181

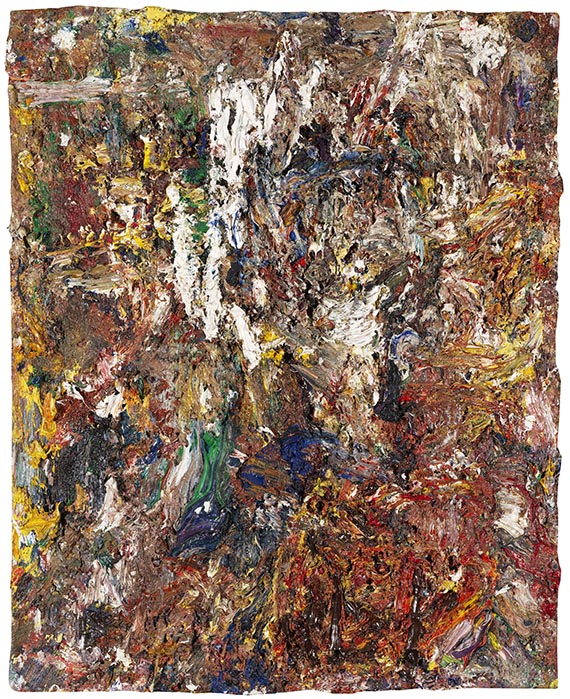

Eugène Leroy

Sans titre (Atelier 94/18), 1994.

Oil on canvas

Estimate:

€ 25,000 / $ 28,250 Sold:

€ 36,830 / $ 41,617 (incl. surcharge)

Sans titre (Atelier 94/18). 1994.

Oil on canvas.

Signed and dated, inscribed with the dimensions and "Atelier 94/18" on the reverse. 81 x 65 cm (31.8 x 25.5 in).

• Characteristic work by Leroy with a strong haptic quality.

• The impasto painting requires an active observation.

• In 1992, the artist participated in documenta IX in Kassel.

Accompanied by a confirmation of authenticity issued by Jean-Jacques Leroy from November 30, 2023.

PROVENANCE: Private collection Berlin.

EXHIBITION: Galerie de France, Paris (with the label on the reverse).

Oil on canvas.

Signed and dated, inscribed with the dimensions and "Atelier 94/18" on the reverse. 81 x 65 cm (31.8 x 25.5 in).

• Characteristic work by Leroy with a strong haptic quality.

• The impasto painting requires an active observation.

• In 1992, the artist participated in documenta IX in Kassel.

Accompanied by a confirmation of authenticity issued by Jean-Jacques Leroy from November 30, 2023.

PROVENANCE: Private collection Berlin.

EXHIBITION: Galerie de France, Paris (with the label on the reverse).

The works of Eugène Leroy, including the present painting from 1988, initially impress with the almost tactile quality of the paint application: oil paint layered in thick crusts, an abstract pattern of subtly coordinated tones. It is little surprising that the artist was deeply impressed by Rembrandt's famous "Jewish Bride," a painting in which the shimmering-abstract effect of the impasto paint application is virtually "preconceived" in exemplary fashion. Following these paths, which first opened up in Dutch Baroque, Leroy developed his outstanding opulent oeuvre that oscillates between figure and abstraction, and that won’t fit any "-isms". For the almost meditative effect of the image surface, the inspiring quality of the close-up view, offer a surprise moment at second glance: if one looks at Leroy's paintings intensively enough, the hidden motif suddenly shows itself. [EH]

181

Eugène Leroy

Sans titre (Atelier 94/18), 1994.

Oil on canvas

Estimate:

€ 25,000 / $ 28,250 Sold:

€ 36,830 / $ 41,617 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 181

Lot 181