486

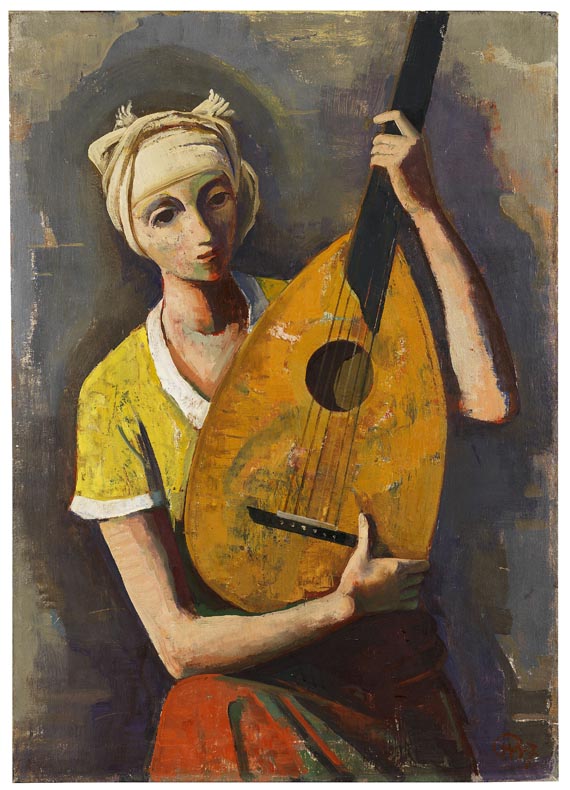

Karl Hofer

Mann und Frau, 1948.

Oil on canvas

Estimate:

€ 30,000 - 40,000

$ 32,100 - 42,800

Mann und Frau. 1948.

Oil on canvas.

Monogrammed and dated in upper right. 90 x 70 cm (35.4 x 27.5 in).

• Karl Hofer creates distinct modern aesthetics through a reduced composition and the use of flat colors.

• With an intimate aesthetic characterized by distance and a sense of strangeness, he was a visionary chronicler of his time.

• Karl Hofer's figure paintings were exhibited alongside Dix, Grosz and Beckmann in the legendary exhibition "German Art of the 20th Century" at the Museum of Modern Art, New York, in 1957.

PROVENANCE: Hofer Estate, no. 106

Wirnitzer list 159

Private collection Karlsruhe.

Private collection Southern Germany (through Galerie W.Ketterer in 1991, ever since family-owned).

EXHIBITION: Karl Hofer, Magistrat von Groß-Berlin, Galerie des 20. Jahrhunderts, Berlin 1948.

Karl Hofer Städtische Galerie Schloss Oberhausen 1962, cat. 11

Karl Hofer, Baukunst Galerie Köln, Cologne 1978, no. 85

Karl Hofer, Baukunst Galerie Köln, Cologne 1982, no. 39 (here erroneously 80 x 70 cm).

Karl Hofer, Baukunst Galerie Köln, Cologne 1984, no. 20 (here erroneously 80 x 70 cm).

LITERATURE: Karl Bernhard Wohlert (ed.), Markus Eisenbeis (ed.), Karl Hofer. Werkverzeichnis der Gemälde, vol. 3, Cologne 2007, no. 2143 (B)

- -

Carl Hofer, Das Selbstverständliche und das Artistische in der Kunst. Ein Beitrag zum Ismenkampf und zum eigenen Werk, in: Thema. Zeitschrift für die Einheit der Kultur, issue 1.1949/50, issue 1, p. 36 (illu.)

Galerie Wolfgang Ketterer, Moderne Kunst, 161st auction, Munich May 27, 1991, lot 51 (illu. in color on p. 75 and on the title).

"I have nothing more to say about my work and myself, I always thought that's the pictures' job."

Karl Hofer in: Thema, vol. 1, p.32.

Called up: June 8, 2024 - ca. 18.56 h +/- 20 min.

Oil on canvas.

Monogrammed and dated in upper right. 90 x 70 cm (35.4 x 27.5 in).

• Karl Hofer creates distinct modern aesthetics through a reduced composition and the use of flat colors.

• With an intimate aesthetic characterized by distance and a sense of strangeness, he was a visionary chronicler of his time.

• Karl Hofer's figure paintings were exhibited alongside Dix, Grosz and Beckmann in the legendary exhibition "German Art of the 20th Century" at the Museum of Modern Art, New York, in 1957.

PROVENANCE: Hofer Estate, no. 106

Wirnitzer list 159

Private collection Karlsruhe.

Private collection Southern Germany (through Galerie W.Ketterer in 1991, ever since family-owned).

EXHIBITION: Karl Hofer, Magistrat von Groß-Berlin, Galerie des 20. Jahrhunderts, Berlin 1948.

Karl Hofer Städtische Galerie Schloss Oberhausen 1962, cat. 11

Karl Hofer, Baukunst Galerie Köln, Cologne 1978, no. 85

Karl Hofer, Baukunst Galerie Köln, Cologne 1982, no. 39 (here erroneously 80 x 70 cm).

Karl Hofer, Baukunst Galerie Köln, Cologne 1984, no. 20 (here erroneously 80 x 70 cm).

LITERATURE: Karl Bernhard Wohlert (ed.), Markus Eisenbeis (ed.), Karl Hofer. Werkverzeichnis der Gemälde, vol. 3, Cologne 2007, no. 2143 (B)

- -

Carl Hofer, Das Selbstverständliche und das Artistische in der Kunst. Ein Beitrag zum Ismenkampf und zum eigenen Werk, in: Thema. Zeitschrift für die Einheit der Kultur, issue 1.1949/50, issue 1, p. 36 (illu.)

Galerie Wolfgang Ketterer, Moderne Kunst, 161st auction, Munich May 27, 1991, lot 51 (illu. in color on p. 75 and on the title).

"I have nothing more to say about my work and myself, I always thought that's the pictures' job."

Karl Hofer in: Thema, vol. 1, p.32.

Called up: June 8, 2024 - ca. 18.56 h +/- 20 min.

486

Karl Hofer

Mann und Frau, 1948.

Oil on canvas

Estimate:

€ 30,000 - 40,000

$ 32,100 - 42,800

Buyer's premium, taxation and resale right compensation for Karl Hofer "Mann und Frau"

This lot can be purchased subject to differential or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 486

Lot 486