347

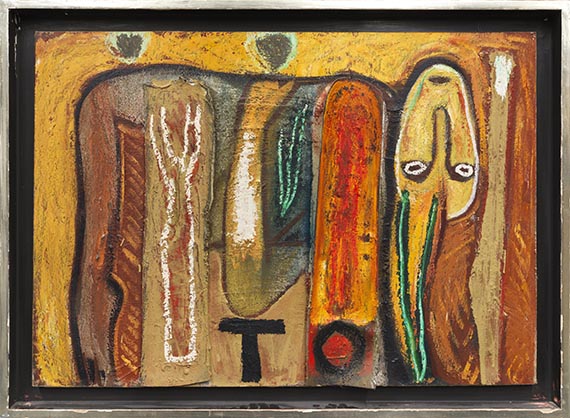

Mimmo Paladino

Senza titolo, 1985.

Mixed media. Oil and cardboard collage on cardb...

Estimate:

€ 20,000 / $ 23,600 Sold:

€ 17,780 / $ 20,980 (incl. surcharge)

Senza titolo. 1985.

Mixed media. Oil and cardboard collage on cardboard, laid on wood.

Signed and dated on the reverse. 72.5 x 102.5 cm (28.5 x 40.3 in). [AW].

• Palladino creates pictorial parallel worlds full of symbolic encryptions and alienations.

• In this vibrant work, he explores flora and fauna in a both enigmatic and fascinating fashion.

• The use of tactile materials opens up a dialog between reality and dream.

• Palladino is an important representative of the Italian Transavanguardia of the 1970s.

PROVENANCE: Galerie Delta, Rotterdam (with two labels on the rear of the frame).

Private collection, Hesse.

Mixed media. Oil and cardboard collage on cardboard, laid on wood.

Signed and dated on the reverse. 72.5 x 102.5 cm (28.5 x 40.3 in). [AW].

• Palladino creates pictorial parallel worlds full of symbolic encryptions and alienations.

• In this vibrant work, he explores flora and fauna in a both enigmatic and fascinating fashion.

• The use of tactile materials opens up a dialog between reality and dream.

• Palladino is an important representative of the Italian Transavanguardia of the 1970s.

PROVENANCE: Galerie Delta, Rotterdam (with two labels on the rear of the frame).

Private collection, Hesse.

347

Mimmo Paladino

Senza titolo, 1985.

Mixed media. Oil and cardboard collage on cardb...

Estimate:

€ 20,000 / $ 23,600 Sold:

€ 17,780 / $ 20,980 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 347

Lot 347