107

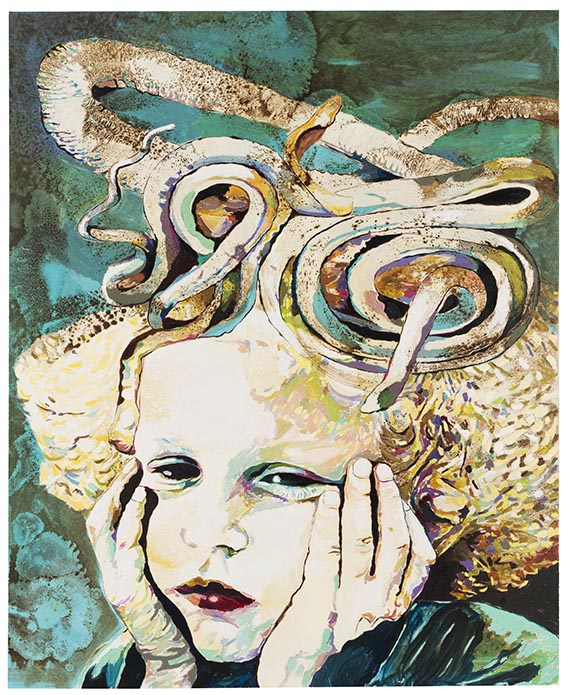

Cornelia Schleime

Trotzengel, 2012.

Acrylic, shellac and asphalt varnish on canvas

Post auction sale: € 20,000 / $ 22,600

Trotzengel. 2012.

Acrylic, shellac and asphalt varnish on canvas.

Signed, dated, and numbered “570” on the reverse of the canvas. 220 x 180 cm (86.6 x 70.8 in). [CH].

• Using special materials and techniques, Schleime's paintings are characterized by an uneven, impasto surface with a particularly appealing texture.

• “Trotzkopf and Medusa”: the large-format fictional portraits dominate the artist's oeuvre and rank among her most sought-after works.

• Besides painting, her creative output includes collages, photography, films, performance art, artist's books, travel diaries, and literature.

• Until the end of June/August 2025, the artist's works are on display in exhibitions at the Kunsthalle Darmstadt and the Palais Populaire in Berlin.

This work will be included in the catalogue raisonné for Cornelia Schleime by Juerg Judin and Pay Matthis Karstens, Berlin (in preparation).

PROVENANCE: Galerie Michael Schultz, Berlin.

Private collection, Berlin (acquired from the above in 2013).

Acrylic, shellac and asphalt varnish on canvas.

Signed, dated, and numbered “570” on the reverse of the canvas. 220 x 180 cm (86.6 x 70.8 in). [CH].

• Using special materials and techniques, Schleime's paintings are characterized by an uneven, impasto surface with a particularly appealing texture.

• “Trotzkopf and Medusa”: the large-format fictional portraits dominate the artist's oeuvre and rank among her most sought-after works.

• Besides painting, her creative output includes collages, photography, films, performance art, artist's books, travel diaries, and literature.

• Until the end of June/August 2025, the artist's works are on display in exhibitions at the Kunsthalle Darmstadt and the Palais Populaire in Berlin.

This work will be included in the catalogue raisonné for Cornelia Schleime by Juerg Judin and Pay Matthis Karstens, Berlin (in preparation).

PROVENANCE: Galerie Michael Schultz, Berlin.

Private collection, Berlin (acquired from the above in 2013).

107

Cornelia Schleime

Trotzengel, 2012.

Acrylic, shellac and asphalt varnish on canvas

Post auction sale: € 20,000 / $ 22,600

Buyer's premium, taxation and resale right compensation for Cornelia Schleime "Trotzengel"

This lot can only be purchased subject to regular taxation, artist‘s resale right compensation is due.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 7 % is levied to the sum of hammer price and premium.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 7 % is levied to the sum of hammer price and premium.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 107

Lot 107