319

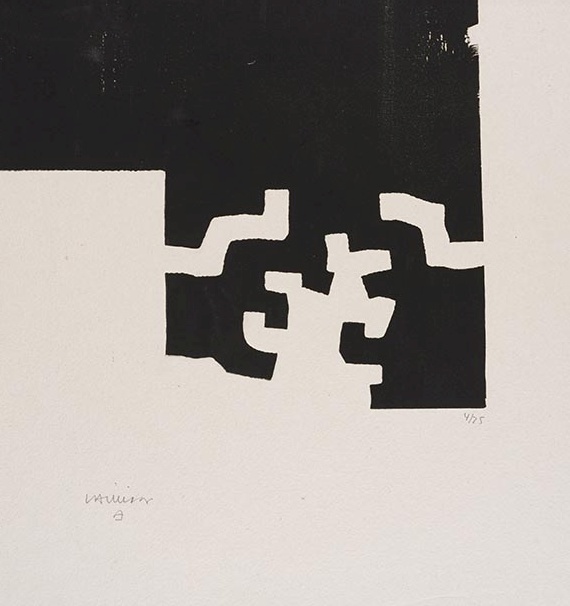

Eduardo Chillida

Jatorri, 1975.

Woodcut

Estimate:

€ 2,000 / $ 2,360 Sold:

€ 3,125 / $ 3,687 (incl. surcharge)

Eduardo Chillida

Jatorri. Orig.-Holzschnitt. Signiert und numeriert. 1975. Auf festem Velin von Guarro (ohne Wasserzeichen). 34 : 41,4 cm. Papierformat 53 : 50 cm.

1 von 75 Exemplaren. Schöne Variante von Chillidas abstrakten Holzschnitt-Arbeiten, die von der besonderen Materialität seiner Papierarbeiten zeugt.

Gedruckt bei Les Estampas de la Cometa , Barcelona. Herausgegeben vom Grafos Verlag, Vaduz 1975.

- ZUSTAND: Mit wenigen geringfüg. Bereibungen. - PROVENIENZ: Privatsammlung Hessen.

LITERATUR: Van der Koelen 75013.

Orig. woodcut. 1 of 75 signed and numberd copies. On firm paper by Guarro. - With only a few minor rubbings. - Private collection Hesse.

Jatorri. Orig.-Holzschnitt. Signiert und numeriert. 1975. Auf festem Velin von Guarro (ohne Wasserzeichen). 34 : 41,4 cm. Papierformat 53 : 50 cm.

1 von 75 Exemplaren. Schöne Variante von Chillidas abstrakten Holzschnitt-Arbeiten, die von der besonderen Materialität seiner Papierarbeiten zeugt.

Gedruckt bei Les Estampas de la Cometa , Barcelona. Herausgegeben vom Grafos Verlag, Vaduz 1975.

- ZUSTAND: Mit wenigen geringfüg. Bereibungen. - PROVENIENZ: Privatsammlung Hessen.

LITERATUR: Van der Koelen 75013.

Orig. woodcut. 1 of 75 signed and numberd copies. On firm paper by Guarro. - With only a few minor rubbings. - Private collection Hesse.

319

Eduardo Chillida

Jatorri, 1975.

Woodcut

Estimate:

€ 2,000 / $ 2,360 Sold:

€ 3,125 / $ 3,687 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 319

Lot 319