28

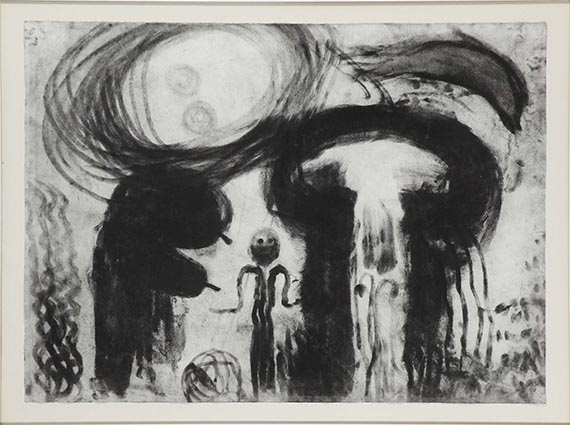

Miriam Cahn

Frau mit drei Körpern (3-teilig), 1985.

Charcoal drawing

Starting bid: € 15,000 / $ 17,700

Frau mit drei Körpern (3-teilig). Um 1985.

Charcoal drawing.

Signed, dated, and numbered in sequence on the reverse of one shee. On Hahnemühle laid paper (each with watermark). Each 78 x 106.5 cm (30.7 x 41.9 in), the full sheet.

From the series "Lesen in Staub". [KA].

• Unique piece.

• Impressive triptych in Miriam Cahn's unmistakable narrative visual language.

• Miriam Cahn's drawings are uncompromising representations of personal experiences and emotions.

• The artist was invited to the documenta in Kassel in 1982 (and again in 2017) and was represented at the Venice Biennale in 1984 and 2022.

• Cahn's works are in international collections, including the Museum of Modern Art, New York, the Tate Modern, London, the Museo Reina Sofía, Madrid, and the Städtische Galerie im Lenbachhaus, Munich.

PROVENANCE: Private collection, Berlin (in 2025 inherited from Prof. Dr. Jark Michael Bodemann).

In good condition. Each with minimal handling marks. Partial isolated tiny scuffs in the black areas.

Charcoal drawing.

Signed, dated, and numbered in sequence on the reverse of one shee. On Hahnemühle laid paper (each with watermark). Each 78 x 106.5 cm (30.7 x 41.9 in), the full sheet.

From the series "Lesen in Staub". [KA].

• Unique piece.

• Impressive triptych in Miriam Cahn's unmistakable narrative visual language.

• Miriam Cahn's drawings are uncompromising representations of personal experiences and emotions.

• The artist was invited to the documenta in Kassel in 1982 (and again in 2017) and was represented at the Venice Biennale in 1984 and 2022.

• Cahn's works are in international collections, including the Museum of Modern Art, New York, the Tate Modern, London, the Museo Reina Sofía, Madrid, and the Städtische Galerie im Lenbachhaus, Munich.

PROVENANCE: Private collection, Berlin (in 2025 inherited from Prof. Dr. Jark Michael Bodemann).

In good condition. Each with minimal handling marks. Partial isolated tiny scuffs in the black areas.

28

Miriam Cahn

Frau mit drei Körpern (3-teilig), 1985.

Charcoal drawing

Starting bid: € 15,000 / $ 17,700

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 28

Lot 28