168

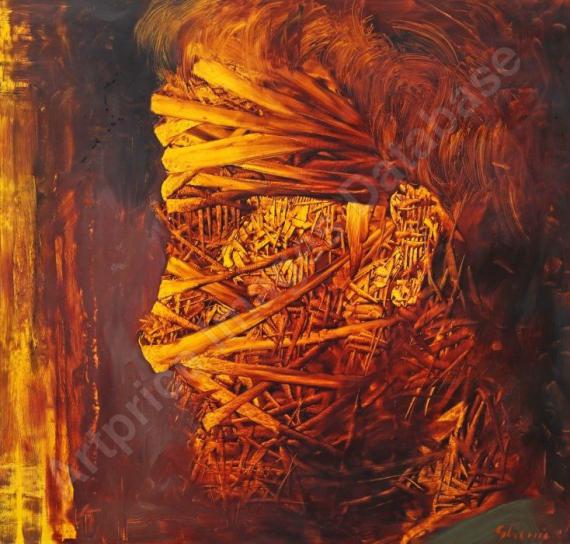

Adrian Ghenie

Aripile Destinului (Flügel des Schicksals), 2002.

Oil on cardboard

Estimate:

€ 50,000 - 70,000

$ 53,500 - 74,900

Aripile Destinului (Flügel des Schicksals). 2002.

Oil on cardboard.

Signed and dated in upper right. 29.8 x 45.8 cm (11.7 x 18 in).

Twice stamped in Romanian on the reverse. [AR].

• Ghenie's pictorial worlds are filled with notions of the unconscious and the unfathomable.

• The yellow glow from the depths of the picture's background lends the a mystical atmosphere to the scene of angels and a half-naked female body.

• Works by the artist can be found in the Metropolitan Museum of Art, New York, the Tate Modern, London, and the Centre Pompidou, Paris.

PROVENANCE: Private collection Austria

Private collection Berlin.

"On one hand, I work on an image in an almost classical vein: composition, figuration, use of light. On the other hand, I do not refrain from resorting to all kinds of idioms, such as the surrealist principle of association or the abstract experiments which foreground texture and surface."

Adrian Ghenie, quoted from: Galerie Thaddaeus Ropac, online: www.ropac.net/de/artists/44-adrian-ghenie/

Called up: June 7, 2024 - ca. 15.03 h +/- 20 min.

Oil on cardboard.

Signed and dated in upper right. 29.8 x 45.8 cm (11.7 x 18 in).

Twice stamped in Romanian on the reverse. [AR].

• Ghenie's pictorial worlds are filled with notions of the unconscious and the unfathomable.

• The yellow glow from the depths of the picture's background lends the a mystical atmosphere to the scene of angels and a half-naked female body.

• Works by the artist can be found in the Metropolitan Museum of Art, New York, the Tate Modern, London, and the Centre Pompidou, Paris.

PROVENANCE: Private collection Austria

Private collection Berlin.

"On one hand, I work on an image in an almost classical vein: composition, figuration, use of light. On the other hand, I do not refrain from resorting to all kinds of idioms, such as the surrealist principle of association or the abstract experiments which foreground texture and surface."

Adrian Ghenie, quoted from: Galerie Thaddaeus Ropac, online: www.ropac.net/de/artists/44-adrian-ghenie/

Called up: June 7, 2024 - ca. 15.03 h +/- 20 min.

168

Adrian Ghenie

Aripile Destinului (Flügel des Schicksals), 2002.

Oil on cardboard

Estimate:

€ 50,000 - 70,000

$ 53,500 - 74,900

Buyer's premium, taxation and resale right compensation for Adrian Ghenie "Aripile Destinului (Flügel des Schicksals)"

This lot can be purchased subject to differential or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 168

Lot 168