159

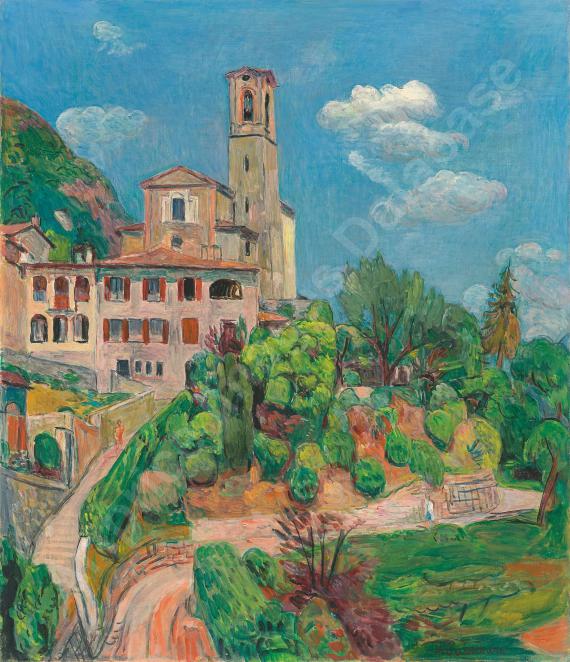

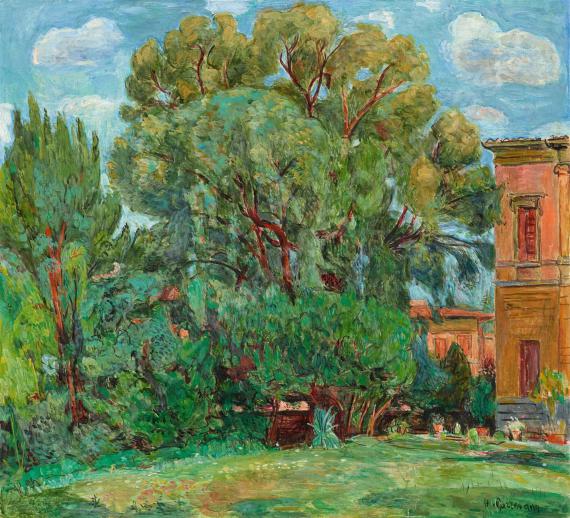

Hans Purrmann

Landschaft bei Galluzzo, 1942.

Oil on canvas

Post auction sale: € 27,000 / $ 31,860

Landschaft bei Galluzzo. 1942.

Oil on canvas.

Signed lower right. 39 x 51 cm (15.3 x 20 in). [AW].

• Part of the 2024 exhibition "Gemischtes Doppel. Die Molls und die Purrmanns - Zwei Künstlerpaare der Moderne" at the Edwin Scharff Museum, Neu-Ulm, and the Museum Wiesbaden.

• A powerful depiction of the Galluzzo district of Florence.

• In 1935, Hans Purrmann fled to Florence, where he took over the management of the Villa Romana Artist Foundation.

• His vibrant depictions of Italian landscapes are considered the artist's most sought-after works on the international auction market (source: artprice.com).

PROVENANCE: Gualtiero Loria Collection, Florence.

Private collection (since 1978).

Private collection (since 1979).

Galerie Brusberg, Berlin.

Private collection, Lower Saxony (acquired from the above in 1988).

EXHIBITION: Gemischtes Doppel. Die Molls und die Purrmanns – Zwei Künstlerpaare der Moderne, Museum Wiesbaden, Hessisches Landesmuseum, October 12, 2023 - February 18, 2024; Edwin Scharff Museum, Neu-Ulm, April 27 - August 18, 2024.

LITERATURE: Christian Lenz, Felix Billeter, Hans Purrmann. Die Gemälde II. 1935-1966. Catalogue raisonné, Munich 2004, no. 1942/03 (illustrated in color).

- -

Villa Grisebach, Berlin, 2nd auction, June 10, 1987, lot 254 (illustrated in color).

Oil on canvas.

Signed lower right. 39 x 51 cm (15.3 x 20 in). [AW].

• Part of the 2024 exhibition "Gemischtes Doppel. Die Molls und die Purrmanns - Zwei Künstlerpaare der Moderne" at the Edwin Scharff Museum, Neu-Ulm, and the Museum Wiesbaden.

• A powerful depiction of the Galluzzo district of Florence.

• In 1935, Hans Purrmann fled to Florence, where he took over the management of the Villa Romana Artist Foundation.

• His vibrant depictions of Italian landscapes are considered the artist's most sought-after works on the international auction market (source: artprice.com).

PROVENANCE: Gualtiero Loria Collection, Florence.

Private collection (since 1978).

Private collection (since 1979).

Galerie Brusberg, Berlin.

Private collection, Lower Saxony (acquired from the above in 1988).

EXHIBITION: Gemischtes Doppel. Die Molls und die Purrmanns – Zwei Künstlerpaare der Moderne, Museum Wiesbaden, Hessisches Landesmuseum, October 12, 2023 - February 18, 2024; Edwin Scharff Museum, Neu-Ulm, April 27 - August 18, 2024.

LITERATURE: Christian Lenz, Felix Billeter, Hans Purrmann. Die Gemälde II. 1935-1966. Catalogue raisonné, Munich 2004, no. 1942/03 (illustrated in color).

- -

Villa Grisebach, Berlin, 2nd auction, June 10, 1987, lot 254 (illustrated in color).

159

Hans Purrmann

Landschaft bei Galluzzo, 1942.

Oil on canvas

Post auction sale: € 27,000 / $ 31,860

Buyer's premium, taxation and resale right compensation for Hans Purrmann "Landschaft bei Galluzzo"

This lot can be purchased subject to differential or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 7 % is levied to the sum of hammer price and premium.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 7 % is levied to the sum of hammer price and premium.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 159

Lot 159