464

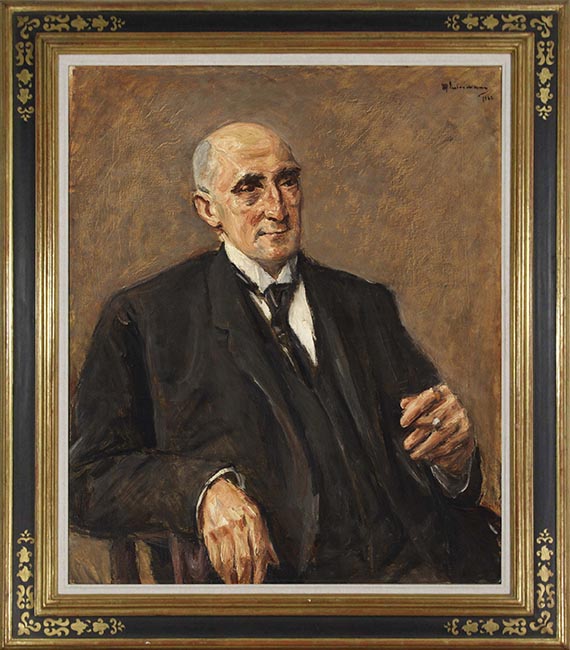

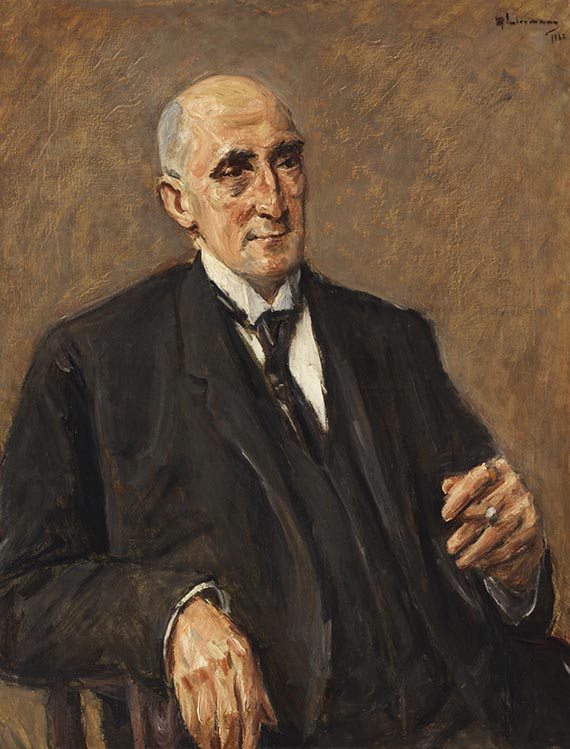

Max Liebermann

Bildnis des Textilfabrikanten Carl Lewin, 1922.

Oil on canvas

Estimate:

€ 40,000 - 60,000

$ 42,800 - 64,200

Bildnis des Textilfabrikanten Carl Lewin. 1922.

Oil on canvas.

Signed and dated in upper right. 90 x 72.5 cm (35.4 x 28.5 in).

[AR].

• Striking portrait of the textile manufacturer Carl Lewin.

• Made for one of the six children of the art-loving industrialist from Wroclaw, who was also portrayed by Georg Kolbe.

• Initially criticized for a lack of idealization in his earlier portraits, Liebermann eventually became one of the most sought-after portraitists of his time.

• In 1927, he received a commission to paint the Reich President Paul von Hindenburg.

• Similar works can be found in numerous museum collections, including the Kunsthalle Hamburg, the Staatliche Museen Schwerin and the Alte Nationalgalerie in Berlin.

PROVENANCE: The work is free from restitution claims. The offer is made subject to an amicable agreement with the heirs of Cäcilie Beermann on the basis of a fair and just solution.

LITERATURE: Matthias Eberle, Max Liebermann. Werkverzeichnis der Gemälde und Ölstudien, vol. II: 1900-1935, Munich 1996, no. 1922/15 (illu. in black and white on p. 1058).

--

Galerie Rosen, auction 24, Berlin May 16 - 18, 1955, no. 1876.

Peter Günnemann, Hamburg, 18th auction, April 4, 1992, lot 15 (illu. in color).

Called up: June 8, 2024 - ca. 18.25 h +/- 20 min.

Oil on canvas.

Signed and dated in upper right. 90 x 72.5 cm (35.4 x 28.5 in).

[AR].

• Striking portrait of the textile manufacturer Carl Lewin.

• Made for one of the six children of the art-loving industrialist from Wroclaw, who was also portrayed by Georg Kolbe.

• Initially criticized for a lack of idealization in his earlier portraits, Liebermann eventually became one of the most sought-after portraitists of his time.

• In 1927, he received a commission to paint the Reich President Paul von Hindenburg.

• Similar works can be found in numerous museum collections, including the Kunsthalle Hamburg, the Staatliche Museen Schwerin and the Alte Nationalgalerie in Berlin.

PROVENANCE: The work is free from restitution claims. The offer is made subject to an amicable agreement with the heirs of Cäcilie Beermann on the basis of a fair and just solution.

LITERATURE: Matthias Eberle, Max Liebermann. Werkverzeichnis der Gemälde und Ölstudien, vol. II: 1900-1935, Munich 1996, no. 1922/15 (illu. in black and white on p. 1058).

--

Galerie Rosen, auction 24, Berlin May 16 - 18, 1955, no. 1876.

Peter Günnemann, Hamburg, 18th auction, April 4, 1992, lot 15 (illu. in color).

Called up: June 8, 2024 - ca. 18.25 h +/- 20 min.

464

Max Liebermann

Bildnis des Textilfabrikanten Carl Lewin, 1922.

Oil on canvas

Estimate:

€ 40,000 - 60,000

$ 42,800 - 64,200

Buyer's premium and taxation for Max Liebermann "Bildnis des Textilfabrikanten Carl Lewin"

This lot can be purchased subject to differential or regular taxation.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Lot 464

Lot 464