279

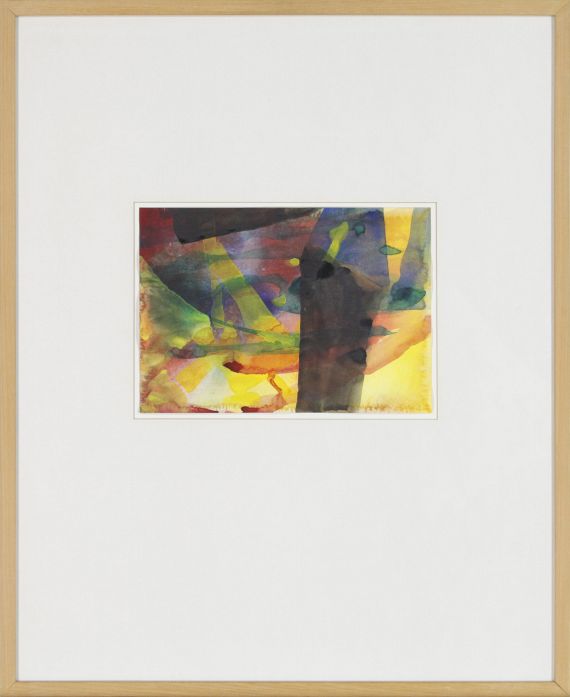

Gerhard Richter

Q.T., 6.5.84/17.6.84, 1984.

Watercolor on paper

Estimate:

€ 90,000 / $ 106,200 Sold:

€ 143,750 / $ 169,625 (incl. surcharge)

Q.T., 6.5.84/17.6.84. 1984.

Watercolor on paper.

Lower right signed and dated "6.5.84". Lower left signed and dated "17.6.84". Verso once more signed and dated. 21 x 29.5 cm (8.2 x 11.6 in). [SM].

• Watercolors make for a small but important group in the artist's oeuvre.

• Transparent and opaque color application: Richter uses the creative possibilities of the watercolro technique to the fullest.

• Watercolors from Gerhard Richters are very rare on the international auction market.

The work is listed in the online work index.

PROVENANCE: Galerie Fred Jahn, Munich.

Private collection Rhineland (acquired from aforementioned in 1991).

EXHIBITION: Gerhard Richter Aquarelle, Graphische Sammlung, Staatsgalerie Stuttgart, 19.1.1985-17.2.1985 (Ausst.-Kat mit Abb.).

LITERATURE: Gerhard Richter. Aquarelle, Munich 1985, color illu. on p. 87.

"Painting pictures is just the official job, the daily work, the occupation; but the watercolors allow me to just follow my mood, my humor." Gerhard Richter Text, Cologne 2008, p. 349).

Watercolor on paper.

Lower right signed and dated "6.5.84". Lower left signed and dated "17.6.84". Verso once more signed and dated. 21 x 29.5 cm (8.2 x 11.6 in). [SM].

• Watercolors make for a small but important group in the artist's oeuvre.

• Transparent and opaque color application: Richter uses the creative possibilities of the watercolro technique to the fullest.

• Watercolors from Gerhard Richters are very rare on the international auction market.

The work is listed in the online work index.

PROVENANCE: Galerie Fred Jahn, Munich.

Private collection Rhineland (acquired from aforementioned in 1991).

EXHIBITION: Gerhard Richter Aquarelle, Graphische Sammlung, Staatsgalerie Stuttgart, 19.1.1985-17.2.1985 (Ausst.-Kat mit Abb.).

LITERATURE: Gerhard Richter. Aquarelle, Munich 1985, color illu. on p. 87.

"Painting pictures is just the official job, the daily work, the occupation; but the watercolors allow me to just follow my mood, my humor." Gerhard Richter Text, Cologne 2008, p. 349).

279

Gerhard Richter

Q.T., 6.5.84/17.6.84, 1984.

Watercolor on paper

Estimate:

€ 90,000 / $ 106,200 Sold:

€ 143,750 / $ 169,625 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 279

Lot 279