Frame image

130

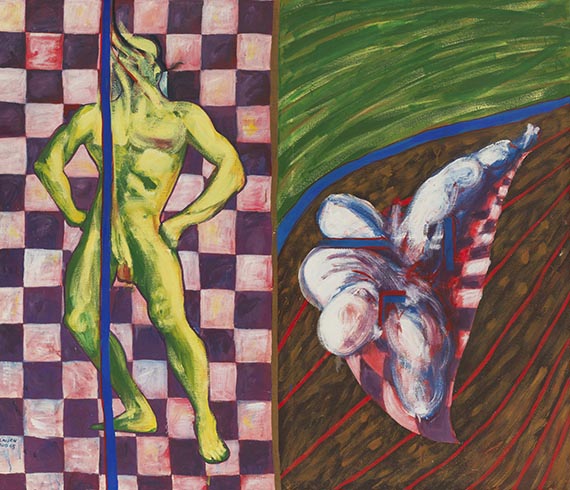

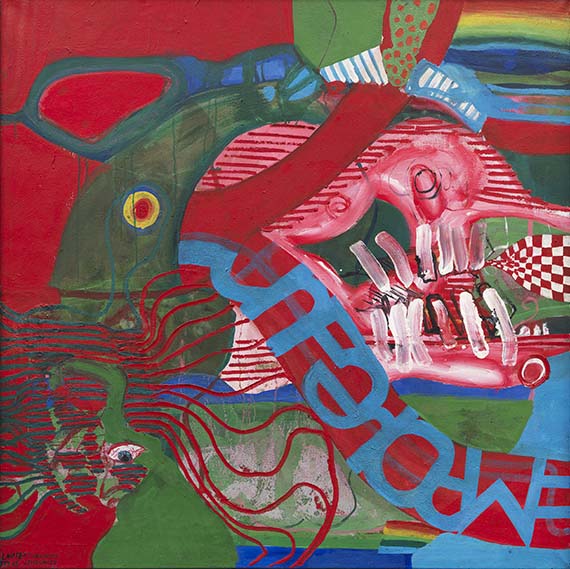

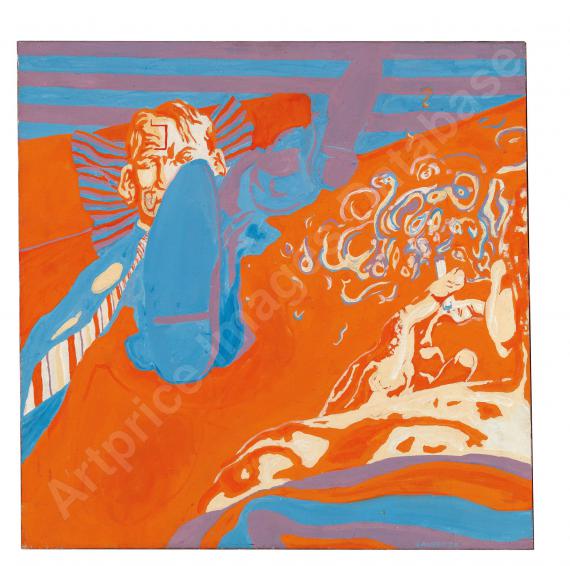

Uwe Lausen

Ohne Titel, 1965.

Oil on canvas

Estimate:

€ 60,000 - 80,000

$ 64,200 - 85,600

Ohne Titel. 1965.

Oil on canvas.

Signed and dated in lower left. 170 x 200 cm (66.9 x 78.7 in).

• The reduced motif as well as a focus on contrasting colors and a photographic adaptation make this a characteristic work of the 1960s.

• Lausen transfers his mental level of perception into a sculptural expression.

• Without any academic training, Uwe Lausen created a striking oeuvre in the course of a short life.

• Privately owned for almost 40 years.

PROVENANCE: From the estate of the artist's family.

Private collection Southern Germany (acquired from the above in 1988).

LITERATURE: Selima Niggl, Uwe Lausen. Werkverzeichnis der Gemälde 1961-1969, Bremen 2010, WVZ-Nr. 65/26 (m. Abb. S. 53).

"Uwe Lausen's oeuvre ranks among the strongest positions in figurative painting in Germany in the 1960s."

From the press release of the Schirn Kunsthalle, Frankfurt a. Main, on the occasion of the major retrospective in 2010.

Called up: June 7, 2024 - ca. 14.11 h +/- 20 min.

Oil on canvas.

Signed and dated in lower left. 170 x 200 cm (66.9 x 78.7 in).

• The reduced motif as well as a focus on contrasting colors and a photographic adaptation make this a characteristic work of the 1960s.

• Lausen transfers his mental level of perception into a sculptural expression.

• Without any academic training, Uwe Lausen created a striking oeuvre in the course of a short life.

• Privately owned for almost 40 years.

PROVENANCE: From the estate of the artist's family.

Private collection Southern Germany (acquired from the above in 1988).

LITERATURE: Selima Niggl, Uwe Lausen. Werkverzeichnis der Gemälde 1961-1969, Bremen 2010, WVZ-Nr. 65/26 (m. Abb. S. 53).

"Uwe Lausen's oeuvre ranks among the strongest positions in figurative painting in Germany in the 1960s."

From the press release of the Schirn Kunsthalle, Frankfurt a. Main, on the occasion of the major retrospective in 2010.

Called up: June 7, 2024 - ca. 14.11 h +/- 20 min.

130

Uwe Lausen

Ohne Titel, 1965.

Oil on canvas

Estimate:

€ 60,000 - 80,000

$ 64,200 - 85,600

Buyer's premium, taxation and resale right compensation for Uwe Lausen "Ohne Titel"

This lot can be purchased subject to differential or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 130

Lot 130