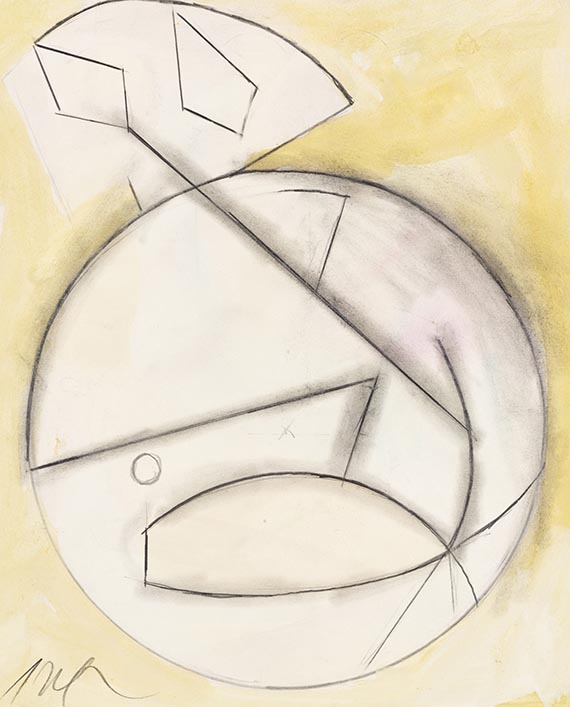

Ohne Titel. Ca. 1960/65.

Pencil drawing with watercolor.

Signed in the lower left. Once more signed and with the dedication "Für Max Niedermayer" on the reverse. On thin cardboard. 29.5 x 24.5 cm (11.6 x 9.6 in). [KA].

More works from the Max Niedermayer Collection, Limes-Verlag Wiesbaden, will be offered in our auctions throughout the year.

• Fascinating depiction in terms of color and composition.

• In 1916, Hans Arp co-founded the revolutionary Dada movement in Zurich.

• Arp's reliefs were exhibited at the Museum of Modern Art in New York as early as 1936, followed by a solo exhibition at the Museum of Modern Art in 1958 and a retrospective at the Solomon R. Guggenheim Museum in New York in 1969, three years after his death.

• Drawings by Hans Arp can be found in important museum collections such as the Museum of Modern Art, New York, the Metropolitan Museum of Art, New York, and the Centre Pompidou, Paris.

We are grateful to the Hans Arp and Sophie Taeuber-Arp Foundation for the kind support in cataloging this lot.

PROVENANCE: Collection of Dr. Max Niedermayer (1905–1968), Wiesbaden.

Estate of Dr. Max Niedermayer, Wiesbaden.

Private collection, Rhineland-Palatinate (acquired from the above in 1979).

In family ownership since.

To view artwork condition please click on the high-definition images and use the zoom function.

Pencil drawing with watercolor.

Signed in the lower left. Once more signed and with the dedication "Für Max Niedermayer" on the reverse. On thin cardboard. 29.5 x 24.5 cm (11.6 x 9.6 in). [KA].

More works from the Max Niedermayer Collection, Limes-Verlag Wiesbaden, will be offered in our auctions throughout the year.

• Fascinating depiction in terms of color and composition.

• In 1916, Hans Arp co-founded the revolutionary Dada movement in Zurich.

• Arp's reliefs were exhibited at the Museum of Modern Art in New York as early as 1936, followed by a solo exhibition at the Museum of Modern Art in 1958 and a retrospective at the Solomon R. Guggenheim Museum in New York in 1969, three years after his death.

• Drawings by Hans Arp can be found in important museum collections such as the Museum of Modern Art, New York, the Metropolitan Museum of Art, New York, and the Centre Pompidou, Paris.

We are grateful to the Hans Arp and Sophie Taeuber-Arp Foundation for the kind support in cataloging this lot.

PROVENANCE: Collection of Dr. Max Niedermayer (1905–1968), Wiesbaden.

Estate of Dr. Max Niedermayer, Wiesbaden.

Private collection, Rhineland-Palatinate (acquired from the above in 1979).

In family ownership since.

To view artwork condition please click on the high-definition images and use the zoom function.

52

Hans (Jean) Arp

Ohne Titel, 1960.

Pencil drawing

Starting bid: € 7,200 / $ 8,136

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 52

Lot 52