195

Marlene Dumas

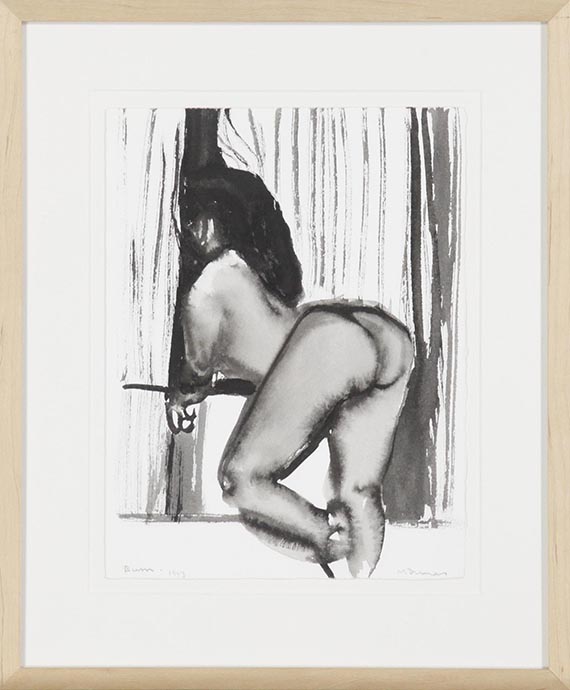

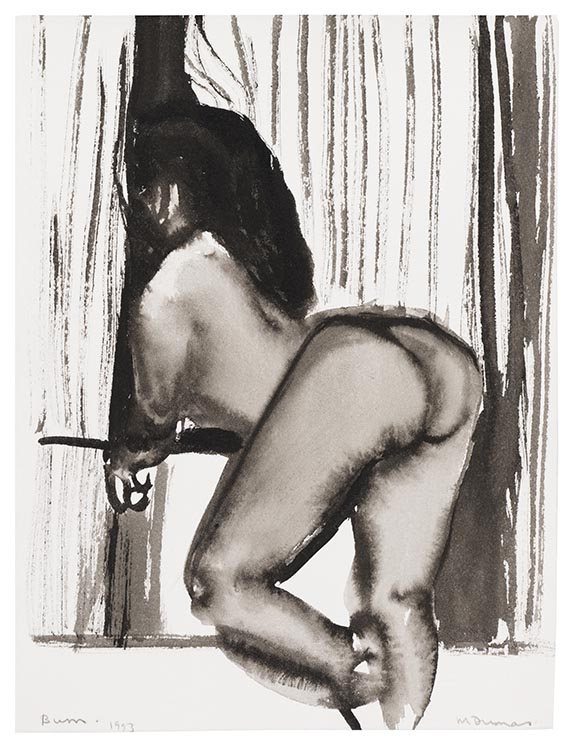

Bum, 1993.

India ink drawing

Estimate:

€ 20,000 - 30,000

$ 21,400 - 32,100

Bum. 1993.

India ink drawing.

Titled and dated in lower left. Signed in lower right. On BFK Rives wove paper (with watermark). 31.7 x 24 cm (12.4 x 9.4 in), the full sheet. [AW].

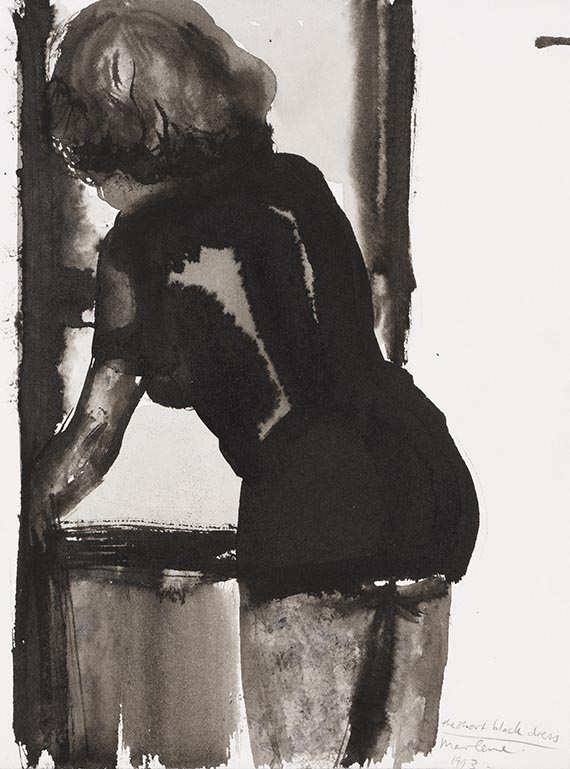

• The human figure and the portrait are at the center of Dumas' oeuvre.

• Most of her works are based on her own photographs or on media images.

• In 1995 she took part in the Venice Biennale and in 1982 and 1992 in the documenta in Kassel

• Works by the artist can be found in renowned international collections like the Stedelijk Museum, Amsterdam, the Art Institute of Chicago, Tate Gallery, London, and the Museum of Modern Art, New York.

We are grateful to the Archive Studio Dumas, Amsterdam, for their kind expert advice.

PROVENANCE: Produzentengalerie Hamburg.

Olbricht Collection, Essen/Berlin (acquired from the above in 2000).

EXHIBITION: Holtegaard Breda-Fonden, Holte, 2002.

Rockers Island, Museum Folkwang, Essen, May 5 - July 1, 2007.

Queensize. Works from the Olbricht Collection, Museum Arnhem, Arnhem, February 13 - May 16, 2016.

Women in Art - selected from the Olbricht Collection, Ketterer Kunst, Berlin, September 7 - November 11, 2023.

LITERATURE: Axel Heil, Wolfgang Schoppmann (eds.), Most wanted: The Olbricht collection. Some recent acquisitions, Cologne 2005, p. 41 (illu.).

Called up: June 7, 2024 - ca. 15.39 h +/- 20 min.

India ink drawing.

Titled and dated in lower left. Signed in lower right. On BFK Rives wove paper (with watermark). 31.7 x 24 cm (12.4 x 9.4 in), the full sheet. [AW].

• The human figure and the portrait are at the center of Dumas' oeuvre.

• Most of her works are based on her own photographs or on media images.

• In 1995 she took part in the Venice Biennale and in 1982 and 1992 in the documenta in Kassel

• Works by the artist can be found in renowned international collections like the Stedelijk Museum, Amsterdam, the Art Institute of Chicago, Tate Gallery, London, and the Museum of Modern Art, New York.

We are grateful to the Archive Studio Dumas, Amsterdam, for their kind expert advice.

PROVENANCE: Produzentengalerie Hamburg.

Olbricht Collection, Essen/Berlin (acquired from the above in 2000).

EXHIBITION: Holtegaard Breda-Fonden, Holte, 2002.

Rockers Island, Museum Folkwang, Essen, May 5 - July 1, 2007.

Queensize. Works from the Olbricht Collection, Museum Arnhem, Arnhem, February 13 - May 16, 2016.

Women in Art - selected from the Olbricht Collection, Ketterer Kunst, Berlin, September 7 - November 11, 2023.

LITERATURE: Axel Heil, Wolfgang Schoppmann (eds.), Most wanted: The Olbricht collection. Some recent acquisitions, Cologne 2005, p. 41 (illu.).

Called up: June 7, 2024 - ca. 15.39 h +/- 20 min.

195

Marlene Dumas

Bum, 1993.

India ink drawing

Estimate:

€ 20,000 - 30,000

$ 21,400 - 32,100

Buyer's premium, taxation and resale right compensation for Marlene Dumas "Bum"

This lot can be purchased subject to differential or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 195

Lot 195