118

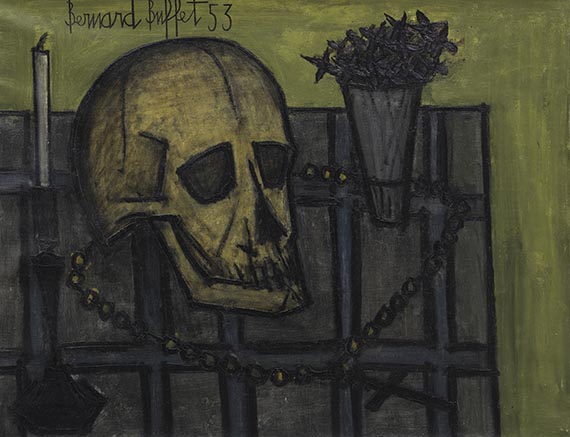

Bernard Buffet

Vanité, 1953.

Oil on canvas

Estimate:

€ 30,000 - 40,000

$ 32,100 - 42,800

Vanité. 1953.

Oil on canvas.

Signed and dated in upper left. Inscribed “J 16” on the reverse of the canvas. 49.8 x 64.8 cm (19.6 x 25.5 in). [AW].

• Buffet was the star of the French art scene in the 1950s and has a reputation as "painter of existentialism".

• His unmistakable realistic style is based on Rembrandt, Géricault, Courbet and van Gogh.

• Death, hunger and disgust are the basic themes of his gloomy still lifes.

• His works are in renowned international collections like the Kunstmuseum Basel, Tate Gallery, London, the Musée Nacional d'Art Moderne, Paris, and the Museum of Modern Art, New York.

PROVENANCE: Galerie Drouant-David, Paris.

Olbricht Collection, Essen/Berlin (acquired from the above in 2007).

EXHIBITION: Go for it! Olbricht Collection (a sequel), Weserburg, Museum für moderne Kunst, Berlin, May 10, 2008 - November 1, 2009.

Lebenslust & Totentanz. Olbricht Collection, Kunsthalle Krems, July 18 - November 7, 2010.

LITERATURE: Fonds du Dotation Bernard Buffet, Bernard Buffet. Catalogue raisonné de l'Œuvre peint. 1941-1953, vol. I, Paris 2019, p. 360 (illu.).

- -

Christie's, New York, auction 1901, November 7, 2007, lot 437.

Called up: June 7, 2024 - ca. 13.55 h +/- 20 min.

Oil on canvas.

Signed and dated in upper left. Inscribed “J 16” on the reverse of the canvas. 49.8 x 64.8 cm (19.6 x 25.5 in). [AW].

• Buffet was the star of the French art scene in the 1950s and has a reputation as "painter of existentialism".

• His unmistakable realistic style is based on Rembrandt, Géricault, Courbet and van Gogh.

• Death, hunger and disgust are the basic themes of his gloomy still lifes.

• His works are in renowned international collections like the Kunstmuseum Basel, Tate Gallery, London, the Musée Nacional d'Art Moderne, Paris, and the Museum of Modern Art, New York.

PROVENANCE: Galerie Drouant-David, Paris.

Olbricht Collection, Essen/Berlin (acquired from the above in 2007).

EXHIBITION: Go for it! Olbricht Collection (a sequel), Weserburg, Museum für moderne Kunst, Berlin, May 10, 2008 - November 1, 2009.

Lebenslust & Totentanz. Olbricht Collection, Kunsthalle Krems, July 18 - November 7, 2010.

LITERATURE: Fonds du Dotation Bernard Buffet, Bernard Buffet. Catalogue raisonné de l'Œuvre peint. 1941-1953, vol. I, Paris 2019, p. 360 (illu.).

- -

Christie's, New York, auction 1901, November 7, 2007, lot 437.

Called up: June 7, 2024 - ca. 13.55 h +/- 20 min.

118

Bernard Buffet

Vanité, 1953.

Oil on canvas

Estimate:

€ 30,000 - 40,000

$ 32,100 - 42,800

Buyer's premium, taxation and resale right compensation for Bernard Buffet "Vanité"

This lot can be purchased subject to differential or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 118

Lot 118