8

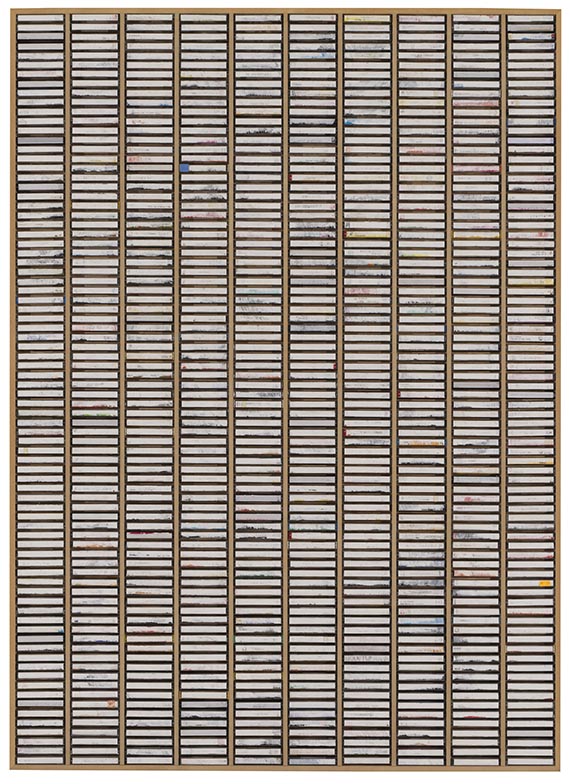

Gregor Hildebrandt

Kassettenkasten, 2008.

Mixed media

Starting bid: € 10,000 / $ 11,800

Kassettenkasten. 2008.

Mixed media. Wood, tape cases, paint, paper.

Signed, dated, titled, and inscribed with a direction arrow on the reverse. Inscribed “GH/M 1/00” on the reverse of the frame. 170 x 123 x 12 cm (66.9 x 48.4 x 4.7 in).

From a German collection. [EH].

• Hildebrand uses analog sound and data carriers for his art.

• The cassette tape, a technology that's gone extinct in the digital age, is at the center of his artistic work.

• The tapes' rhythmical arrangement references Geometric Abstraction.

• The Museo de Arte Zapopan in Guadalajara, Mexico, presented the exhibition “Beyond Behind by Alicja Kwade and Gregor Hildebrandt” from October 29, 2023, to April 7, 2024.

• Works by the artist are at, among others, the Centre Georges-Pompidou, Paris, the Rubell Family Collection, Miami (USA), and the Yuz Museum, Shanghai (China).

In good condition. One cassette with a crack in the plastic at the top left on the back.

Mixed media. Wood, tape cases, paint, paper.

Signed, dated, titled, and inscribed with a direction arrow on the reverse. Inscribed “GH/M 1/00” on the reverse of the frame. 170 x 123 x 12 cm (66.9 x 48.4 x 4.7 in).

From a German collection. [EH].

• Hildebrand uses analog sound and data carriers for his art.

• The cassette tape, a technology that's gone extinct in the digital age, is at the center of his artistic work.

• The tapes' rhythmical arrangement references Geometric Abstraction.

• The Museo de Arte Zapopan in Guadalajara, Mexico, presented the exhibition “Beyond Behind by Alicja Kwade and Gregor Hildebrandt” from October 29, 2023, to April 7, 2024.

• Works by the artist are at, among others, the Centre Georges-Pompidou, Paris, the Rubell Family Collection, Miami (USA), and the Yuz Museum, Shanghai (China).

In good condition. One cassette with a crack in the plastic at the top left on the back.

8

Gregor Hildebrandt

Kassettenkasten, 2008.

Mixed media

Starting bid: € 10,000 / $ 11,800

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 8

Lot 8