206

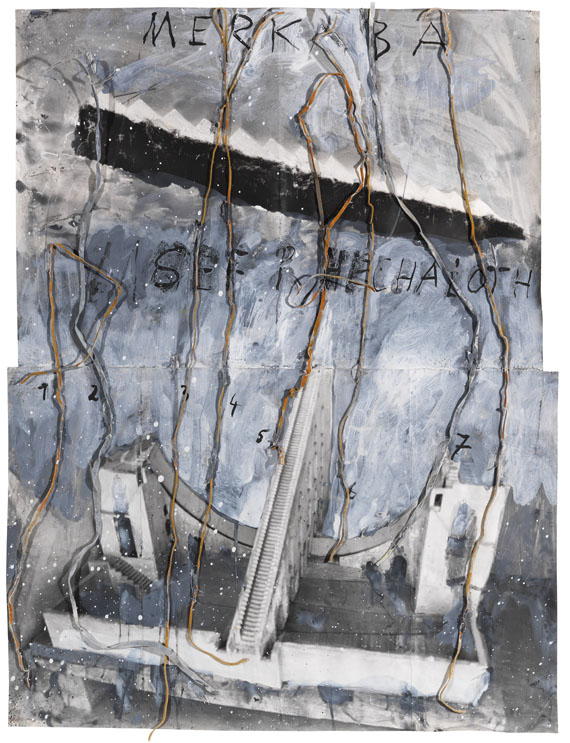

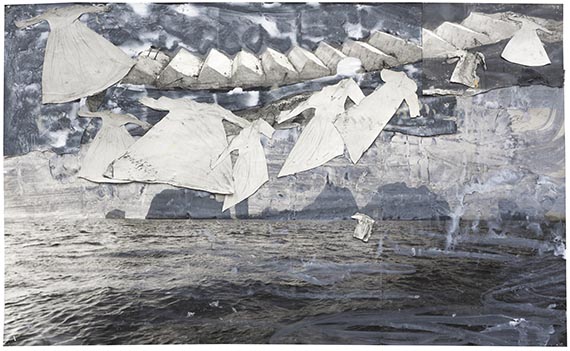

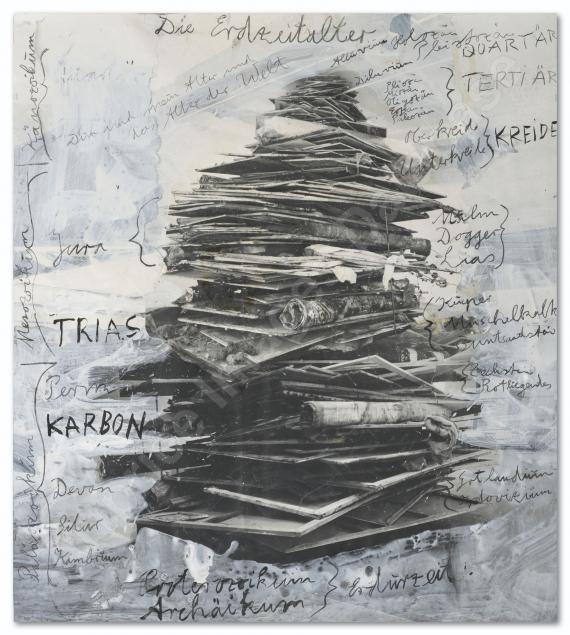

Anselm Kiefer

Leonardo Pisano - liber quadratorum geometriae (Aus der Serie "Freimaurer"), Um 2007.

Mixed media. Gouache and charcoal over photo co...

Post auction sale: € 80,000 / $ 94,400

Leonardo Pisano - liber quadratorum geometriae (Aus der Serie "Freimaurer"). Um 2007.

Mixed media. Gouache and charcoal over photo collage.

Titled and inscribed in the image. 148 x 90 cm (58.2 x 35.4 in), the full sheet.

• Characteristic work by the important German-Austrian artist.

• With his unique visual language, Anselm Kiefer reflects on German history and mythology, incorporating philosophy, literature, and alchemy.

• Even in smaller formats, he achieves a monumental effect.

• Until June 9, 2025, the Stedelijk Museum in Amsterdam and the Van Gogh Museum are showing the monumental exhibition “Tell Me Where the Flowers Are.”

• The artist has created a large installation of photographs from his archive for the historic staircase of the Stedelijk Museum.

PROVENANCE: Private collection, South Germany.

Mixed media. Gouache and charcoal over photo collage.

Titled and inscribed in the image. 148 x 90 cm (58.2 x 35.4 in), the full sheet.

• Characteristic work by the important German-Austrian artist.

• With his unique visual language, Anselm Kiefer reflects on German history and mythology, incorporating philosophy, literature, and alchemy.

• Even in smaller formats, he achieves a monumental effect.

• Until June 9, 2025, the Stedelijk Museum in Amsterdam and the Van Gogh Museum are showing the monumental exhibition “Tell Me Where the Flowers Are.”

• The artist has created a large installation of photographs from his archive for the historic staircase of the Stedelijk Museum.

PROVENANCE: Private collection, South Germany.

206

Anselm Kiefer

Leonardo Pisano - liber quadratorum geometriae (Aus der Serie "Freimaurer"), Um 2007.

Mixed media. Gouache and charcoal over photo co...

Post auction sale: € 80,000 / $ 94,400

Buyer's premium, taxation and resale right compensation for Anselm Kiefer "Leonardo Pisano - liber quadratorum geometriae (Aus der Serie "Freimaurer")"

This lot can be purchased subject to differential or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 7 % is levied to the sum of hammer price and premium.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 7 % is levied to the sum of hammer price and premium.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 206

Lot 206