128

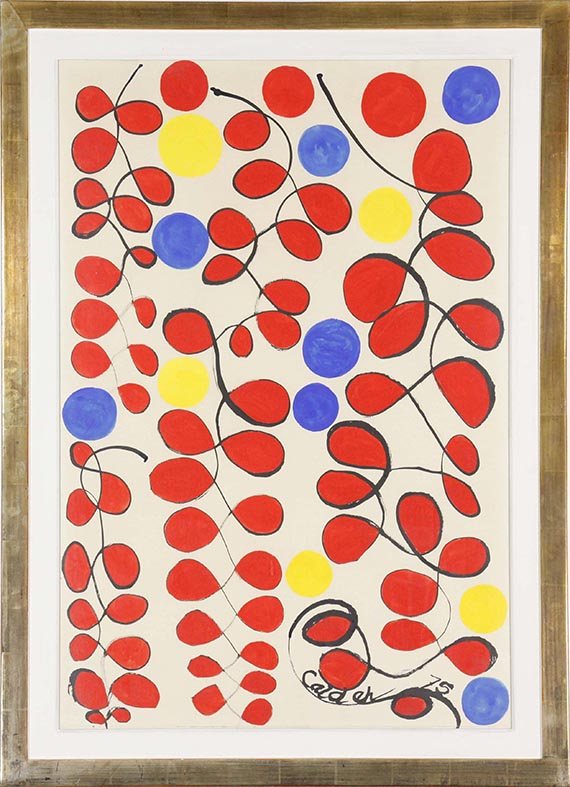

Alexander Calder

Sweet peas, 1975.

Gouache and India ink

Estimate:

€ 40,000 / $ 47,200 Sold:

€ 73,660 / $ 86,918 (incl. surcharge)

Sweet peas. 1975.

Gouache and India ink.

Lower right signed and dated. With the inscriptions "Sweet Peas" and "14 6 81" on the reverse. On Canson wove paper (with the blindstamp). 110 x 74.5 cm (43.3 x 29.3 in), size of sheet. [EH].

• Alexander Calder is one of the most important sculptors of the 20th century.

• In the gouache, he transfers the movement in space into line and surface on paper.

• His work is very diverse: in 1975 he also designed the first BMW Art Car.

• Alexander Calder was a participant in documenta 1 in 1955, as well as in the two subsequent documenta exhibitions in 1959 and 1964.

The authenticity of this work has kindly been confirmed orally by the Calder Foundation, New York. It is recorded in the foundation's archive under the number A 11678.

PROVENANCE: Galerie Maeght, Paris.

George Goodstadt, New York (1975)

Private collection Basel.

Gant-Amt Basel

Private collection Baden-Württemberg (acquired from the above in 1978).

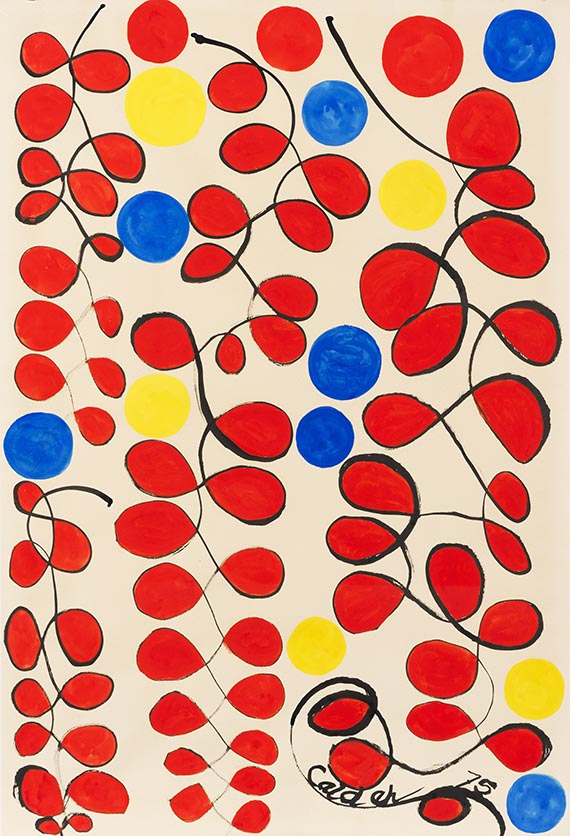

Gouache and India ink.

Lower right signed and dated. With the inscriptions "Sweet Peas" and "14 6 81" on the reverse. On Canson wove paper (with the blindstamp). 110 x 74.5 cm (43.3 x 29.3 in), size of sheet. [EH].

• Alexander Calder is one of the most important sculptors of the 20th century.

• In the gouache, he transfers the movement in space into line and surface on paper.

• His work is very diverse: in 1975 he also designed the first BMW Art Car.

• Alexander Calder was a participant in documenta 1 in 1955, as well as in the two subsequent documenta exhibitions in 1959 and 1964.

The authenticity of this work has kindly been confirmed orally by the Calder Foundation, New York. It is recorded in the foundation's archive under the number A 11678.

PROVENANCE: Galerie Maeght, Paris.

George Goodstadt, New York (1975)

Private collection Basel.

Gant-Amt Basel

Private collection Baden-Württemberg (acquired from the above in 1978).

128

Alexander Calder

Sweet peas, 1975.

Gouache and India ink

Estimate:

€ 40,000 / $ 47,200 Sold:

€ 73,660 / $ 86,918 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 128

Lot 128