116

A. R. Penck (d.i. Ralf Winkler)

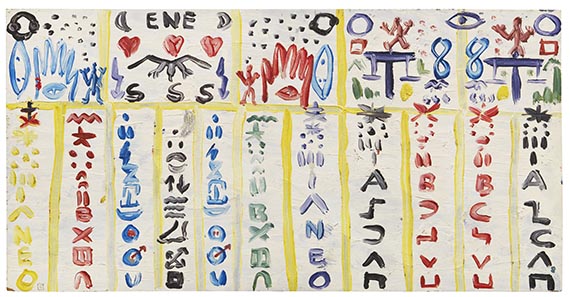

Ohne Titel, 1968.

Oil on fibreboard

Estimate:

€ 35,000 / $ 41,300 Sold:

€ 107,950 / $ 127,381 (incl. surcharge)

Ohne Titel. 1968.

Oil on fibreboard.

Jensen 1.310. Lower left monogrammed "R". 27.3 x 54.3 cm (10.7 x 21.3 in). [CH].

• The artist adopted the sobriquet A. R. Penck in 1967.

• Early works from the 1960s are very rare on the international auction market (source: artprice.com).

• Wih signs, symbols, letters, as well as early appearances of his stick figures and animals, Penck created a whole new pictorial language, a sort of artistic diagram.

• Logic and systematics behind A. R. Penck's sign language are unqiue in German post-war art.

PROVENANCE: Galerie Neuendorf, Hamburg.

Private collection Great Britain (acquired from the above in 1978).

Ever since family-owned.

LITERATURE: Ulf Jensen (ed.), A.R. Penck. Malerei 1953-1977 (catalogue raisonné), vol. 1, Cologne 2023, cat. no. 1.310 (with black-and-white illu.).

Oil on fibreboard.

Jensen 1.310. Lower left monogrammed "R". 27.3 x 54.3 cm (10.7 x 21.3 in). [CH].

• The artist adopted the sobriquet A. R. Penck in 1967.

• Early works from the 1960s are very rare on the international auction market (source: artprice.com).

• Wih signs, symbols, letters, as well as early appearances of his stick figures and animals, Penck created a whole new pictorial language, a sort of artistic diagram.

• Logic and systematics behind A. R. Penck's sign language are unqiue in German post-war art.

PROVENANCE: Galerie Neuendorf, Hamburg.

Private collection Great Britain (acquired from the above in 1978).

Ever since family-owned.

LITERATURE: Ulf Jensen (ed.), A.R. Penck. Malerei 1953-1977 (catalogue raisonné), vol. 1, Cologne 2023, cat. no. 1.310 (with black-and-white illu.).

The time of origin is crucial for Ralf Winkler, who in 1967 chooses the pseudonym A. R. Penck, under which he achieved worldwide over the following decades. Penck lived in the GDR, where the repressions of the system determined his art. He was interested in scientific discourses and the search for new pictorial forms. He saw images as a means of communication that can be understood by everyone but should not be one-dimensionally decipherable. In the early years, he described his art as "Standart" and developed a complex concept that aims to explore new pictorial forms. In a kind of painterly diagram, he assembled signs, symbols, letters, but also early forms of his stick figures and the eagle in what appears to be a mathematical sequence in these early picture. The letter T appears twice, suggesting the formulation of a theory, but ultimately no clear message emerges. Does the artist provide us with secret codes to put the unspeakable into pictorial formulation? A lot had to remain hidden back then. Penck quickly became a legend in the West, too, when Michael Werner showed the so-called Standart pictures at Galerie Hake in Cologne for the first time in 1968. The true identity of the artist, however, is officially kept secret. Works from these years still form the basis of his entire artistic work today. [SN]

116

A. R. Penck (d.i. Ralf Winkler)

Ohne Titel, 1968.

Oil on fibreboard

Estimate:

€ 35,000 / $ 41,300 Sold:

€ 107,950 / $ 127,381 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 116

Lot 116