Back side

275

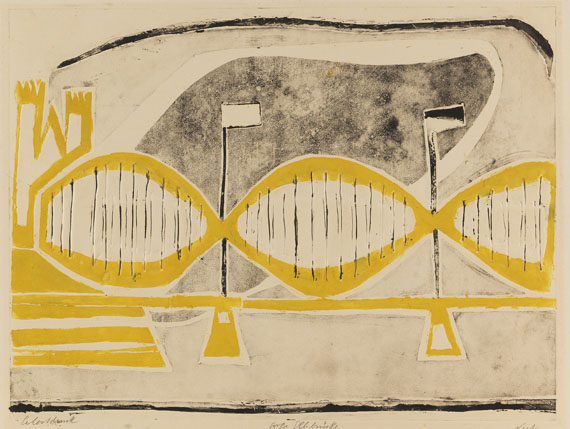

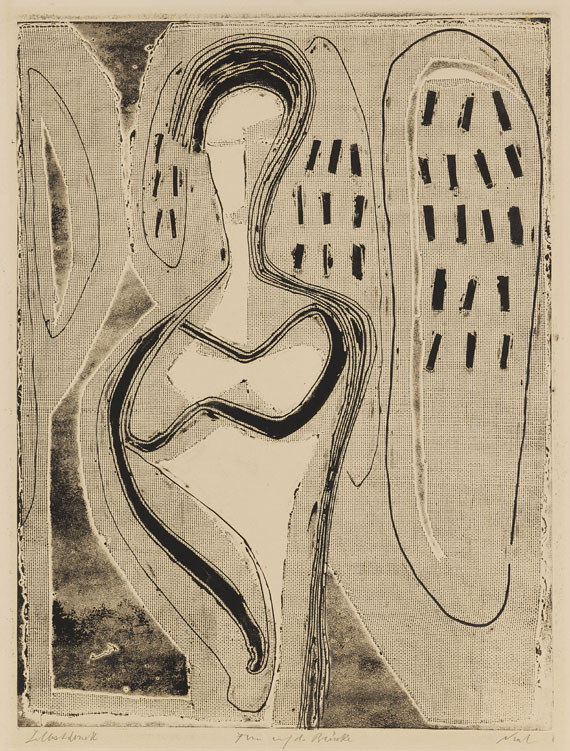

Rolf Nesch

Freihafenbrücke I, 1932.

Metal print

Post auction sale: € 15,000 / $ 17,700

Freihafenbrücke I. 1932.

Metal print.

Signed, titled and inscribed "Selbstdruck". From an edition of at least 8 copies. On firm, brown wove paper. 44.9 x 59.7 cm (17.6 x 23.5 in). Sheet: 49,8 x 65,9 cm (19,6 x 25,9 in).

From the series “Hamburger Brücken” (Hamburg Bridges), which was first exhibited at the Commeter Gallery in Hamburg in October 1932. [AW].

• The series “Hamburger Brücken” (Hamburg Bridges) is considered a key work within Nesch's technically innovative graphic art, it was the first time he used his new metal printing technique.

• Another print from this edition is in the Museum of Modern Art, New York.

• This is the first time a work from this edition is offered on the international auction market (source: artprice.com).

• In Norway, Nesch is considered one of the country's most important artists.

• Nesch participated in documenta 1, II, and III (1955, 1959, 1964) in Kassel.

• In autumn 2025, the Kunstmuseum Stuttgart shows the major exhibition “Prägungen und Entfaltungen” (Imprints and Developments), featuring graphic works by, among others, Rolf Nesch.

PROVENANCE: Private collection, Baden-Württemberg (probably acquired directly from the artist in the 1950s).

In family ownership ever since.

LITERATURE: Sidsel Helliesen, Bodil Sørensen, Rolf Nesch. The Complete Graphic Works, Milan 2009, catalogue raisonné no. 448.

Metal print.

Signed, titled and inscribed "Selbstdruck". From an edition of at least 8 copies. On firm, brown wove paper. 44.9 x 59.7 cm (17.6 x 23.5 in). Sheet: 49,8 x 65,9 cm (19,6 x 25,9 in).

From the series “Hamburger Brücken” (Hamburg Bridges), which was first exhibited at the Commeter Gallery in Hamburg in October 1932. [AW].

• The series “Hamburger Brücken” (Hamburg Bridges) is considered a key work within Nesch's technically innovative graphic art, it was the first time he used his new metal printing technique.

• Another print from this edition is in the Museum of Modern Art, New York.

• This is the first time a work from this edition is offered on the international auction market (source: artprice.com).

• In Norway, Nesch is considered one of the country's most important artists.

• Nesch participated in documenta 1, II, and III (1955, 1959, 1964) in Kassel.

• In autumn 2025, the Kunstmuseum Stuttgart shows the major exhibition “Prägungen und Entfaltungen” (Imprints and Developments), featuring graphic works by, among others, Rolf Nesch.

PROVENANCE: Private collection, Baden-Württemberg (probably acquired directly from the artist in the 1950s).

In family ownership ever since.

LITERATURE: Sidsel Helliesen, Bodil Sørensen, Rolf Nesch. The Complete Graphic Works, Milan 2009, catalogue raisonné no. 448.

275

Rolf Nesch

Freihafenbrücke I, 1932.

Metal print

Post auction sale: € 15,000 / $ 17,700

Buyer's premium, taxation and resale right compensation for Rolf Nesch "Freihafenbrücke I"

This lot can be purchased subject to differential or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 7 % is levied to the sum of hammer price and premium.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 7 % is levied to the sum of hammer price and premium.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 275

Lot 275