151

Imi Knoebel

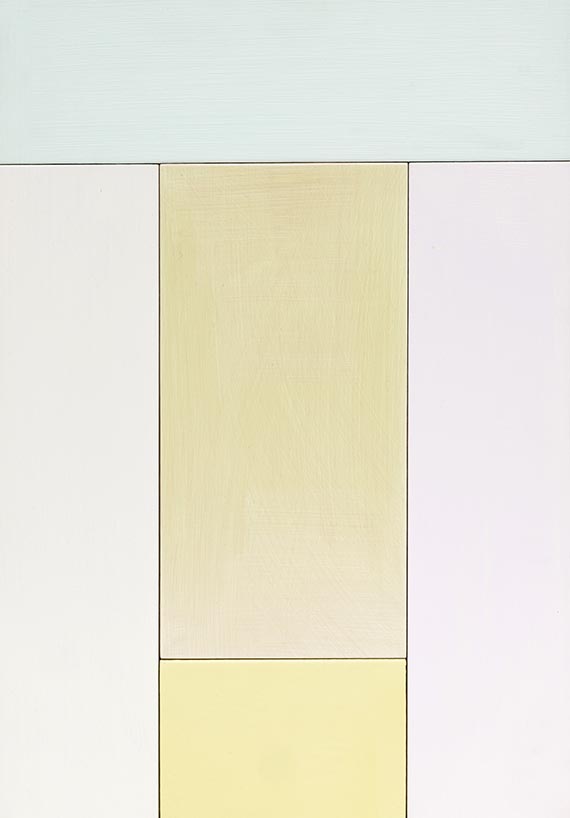

Portrait (Susanne), 1993.

Acrylic on panel

Estimate:

€ 30,000 - 40,000

$ 32,100 - 42,800

Portrait (Susanne). 1993.

Acrylic on panel.

Signed and dated on the reverse, as well as with a label that is typographically inscribed "Susanne", signed and dated "25.12.98". 50 x 35 x 8.7 cm (19.6 x 13.7 x 3.4 in). [JS].

• In Knoebel's famous series of portraits, he took the stylization of the human portrait head that began with Jawlensky's "Meditations" to the extreme.

• This is an outstanding example of Knoebel's masterly play with reduction and variation.

• Knoebel lends the three-dimensional wooden corpus a "painterly incarnate" and an individual character solely through the color combination.

• The color scheme in soft pastels with the fascinating mother-of-pearl-like shimmer in the center and the radiant yellow is very rare.

• Most recently, Knoebel's works were shown in "Imi Knoebel. Green Flag" at the White Cube, Hong Kong (2023), and in the exhibition "Balance" at the Hamburger Bahnhof - Nationalgalerie der Gegenwart, Berlin (2022).

• Imi Knoebel's works can be found in important international collections like the Museum of Modern Art, New York, the Hamburger Bahnhof, Berlin, and the Pinakothek der Moderne, Munich.

PROVENANCE: Private collection Berlin.

"Imi Knoebel is one of today's most radical and consistent abstract artists [..] in Knoebel's work, radicalism and consistency come together to form a balanced unity that is constantly put to the test."

Zdenek Felix, quoted from: Imi Knoebel. Retrospektive 1968-1996, ex.cat. Haus der Kunst, Munich 1996, pp. 291f.

Called up: June 7, 2024 - ca. 14.40 h +/- 20 min.

Acrylic on panel.

Signed and dated on the reverse, as well as with a label that is typographically inscribed "Susanne", signed and dated "25.12.98". 50 x 35 x 8.7 cm (19.6 x 13.7 x 3.4 in). [JS].

• In Knoebel's famous series of portraits, he took the stylization of the human portrait head that began with Jawlensky's "Meditations" to the extreme.

• This is an outstanding example of Knoebel's masterly play with reduction and variation.

• Knoebel lends the three-dimensional wooden corpus a "painterly incarnate" and an individual character solely through the color combination.

• The color scheme in soft pastels with the fascinating mother-of-pearl-like shimmer in the center and the radiant yellow is very rare.

• Most recently, Knoebel's works were shown in "Imi Knoebel. Green Flag" at the White Cube, Hong Kong (2023), and in the exhibition "Balance" at the Hamburger Bahnhof - Nationalgalerie der Gegenwart, Berlin (2022).

• Imi Knoebel's works can be found in important international collections like the Museum of Modern Art, New York, the Hamburger Bahnhof, Berlin, and the Pinakothek der Moderne, Munich.

PROVENANCE: Private collection Berlin.

"Imi Knoebel is one of today's most radical and consistent abstract artists [..] in Knoebel's work, radicalism and consistency come together to form a balanced unity that is constantly put to the test."

Zdenek Felix, quoted from: Imi Knoebel. Retrospektive 1968-1996, ex.cat. Haus der Kunst, Munich 1996, pp. 291f.

Called up: June 7, 2024 - ca. 14.40 h +/- 20 min.

151

Imi Knoebel

Portrait (Susanne), 1993.

Acrylic on panel

Estimate:

€ 30,000 - 40,000

$ 32,100 - 42,800

Buyer's premium, taxation and resale right compensation for Imi Knoebel "Portrait (Susanne)"

This lot can be purchased subject to differential or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 151

Lot 151