147

Imi Knoebel

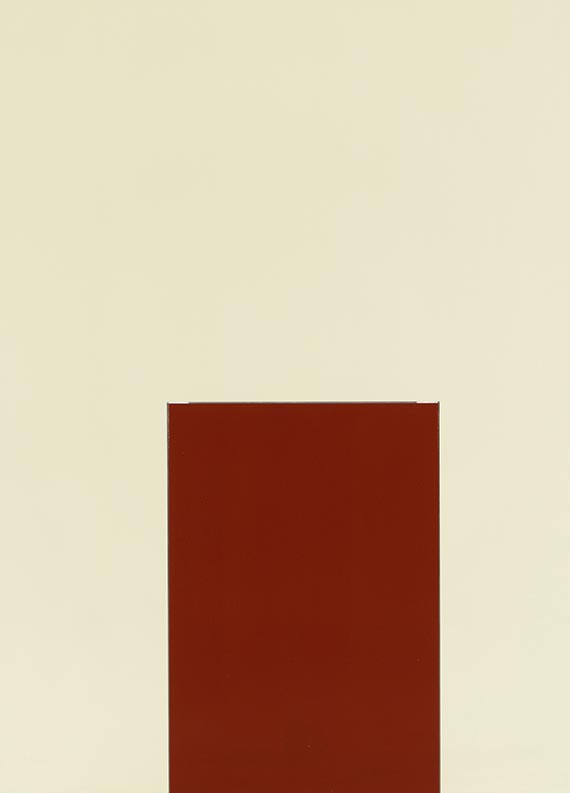

Pure Freude (45), 2002.

Acrylic on aluminum

Estimate:

€ 40,000 - 60,000

$ 42,800 - 64,200

Pure Freude (45). 2002.

Acrylic on aluminum.

Monogrammed, dated and inscribed "45." on the reverse. 159.5 x 114.5 cm (62.7 x 45 in). [EH].

• From the “Pure Freude” (Pure Joy) series.

• Characteristic reduced pictorial language.

• Color, surface and space are at the heart of his artistic work.

Called up: June 7, 2024 - ca. 14.35 h +/- 20 min.

Acrylic on aluminum.

Monogrammed, dated and inscribed "45." on the reverse. 159.5 x 114.5 cm (62.7 x 45 in). [EH].

• From the “Pure Freude” (Pure Joy) series.

• Characteristic reduced pictorial language.

• Color, surface and space are at the heart of his artistic work.

Called up: June 7, 2024 - ca. 14.35 h +/- 20 min.

Since the late 1980s, Imi Knoebel has concentrated entirely on the effects of color, as in the "Pure Freude" (Pure Joy) series created around 2001, to which the present work belongs. The series is named after the cult record label founded by his wife Carmen in 1979; while Imi Knoebel's daughter runs a patisserie of the same name in Düsseldorf today. Thus "Pure Joy" seems to be a statement of creativity in action. Formally, the entire work complex is dedicated to the fragmentation of the vertical format in a slight variation: the monochrome ground, structured only by the visible brushstroke, is interrupted by a formally corresponding rectangle in contrasting colors. In our work, a rectangle in rich red pushes itself from the lower edge of the picture in front of the brighter surface. The composition is accentuated by a small gap between the contrasting surfaces. This work is infused with Imi Knoebel's working method, for whom the exploration of color, color surface, and space has been the focus of his artistic work from the very beginning.

147

Imi Knoebel

Pure Freude (45), 2002.

Acrylic on aluminum

Estimate:

€ 40,000 - 60,000

$ 42,800 - 64,200

Buyer's premium, taxation and resale right compensation for Imi Knoebel "Pure Freude (45)"

This lot can be purchased subject to differential or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 147

Lot 147