74

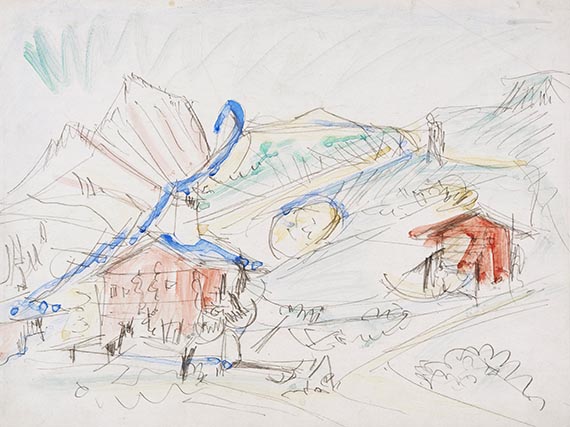

Ernst Ludwig Kirchner

Längmatte, 1921.

Pencil drawing

Starting bid: € 10,000 / $ 11,800

Längmatte. 1921.

Pencil drawing and watercolor.

With the estate stamp of the Kunstmuseum Basel (Lugt 1570 b) and the hand-written registration number "A Da / Aa 57" on the reverse. There also titled "Berghütte" by a hand other than that of the artist. On chalk-primed wove paper. 38 x 50 cm (14.9 x 19.6 in), the full sheet. [CH].

• Part of the Hermann Gerlinger collection for over 50 years.

• Dynamic yet detailed depiction from the Davos period.

• The hard life of the peasant families in Davos and the bucolic village idyll were important sources of inspiration for Kirchner at this time.

• In the summer of 1921, the year our work was created, the artist lived in the house "In den Lärchen" in Davos Frauenkirch and, despite his recurring illness, was able to unfold a seemingly inexhaustible creative energy.

• The depiction combines the grand Swiss mountains, Kirchner's simple, balanced life far away from the tumultuous city life with his masterful draughtsmanship and bold, expressionist color accents.

This work is documented in the Ernst Ludwig Kirchner Archive, Wichtrach/Bern.

PROVENANCE: Artist's estate (Davos 1938, Kunstmuseum Basel 1946).

Stuttgarter Kunstkabinett Roman Norbert Ketterer, Stuttgart (1954).

Galerie Nierendorf, Berlin.

Hermann Gerlinger Collection, Würzburg (with the collector's stamp, Lugt 6032, acquired from the above in 1971).

EXHIBITION: Schleswig-Holsteinisches Landesmuseum, Schloss Gottorf, Schleswig (permanent loan from the Hermann Gerlinger Collection, 1995-2001).

Kunstmuseum Moritzburg, Halle an der Saale (permanent loan from the Hermann Gerlinger Collection, 2001-2017).

Buchheim Museum, Bernried (permanent loan from the Hermann Gerlinger Collection, 2017-2022).

LITERATURE: Heinz Spielmann (ed.), Die Maler der Brücke. Sammlung Hermann Gerlinger, Stuttgart 1995, p. 273, SHG no. 399 (illu.).

Hermann Gerlinger, Katja Schneider (eds.), Die Maler der Brücke. Inventory catalog Hermann Gerlinger Collection, Halle (Saale) 2005, p. 352, SHG no. 787 (illu.).

Ernst Ludwig Kirchner, 1919, quoted from: Lucius Grisebach, Ernst Ludwig Kirchner 1880-1938, Cologne 1995, p. 153.

It was because of his poor health that E. L. Kirchner went to Davos to seek medical treatment from Dr. Frédéric Bauer, then head physician at the Davos Park Sanatorium, several times from 1917 onward, before he and his partner Erna Schilling finally movied to Switzerland for good. Until 1923, Kirchner lived in the house "In den Lärchen" in Davos-Frauenkirch, where this work was also created. At his place of longing in the Swiss mountains, he could enjoy a simple, rustic life with only a few amenities. The Alpine landscape, the life of the local farmers' families and the bucolic idyll nature had to offer were important sources of inspiration for Kirchner during these years and led to both mental stability and a renewal of creativity. Impressed by the nature he was now surrounded by and which the versatile artist also immortalized in photographs, Kirchner depicted the mountainous landscape in drawings, watercolors, paintings and prints. In this dynamic drawing, he combined the grandiose Swiss mountains and his simple, balanced life far from his former bustling city life with his masterly draftsmanship and bold, expressionist color accents. Kirchner used the dense composition, partly already in color, in, among others, the paintings "Kummeralpberg" (1920, Art Institute of Chicago) and "Tobel der Stafelalp" (1919, Gordon 596). [CH]

In good condition. Edges minimally scuffed in places and slightly worn. The upper third with slight creases and a diagonal folding mark in the area of the upper right corner, there with a small tear in the upper edge. Image minimally rubbed and soiled in places.

Pencil drawing and watercolor.

With the estate stamp of the Kunstmuseum Basel (Lugt 1570 b) and the hand-written registration number "A Da / Aa 57" on the reverse. There also titled "Berghütte" by a hand other than that of the artist. On chalk-primed wove paper. 38 x 50 cm (14.9 x 19.6 in), the full sheet. [CH].

• Part of the Hermann Gerlinger collection for over 50 years.

• Dynamic yet detailed depiction from the Davos period.

• The hard life of the peasant families in Davos and the bucolic village idyll were important sources of inspiration for Kirchner at this time.

• In the summer of 1921, the year our work was created, the artist lived in the house "In den Lärchen" in Davos Frauenkirch and, despite his recurring illness, was able to unfold a seemingly inexhaustible creative energy.

• The depiction combines the grand Swiss mountains, Kirchner's simple, balanced life far away from the tumultuous city life with his masterful draughtsmanship and bold, expressionist color accents.

This work is documented in the Ernst Ludwig Kirchner Archive, Wichtrach/Bern.

PROVENANCE: Artist's estate (Davos 1938, Kunstmuseum Basel 1946).

Stuttgarter Kunstkabinett Roman Norbert Ketterer, Stuttgart (1954).

Galerie Nierendorf, Berlin.

Hermann Gerlinger Collection, Würzburg (with the collector's stamp, Lugt 6032, acquired from the above in 1971).

EXHIBITION: Schleswig-Holsteinisches Landesmuseum, Schloss Gottorf, Schleswig (permanent loan from the Hermann Gerlinger Collection, 1995-2001).

Kunstmuseum Moritzburg, Halle an der Saale (permanent loan from the Hermann Gerlinger Collection, 2001-2017).

Buchheim Museum, Bernried (permanent loan from the Hermann Gerlinger Collection, 2017-2022).

LITERATURE: Heinz Spielmann (ed.), Die Maler der Brücke. Sammlung Hermann Gerlinger, Stuttgart 1995, p. 273, SHG no. 399 (illu.).

Hermann Gerlinger, Katja Schneider (eds.), Die Maler der Brücke. Inventory catalog Hermann Gerlinger Collection, Halle (Saale) 2005, p. 352, SHG no. 787 (illu.).

Ernst Ludwig Kirchner, 1919, quoted from: Lucius Grisebach, Ernst Ludwig Kirchner 1880-1938, Cologne 1995, p. 153.

It was because of his poor health that E. L. Kirchner went to Davos to seek medical treatment from Dr. Frédéric Bauer, then head physician at the Davos Park Sanatorium, several times from 1917 onward, before he and his partner Erna Schilling finally movied to Switzerland for good. Until 1923, Kirchner lived in the house "In den Lärchen" in Davos-Frauenkirch, where this work was also created. At his place of longing in the Swiss mountains, he could enjoy a simple, rustic life with only a few amenities. The Alpine landscape, the life of the local farmers' families and the bucolic idyll nature had to offer were important sources of inspiration for Kirchner during these years and led to both mental stability and a renewal of creativity. Impressed by the nature he was now surrounded by and which the versatile artist also immortalized in photographs, Kirchner depicted the mountainous landscape in drawings, watercolors, paintings and prints. In this dynamic drawing, he combined the grandiose Swiss mountains and his simple, balanced life far from his former bustling city life with his masterly draftsmanship and bold, expressionist color accents. Kirchner used the dense composition, partly already in color, in, among others, the paintings "Kummeralpberg" (1920, Art Institute of Chicago) and "Tobel der Stafelalp" (1919, Gordon 596). [CH]

In good condition. Edges minimally scuffed in places and slightly worn. The upper third with slight creases and a diagonal folding mark in the area of the upper right corner, there with a small tear in the upper edge. Image minimally rubbed and soiled in places.

74

Ernst Ludwig Kirchner

Längmatte, 1921.

Pencil drawing

Starting bid: € 10,000 / $ 11,800

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 74

Lot 74