222

Friedrich Meckseper

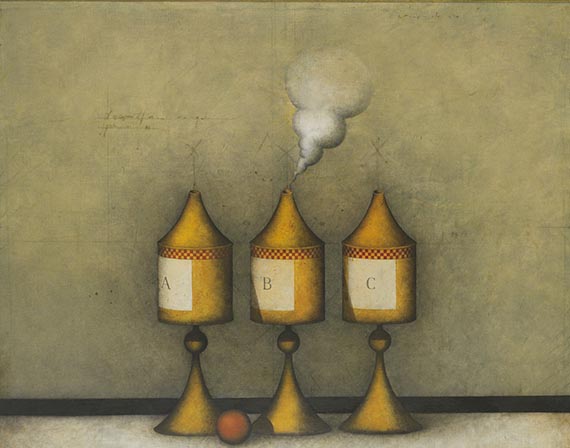

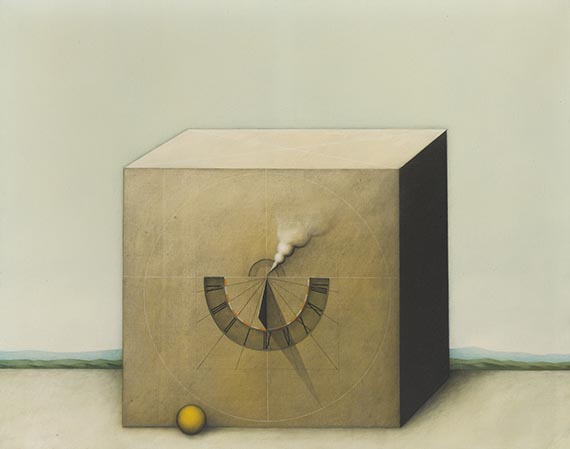

Nature morte, 1988.

Material assemblage

Post auction sale: € 10,000 / $ 11,800

Nature morte. 1988.

Material assemblage.

47.5 x 155 x 16 cm (18.7 x 61 x 6.2 in).

The artist mounted various objects on a steel beam, including glasses and test tubes, hooks, metal signs, screws, a pen holder, a light bulb, a fossil (ammonite), an artificial skull, boxes of matches, a funnel, picture frames, and a fragment of a stone.

A Meckseper painting with an almost identical motif is available in our Day Sale on June 7. [CH].

• Meckseper transfers the bizarre, enigmatic combinations of mostly industrial objects from his neo-objective still lifes into the third dimension.

• Very rare: one of these fascinating assemblages was last offered on the auction market almost fifteen years ago (source: artprice.com).

• Meckseper's prints and paintings are part of important collections, including the Kunsthalle Bremen, the Städtische Galerie im Lenbachhaus, Munich, the British Museum, London, and the National Gallery of Art, Washington, DC.

PROVENANCE: Galerie Peerlings, Krefeld / Kampen (Sylt).

Private collection, North Rhine-Westphalia (acquired from the above in 1990).

Family-owned ever since.

EXHIBITION: Meckseper: aus der Sammlung Großhaus, Städtisches Museum Brunswick, February 24 - April 14, 1991, pp. 138f (with double-page illu.).

LITERATURE: Friedrich Meckseper, Christiane Vielhaber, Homo ludens. Vollständiges Verzeichnnis der Collagen und Montagen 1987–1989 (3), Krefeld 1989, catalogue raisonné no. 109

- -

Meckseper. Bilder, Radierungen, Zeichnungen, Collagen und Objekte aus der Sammlung Großhaus, Heidelberg 2001, pp. 100f. (double-page illu.).

"He wanted to build locomotives, but then art won: Friedrich Meckseper retained the precise eye of the engineer in his paintings and graphic works, but combined it with mystery and magic."

Monopol Magazin, June 8, 2019, text: dpa.

Material assemblage.

47.5 x 155 x 16 cm (18.7 x 61 x 6.2 in).

The artist mounted various objects on a steel beam, including glasses and test tubes, hooks, metal signs, screws, a pen holder, a light bulb, a fossil (ammonite), an artificial skull, boxes of matches, a funnel, picture frames, and a fragment of a stone.

A Meckseper painting with an almost identical motif is available in our Day Sale on June 7. [CH].

• Meckseper transfers the bizarre, enigmatic combinations of mostly industrial objects from his neo-objective still lifes into the third dimension.

• Very rare: one of these fascinating assemblages was last offered on the auction market almost fifteen years ago (source: artprice.com).

• Meckseper's prints and paintings are part of important collections, including the Kunsthalle Bremen, the Städtische Galerie im Lenbachhaus, Munich, the British Museum, London, and the National Gallery of Art, Washington, DC.

PROVENANCE: Galerie Peerlings, Krefeld / Kampen (Sylt).

Private collection, North Rhine-Westphalia (acquired from the above in 1990).

Family-owned ever since.

EXHIBITION: Meckseper: aus der Sammlung Großhaus, Städtisches Museum Brunswick, February 24 - April 14, 1991, pp. 138f (with double-page illu.).

LITERATURE: Friedrich Meckseper, Christiane Vielhaber, Homo ludens. Vollständiges Verzeichnnis der Collagen und Montagen 1987–1989 (3), Krefeld 1989, catalogue raisonné no. 109

- -

Meckseper. Bilder, Radierungen, Zeichnungen, Collagen und Objekte aus der Sammlung Großhaus, Heidelberg 2001, pp. 100f. (double-page illu.).

"He wanted to build locomotives, but then art won: Friedrich Meckseper retained the precise eye of the engineer in his paintings and graphic works, but combined it with mystery and magic."

Monopol Magazin, June 8, 2019, text: dpa.

222

Friedrich Meckseper

Nature morte, 1988.

Material assemblage

Post auction sale: € 10,000 / $ 11,800

Buyer's premium, taxation and resale right compensation for Friedrich Meckseper "Nature morte"

This lot can be purchased subject to differential or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 7 % is levied to the sum of hammer price and premium.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 7 % is levied to the sum of hammer price and premium.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 222

Lot 222