• With his expressive-realistic painting, K. H. Hödicke is one of the most influential pioneers of post-war Berlin art.

• Exhibited in the extensive 1986 retrospective of the artist's work at the Kunstsammlung Nordrhein-Westfalen.

PROVENANCE: Gallery Gmyrek, Düsseldorf.

Private collection, North Rhine-Westphalia (acquired from the above).

EXHIBITION: K. H. Hödicke. Retrospektive, Kunstsammlung Nordrhein-Westfalen, Düsseldorf, August 15 - September 21, 1986, Städtische Kunsthalle, Mannheim, Feb. - March, 1987, Städtische Galerie Wolfsburg, Wolfsburger Kunstverein e.V., 1987, p. 19 and p. 113 ( illustrated in color, titled "Telefonzelle II", label on the reverse).

350

Karl Horst Hödicke

Die Telefonzelle, 1982.

Synthetic resin on canvas

Estimate:

€ 30,000 / $ 35,400 Sold:

€ 38,100 / $ 44,958 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 350

Lot 350