202

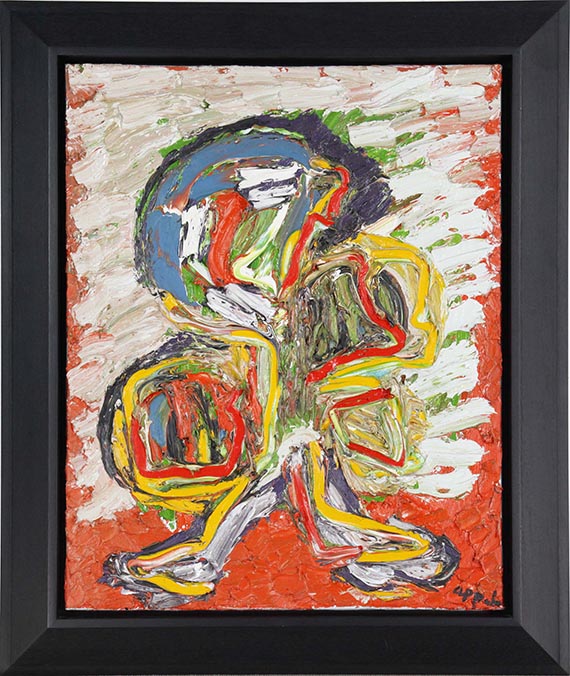

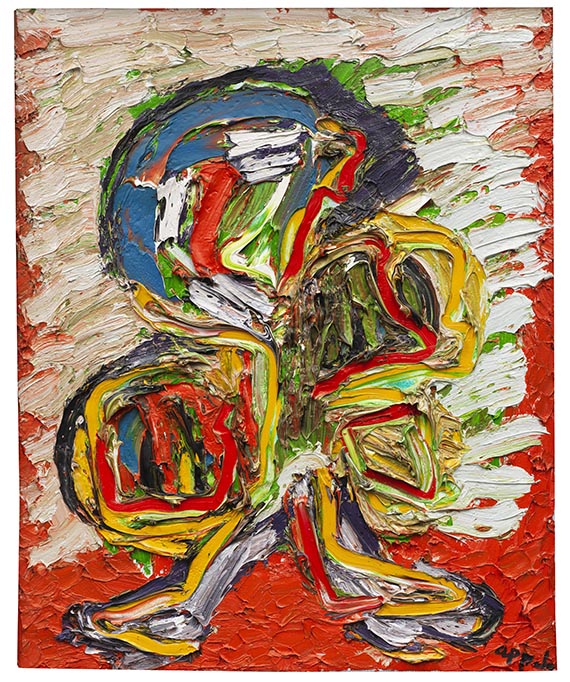

Karel Appel

Figure, 1991.

Oil on canvas

Estimate:

€ 20,000 / $ 23,600 Sold:

€ 38,100 / $ 44,958 (incl. surcharge)

Figure. 1991.

Oil on canvas.

Lower right signed. Inscribed "X91_041" on the reverse. 81 x 65 cm (31.8 x 25.5 in).

• Karel Appel is one of the most important contemporary artists in the Netherlands.

• Particularly expressive gestural-figurative painting.

• Karel Appel emphasizes the motif in the richly structured surface.

• Paintings by Karel Appel can be found at, among others, the Moderna Museet, Stockholm, the Museum of Modern Art, New York, and the Los Angeles County Museum of Art.

The work is registered at the Karel Appel Foundation, Amsterdam, under the number KA.1991.27.

PROVENANCE: Private collection Southern Germany (in 1991 acquired from Waddington Galleries, London).

EXHIBITION: FIAC 1991, Waddington Galleries, London (label on the reverse).

".. I have broken through, through the wall of Abstract, Surrealism etc. my work contains [..] everything You mustn't be pigeon-holed [..]. Your friend Karel."

Karel Appel in a letter to Corneille, quoted from: ex. cat. CoBrA. The color of freedom, Stedelijk Museum Schiedam 2003, p. 42.

Oil on canvas.

Lower right signed. Inscribed "X91_041" on the reverse. 81 x 65 cm (31.8 x 25.5 in).

• Karel Appel is one of the most important contemporary artists in the Netherlands.

• Particularly expressive gestural-figurative painting.

• Karel Appel emphasizes the motif in the richly structured surface.

• Paintings by Karel Appel can be found at, among others, the Moderna Museet, Stockholm, the Museum of Modern Art, New York, and the Los Angeles County Museum of Art.

The work is registered at the Karel Appel Foundation, Amsterdam, under the number KA.1991.27.

PROVENANCE: Private collection Southern Germany (in 1991 acquired from Waddington Galleries, London).

EXHIBITION: FIAC 1991, Waddington Galleries, London (label on the reverse).

".. I have broken through, through the wall of Abstract, Surrealism etc. my work contains [..] everything You mustn't be pigeon-holed [..]. Your friend Karel."

Karel Appel in a letter to Corneille, quoted from: ex. cat. CoBrA. The color of freedom, Stedelijk Museum Schiedam 2003, p. 42.

202

Karel Appel

Figure, 1991.

Oil on canvas

Estimate:

€ 20,000 / $ 23,600 Sold:

€ 38,100 / $ 44,958 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 202

Lot 202