449

Francis Picabia

Paysage maritime, 1938.

Oil on cardboard

Estimate:

€ 20,000 / $ 23,600 Sold:

€ 44,450 / $ 52,451 (incl. surcharge)

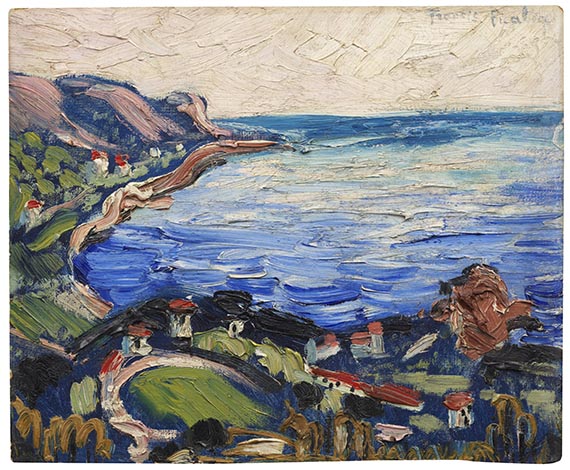

Paysage maritime. 1938.

Oil on cardboard.

Signed in upper right. 37.5 x 45.4 cm (14.7 x 17.8 in). [EH].

• Excellent work in intesive colors.

• In the late 1930s, Picabia revisited the landscape theme and interpreted it in a completely new way with voluminous brushstrokes reminiscent of "Art Brut".

• From 1934 to 1940, Picabia worked in his studio at the port of Golfe-Juan between Cannes and Antibes.

• Paintings by Francis Picabia can be found at, among others, the Guggenheim Museum, New York, the Museum Boijmans von Beuningen, Rotterdam, and the Center Pompidou, Paris.

Accompanied by a photo authentication issued by the Comité Picabia on April 16, 1999.

The painting is registered unter the number 2308 at the Comité Picabia, Paris.

PROVENANCE: Private collection Switzerland.

Private collection Hanover (since 1999, from Hauswedell & Nolte).

LITERATURE: Wiliam A. Camfield, Francis Picabia. Catalogue raisonné, Brussels 2014, vol.3, no. 1509, p. 393

Hauswedell & Nolte, Hamburg, auction 343, Moderne Kunst, June 12, 1999, lot 2096, p. 282 (color illu. p. 283)

Jean-Paul Potron, Paysages de Nice Villefranche-Beaulieu du XVIIème au XXème siècle, Nice, 2000, fig.

Arnauld Pierre, Francis Picabia. La peinture sans aura, Paris 2002, fig.

Oil on cardboard.

Signed in upper right. 37.5 x 45.4 cm (14.7 x 17.8 in). [EH].

• Excellent work in intesive colors.

• In the late 1930s, Picabia revisited the landscape theme and interpreted it in a completely new way with voluminous brushstrokes reminiscent of "Art Brut".

• From 1934 to 1940, Picabia worked in his studio at the port of Golfe-Juan between Cannes and Antibes.

• Paintings by Francis Picabia can be found at, among others, the Guggenheim Museum, New York, the Museum Boijmans von Beuningen, Rotterdam, and the Center Pompidou, Paris.

Accompanied by a photo authentication issued by the Comité Picabia on April 16, 1999.

The painting is registered unter the number 2308 at the Comité Picabia, Paris.

PROVENANCE: Private collection Switzerland.

Private collection Hanover (since 1999, from Hauswedell & Nolte).

LITERATURE: Wiliam A. Camfield, Francis Picabia. Catalogue raisonné, Brussels 2014, vol.3, no. 1509, p. 393

Hauswedell & Nolte, Hamburg, auction 343, Moderne Kunst, June 12, 1999, lot 2096, p. 282 (color illu. p. 283)

Jean-Paul Potron, Paysages de Nice Villefranche-Beaulieu du XVIIème au XXème siècle, Nice, 2000, fig.

Arnauld Pierre, Francis Picabia. La peinture sans aura, Paris 2002, fig.

449

Francis Picabia

Paysage maritime, 1938.

Oil on cardboard

Estimate:

€ 20,000 / $ 23,600 Sold:

€ 44,450 / $ 52,451 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 449

Lot 449