429

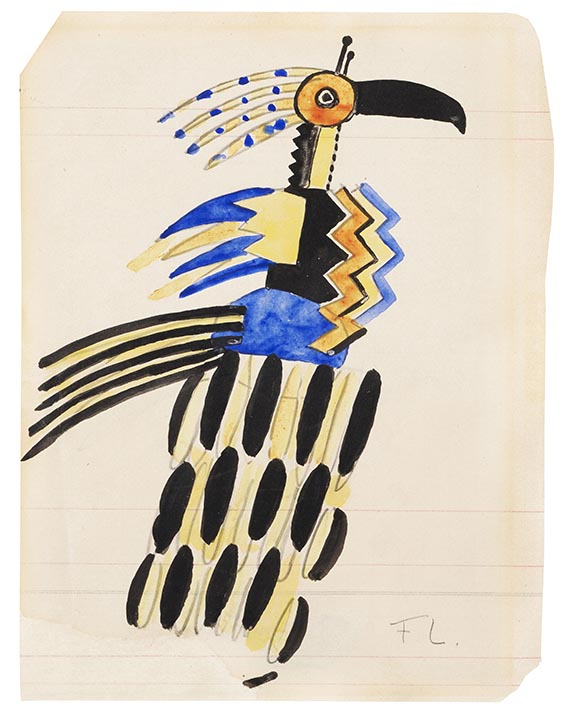

Fernand Léger

Projet de costume: Création du Monde, 1923.

Watercolor and ink over pencil on ruled paper

Estimate:

€ 10,000 / $ 11,800 Sold:

€ 20,320 / $ 23,977 (incl. surcharge)

Projet de costume: Création du Monde. 1923.

Watercolor and ink over pencil on ruled paper.

Lower right monogrammed. Inscribed with the estate number "N°G. 386-1" and titled on the reverse by a hand other than that of the artist. 22 x 17 cm (8.6 x 6.6 in).

[AR].

• Bird of paradise in Léger's characteristic style.

• Costume design for the ballet "La Création du Monde".

• 100 years ago, on October 25, 1923, the piece premiered at the Théâtre des Champs Elysées.

With an authentication issued by the Comité Léger, Paris. The work will be included into the online catalogue raisonné of works on paper aufgenommen.

PROVENANCE: Nadia Léger (artist's wife), Paris.

Pierre Cardin, Paris.

Private collection Portugal.

Corporate Collection Ahlers AG, Herford.

EXHIBITION: Espace Cardin, Paris, 1970.

LITERATURE: Tajan, Paris, auction 9726, Dessins Modernes, May 3, 2012, lot 258.

Watercolor and ink over pencil on ruled paper.

Lower right monogrammed. Inscribed with the estate number "N°G. 386-1" and titled on the reverse by a hand other than that of the artist. 22 x 17 cm (8.6 x 6.6 in).

[AR].

• Bird of paradise in Léger's characteristic style.

• Costume design for the ballet "La Création du Monde".

• 100 years ago, on October 25, 1923, the piece premiered at the Théâtre des Champs Elysées.

With an authentication issued by the Comité Léger, Paris. The work will be included into the online catalogue raisonné of works on paper aufgenommen.

PROVENANCE: Nadia Léger (artist's wife), Paris.

Pierre Cardin, Paris.

Private collection Portugal.

Corporate Collection Ahlers AG, Herford.

EXHIBITION: Espace Cardin, Paris, 1970.

LITERATURE: Tajan, Paris, auction 9726, Dessins Modernes, May 3, 2012, lot 258.

429

Fernand Léger

Projet de costume: Création du Monde, 1923.

Watercolor and ink over pencil on ruled paper

Estimate:

€ 10,000 / $ 11,800 Sold:

€ 20,320 / $ 23,977 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 429

Lot 429