47

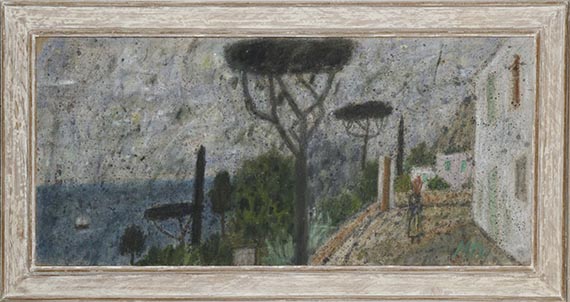

Max Peiffer Watenphul

Landschaft bei Amalfi, 1963.

Oil

Starting bid: € 9,000 / $ 10,620

Landschaft bei Amalfi. 1963.

Oil on burlap.

Monogrammed in the lower right. 54.5 x 120 cm (21.4 x 47.2 in).

A draft in black pen for this work can be found in the sketchbook XII. [MH].

• Atmospheric depiction in the artist's unmistakable style.

• Max Peiffer-Watenphul's dreamily Italian landscapes are an expression of a mindset inspired by the ideals of beauty of bygone eras.

• Most recently, the Casa di Goethe in Rome dedicated an exhibition to Peiffer Watenphul in 2023.

PROVENANCE: Grace Watenphul (the artist's half-sister, handwritten on the reverse of the canvas).

Private collection, Rhineland-Palatinate (since 1996, Galerie Thomas, Munich).

Private collection, Rhineland-Palatinate (inherited from the above).

LITERATURE: Grace Watenphul Pasqualucci, Alessandra Pasqualucci, Max Peiffer Watenphul. Catalogue raisonné, vol. 1: Gemälde - Aquarelle, Cologne 1989, catalog number G 723 (illustrated in black and white).

In good condition. Peiffer Watenphul applied the paint to the coarse canvas without a primer, which means that the coarse fabric structure is partially visible. This is due to the technique and does not constitute damage. Minimal discoloration in places.

The condition report was compiled in daylight with a UV light source and to the best of our knowledge and belief.

Oil on burlap.

Monogrammed in the lower right. 54.5 x 120 cm (21.4 x 47.2 in).

A draft in black pen for this work can be found in the sketchbook XII. [MH].

• Atmospheric depiction in the artist's unmistakable style.

• Max Peiffer-Watenphul's dreamily Italian landscapes are an expression of a mindset inspired by the ideals of beauty of bygone eras.

• Most recently, the Casa di Goethe in Rome dedicated an exhibition to Peiffer Watenphul in 2023.

PROVENANCE: Grace Watenphul (the artist's half-sister, handwritten on the reverse of the canvas).

Private collection, Rhineland-Palatinate (since 1996, Galerie Thomas, Munich).

Private collection, Rhineland-Palatinate (inherited from the above).

LITERATURE: Grace Watenphul Pasqualucci, Alessandra Pasqualucci, Max Peiffer Watenphul. Catalogue raisonné, vol. 1: Gemälde - Aquarelle, Cologne 1989, catalog number G 723 (illustrated in black and white).

In good condition. Peiffer Watenphul applied the paint to the coarse canvas without a primer, which means that the coarse fabric structure is partially visible. This is due to the technique and does not constitute damage. Minimal discoloration in places.

The condition report was compiled in daylight with a UV light source and to the best of our knowledge and belief.

47

Max Peiffer Watenphul

Landschaft bei Amalfi, 1963.

Oil

Starting bid: € 9,000 / $ 10,620

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 47

Lot 47