Frame image

465

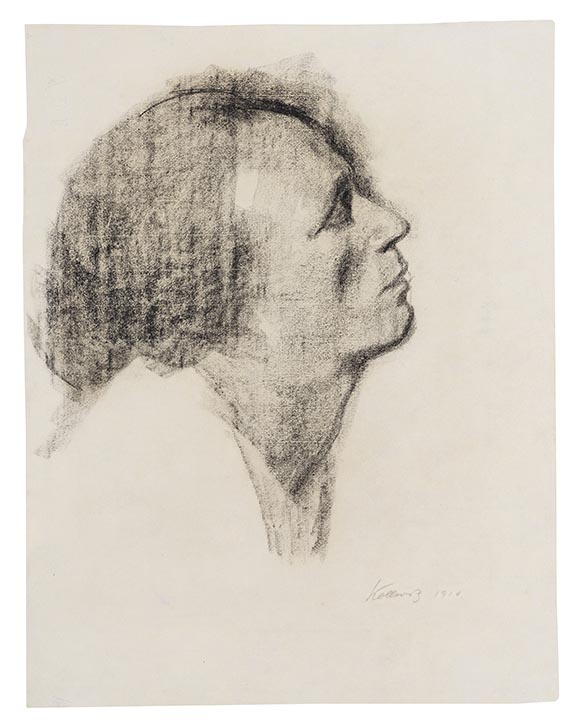

Käthe Kollwitz

Im Profil, 1910.

Charcoal drawing

Estimate:

€ 40,000 - 60,000

$ 42,800 - 64,200

Im Profil. 1910.

Charcoal drawing.

Signed and dated in lower right. On laid paper (with the watermark). 55.5 x 43 cm (21.8 x 16.9 in), size of sheet.

With a discarded charcoal drawing on the reverse.

The work presumably shows Käthe Kollwitz' older brother Conrad Schmidt. [SM].

• Käthe Kollwitz is one of the most important German artists of the 20th century.

• The Städel Museum in Frankfurt am Main honors the artist with a comprehensive exhibition from March 20 to June 9, 2024.

• An expressive and detailed composition that testifies to Kollwitz' quality as a draughtswoman.

PROVENANCE: Private collection North Rhine-Westphalia (since 1977: Lempertz, Cologne).

LITERATURE: Otto Nagel, Werner Timm, Käthe Kollwitz. Die Handzeichnungen, Berlin 1972, no. 572a.

--

Lempertz, Cologne, 558. auction on May 21, 1977, lot 325.

Called up: June 8, 2024 - ca. 18.26 h +/- 20 min.

Charcoal drawing.

Signed and dated in lower right. On laid paper (with the watermark). 55.5 x 43 cm (21.8 x 16.9 in), size of sheet.

With a discarded charcoal drawing on the reverse.

The work presumably shows Käthe Kollwitz' older brother Conrad Schmidt. [SM].

• Käthe Kollwitz is one of the most important German artists of the 20th century.

• The Städel Museum in Frankfurt am Main honors the artist with a comprehensive exhibition from March 20 to June 9, 2024.

• An expressive and detailed composition that testifies to Kollwitz' quality as a draughtswoman.

PROVENANCE: Private collection North Rhine-Westphalia (since 1977: Lempertz, Cologne).

LITERATURE: Otto Nagel, Werner Timm, Käthe Kollwitz. Die Handzeichnungen, Berlin 1972, no. 572a.

--

Lempertz, Cologne, 558. auction on May 21, 1977, lot 325.

Called up: June 8, 2024 - ca. 18.26 h +/- 20 min.

465

Käthe Kollwitz

Im Profil, 1910.

Charcoal drawing

Estimate:

€ 40,000 - 60,000

$ 42,800 - 64,200

Buyer's premium and taxation for Käthe Kollwitz "Im Profil"

This lot can be purchased subject to differential or regular taxation.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Lot 465

Lot 465