434

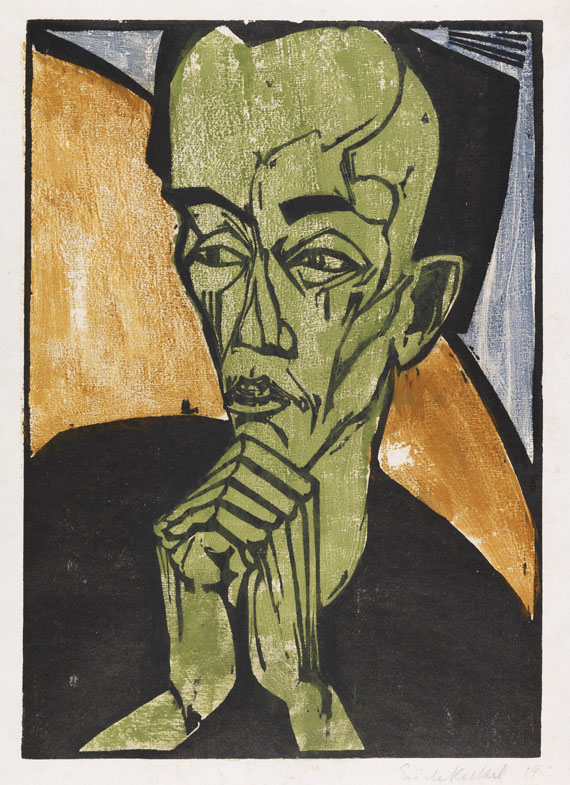

Erich Heckel

Männerbildnis, 1919.

Woodcut in colors

Estimate:

€ 30,000 / $ 35,400 Sold:

€ 27,500 / $ 32,450 (incl. surcharge)

Männerbildnis. 1919.

Woodcut in colors.

Ebner/ Gabelmann 739 H III A (of III B). Dube H 318 III A (of III B). Signed and dated. From an edition of 34 copies from this printing state. On Japon. 46 x 32.4 cm (18.1 x 12.7 in). Sheet: 50 x 36,7 cm (19,6 x 14,4 in).

[SM].

• A milestone of expressionist color print.

• Heckel's most significant graphic art self-portrait.

• Print with rich contrasts and a monotype-like effect.

PROVENANCE: Private collection Southern Germany.

Woodcut in colors.

Ebner/ Gabelmann 739 H III A (of III B). Dube H 318 III A (of III B). Signed and dated. From an edition of 34 copies from this printing state. On Japon. 46 x 32.4 cm (18.1 x 12.7 in). Sheet: 50 x 36,7 cm (19,6 x 14,4 in).

[SM].

• A milestone of expressionist color print.

• Heckel's most significant graphic art self-portrait.

• Print with rich contrasts and a monotype-like effect.

PROVENANCE: Private collection Southern Germany.

434

Erich Heckel

Männerbildnis, 1919.

Woodcut in colors

Estimate:

€ 30,000 / $ 35,400 Sold:

€ 27,500 / $ 32,450 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 434

Lot 434