173

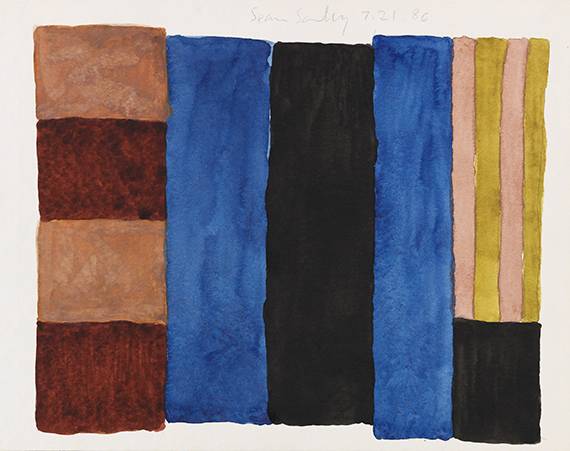

Sean Scully

7.21.86, 1986.

Watercolor over pencil

Estimate:

€ 15,000 / $ 16,950 Sold:

€ 68,750 / $ 77,687 (incl. surcharge)

7.21.86. 1986.

Watercolor over pencil.

Top center signed and dated "7.21.86". On firm paper. 22.8 x 30.5 cm (8.9 x 12 in), size of sheet. [CH].

• Scully's intimate watercolors represent an independent work group at eye level with his large-format paintings.

• In this watercolor, Scully takes on the compositional idea of composit stripe formations in various length and width, a concept he also pursued in his paintings from the 1980s .

• Watercolors from the 1980s are part of the collections of, among others, the National Gallery of Art in Washington, D. C. and the Albertina in Vienna.

PROVENANCE: Hirschl & Adler Modern, New York (with the gallery label on the reverse).

Galerie Lelong, New York (with the gallery label on the reverse).

Private collection Southern Germany (acquired from the above in 1996).

Watercolor over pencil.

Top center signed and dated "7.21.86". On firm paper. 22.8 x 30.5 cm (8.9 x 12 in), size of sheet. [CH].

• Scully's intimate watercolors represent an independent work group at eye level with his large-format paintings.

• In this watercolor, Scully takes on the compositional idea of composit stripe formations in various length and width, a concept he also pursued in his paintings from the 1980s .

• Watercolors from the 1980s are part of the collections of, among others, the National Gallery of Art in Washington, D. C. and the Albertina in Vienna.

PROVENANCE: Hirschl & Adler Modern, New York (with the gallery label on the reverse).

Galerie Lelong, New York (with the gallery label on the reverse).

Private collection Southern Germany (acquired from the above in 1996).

173

Sean Scully

7.21.86, 1986.

Watercolor over pencil

Estimate:

€ 15,000 / $ 16,950 Sold:

€ 68,750 / $ 77,687 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 173

Lot 173